UNCLE NEAREST : Dumpster Fire of a LAWSUIT / Receivership! 2025

By now you’ve likely heard that Uncle Nearest has been sued for violating their loan agreements with a lending entity. There will be much to dissect, and by no means will this story be finished until the legal battle makes its way through the courts. I will be posting LIVE updates on this link.

UPDATE 8/14- Receivership has been granted. Will detail the judges ruling shortly. For more updates please use this link.

Before we begin, please note a few things:

For Speedy.

These are the accusations from an aggrieved lending party that has filed suit against Uncle Nearest and is referenced from a public legal brief. You can read it all here. I quoted the things I found most interesting so if you don’t enjoy reading lengthy legal filings, the content below will suit you. The Weaver’s official court filing is here.

Nothing is proven. Everything is alleged. That’s why there are actual courts, and things aren’t resolved on Xitter.

There are often three sides to any story. My opinions/thoughts/snark will be towards the bottom of this piece. But trust there will be some snark in the images as we go along.

The early public response from Fawn Weaver is here and here. The Weaver’s non-IG and non-legal filing response is summarized lower in the article which is quoted from various news sources.

I never, ever wish to see anyone fail at what they do. In fact the opposite. I do criticize brands and their business practices frequently, it doesn’t mean I want a team of villagers to grab their torches and pitchforks to take to the old sack and pillage routine.

Everything is fine. Nothing to see here. Say, why is it so warm?

Let’s start with the accusations. I will be pulling quotes liberally, again, you can read the entire unedited thing here.

“Uncle Nearest has failed to pay principal and interest payments multiple times.”

“Uncle Nearest used proceeds of a loan from the Lender to purchase an over $2million home on Martha’s Vineyard through a non-loan party and mortgage such property to another lender.”

“Uncle Nearest provided apparently inaccurate Borrowing Base reports with respect to the whiskey barrels that constitute a majority of the Lender’s collateral.”

“Uncle Nearest sold barrels to generate cash to pay past due obligations to parties other than the Lenders.”

“Uncle Nearest sold millions of future receipts and revenue streams at a discount to at least four different parties on at least four separate occasions, unbeknownst to the Lenders (thereby depleting the Lender’s collateral).”

“Uncle Nearest failed to maintain a net income of at least $1.00 at the end of each calendar month, as required by the Loan Documents; and failed to maintain a net worth of at least $100 million during 2024, as required by the Loan Documents.”

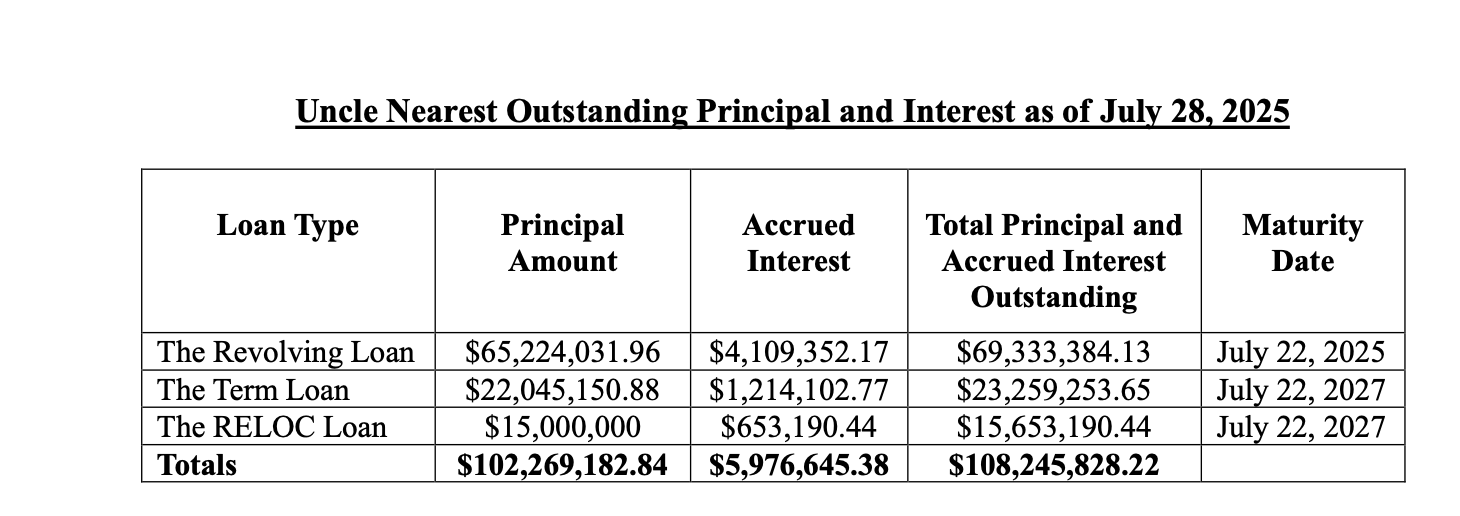

As of July 28, 2025, the following amounts are allegedly due from and payable by Uncle Nearest pursuant to the Loan Documents.

Things that I find interesting-

“Uncle Nearest has admitted that it is in default and has consented to the appointment of a receiver.”

“The Lender is filing an emergency motion requesting the appointment of a receiver in order to put a reputable turnaround firm at the helm of Uncle Nearest and determine whether there is a path forward to a profitable business.”

“There are three loans in this matter: the Revolving Loan, the Term Loan, and the RELOC Loan (collectively, the “Loans”).”

“Uncle Nearest has been in default as early as January 2, 2024.”

Uncle Nearest has, according to this brief, continually failed to provide timely monthly financial documents for almost three years. Failed to submit annual business plans for years 2023/2024. Failed to timely deliver the report on insurance coverage.

“Failure to observe the covenant to maintain proper books and records set forth in Section 6.9.”

“Failure to maintain a minimum Consolidated Tangible Net Worth of no less than $100,000,000 at all times during the period from December 31, 2023, through December 30, 2024, as required.”

“Failure to maintain a Consolidated Net Income of no less than $1.00 for each calendar month during the period commencing December 1, 2023, through January 31, 2025, as required by Section 7.11(b).”

We’ve all been to Bum’s Alley. Just not as a company with a billion dollar valuation. Good bar, good deals on pitchers of PBR. Fish Oil Malort shots too.

A particular thing I found verrrrrrry interesting-

On March 30, 2023, upon request by Uncle Nearest, the Lender entered into that certain Amendment No. 4 to Credit Agreement (“Amendment No. 4”), pursuant to which the Lender provided an additional term loan in the amount of $2,300,000 (the “MV Property Loan”).

Uncle Nearest requested the MV Property Loan to, among other things, purchase a $2.225 million home on the exclusive Martha’s Vineyard Island located off the coast of Cape Cod, Massachusetts (the “MV Property”).

Uncle Nearest presented the purchase of the MV Property to the Lender as a marketing opportunity, which would enable Uncle Nearest to host branding events and rent the property to other distributors for co-branding opportunities. Uncle Nearest represented, and agreed in Amendment No. 4, that the proceeds of the MV Property Loan made to Uncle Nearest would be used by Uncle Nearest to buy the MV Property.

In January 2025, however, the Lender learned that an entity that is not (and never has been) a Borrower or other Loan Party, was used to purchase the MV Property using proceeds from the MV Property Loan, which is a violation of Section 6.11 of the Credit Agreement.4

Further, the Lender learned that UN House MV mortgaged the MV Property to a different lender, Oaktree Funding Corp. (“Oaktree Funding”), on or about September 25, 2024, to secure UN House MV’s obligations to Oaktree Funding under a promissory note in the principal amount of $1,500,000, as reflected in the Dukes County Registry of Deeds.”

A little three card monte never hurt anyone right? Right/

Nitty Gritty Details I found interesting-

“Failure to observe the covenant in Section 7.1 of the Credit Agreement not to create, incur, assume or suffer to exist any Lien upon any of its property, assets or revenues except as permitted by Section 7.1, including but not limited to, the following transactions:

i. Sold $1,021,300 of future revenue stream for a discount of $700,000 less fees pursuant to a contract dated June 26, 2024;

ii. Sold $2,378,300 of future revenue stream for a discount of $1,700,000 less fees pursuant to a contract dated July 26, 2024; and

iii. Refinanced $2,658,100 for a discount of $1,900,000 less fees pursuant to a contract dated November 25, 2024.”

“Collateral Discrepancy was further confirmed in January 2025 when Uncle Nearest provided an updated Borrowing Base and

compliance certificate evidencing that the previously reported Borrowing Base had been overstated by approximately $21,000,000.”

It is also alleged that “the Weavers continued to provide incremental infusions of funds to Uncle Nearest to enable the company to keep its doors open and lights on.”

“Based on the cash flow forecast provided by the interim chief financial officer on May 12, 2025, the forecast purported to show an initial cash balance of $1,500,000 as of May 12, 2025, when, in fact, the Company’s beginning cash balance at that time was approximately $261,000.”

CFO cat DGAF.

A scary thing I found interesting-

Uncle Nearest entered into the Security Agreement granting security interest to the lender in almost all of Uncle Nearest’s personal property, including accounts, inventory, goods, machinery, real estate, and All Copyrights, Patents and Trademarks While this is not unusual for securing financing, the thought of losing the intellectual property of Nearest Green is terrifying.

What the plaintiff is seeking-

An immediate receivership over Uncle Nearest to secure their assets and collateral.

Judgement against Uncle Nearest in an amount to be established at trial, but no less than the principal amount of $102,269,182.84 plus other unpaid interest, legal fees etc…

Removal of Ms. Weaver, Mr. Weaver, and any others currently serving in management positions from their positions with

Uncle Nearest, Inc., the Distillery, and RE Holdings.

It’s frightening when Disaser strikes! Seeking to remove management from management is what I’d call a Disaser.

The Weavers responded Friday-

The Lynchburg Times reached out and were given a statement by the Weavers. Read the full article here. I won’t post unquestioned press releases so you’ll have to read it yourself.

Keith Weaver described the lawsuit as “demonstrably false.”

Keith claims that the lawsuit contains a host of inaccurate claims against the company “such as the suggestion that we have not paid the bank in over a year, which is just not true.”

Keith stated that “they also suggest that we’re using or have used corporate resources for personal benefit in the form of the Martha’s Vineyard house, which is also not true.”

He goes on to describe the values and core principles of the company.

Keith referred to the suit as feeling purposeful, without explaining how.

Keith stated that Uncle Nearest continues to enjoy year-over-year growth in a “tough market for the sector” and that they’ve posted over double-digit growth over the last 52-weeks.

The Weavers say they intend to file a formal response and release a press release on Friday August 2nd. As of Sunday, the Weaver’s have not released said press release, who stated that it’s been delayed but it’s on the way. Update- It wasn’t the promised “doozy” but it was released.

Fun fact- cats can smell bullshit from great distances.

The Weaver’s response via legal filing-

“First, Plaintiff’s Motion claims that Defendants materially overstated their barrel inventory, resulting in an overstatement of collateral by approximately $21,000,000. Plaintiff ignores that it was not the Defendants that made this overstatement but rather it was the Defendants’ former Chief Financial Officer (“CFO”), acting on his own, and who has now been terminated. Between 2022 and 2023, the former CFO represented to the Plaintiff that Uncle Nearest had 77,000 barrels of whiskey on hand and used this overstatement to secure a $24 million line of credit increase. Plaintiff approved the increase without verifying the inventory with thethird-party warehouse provider. While Uncle Nearest’s Chief Executive Officer (“CEO”) signedthe loan amendments reflecting the credit limit increases, those documents contained no information about barrel counts, and the former CFO was the sole signee on all loan notices usedto request funding secured by the barrels. Inventory reporting was handled separately and\exclusively by the former CFO.”

“No one at Uncle Nearest was aware that the CFO had inflated the previous reports. Once the updated report was provided, the discrepancy became evident. Despite being aware for several months of this overstatement by the former CFO, Plaintiff’s Motion tellingly fails to acknowledge that Uncle Nearest was the victim of fraudulent activity and never intended to trigger the technical default.”

The Motion omits that Defendants were fully transparent with the Plaintiff about the purchase and intended purpose of the MV Property. The Plaintiff made no objection to the purchase at the time the funds were advanced.

Third, the Motion suggests that Defendants were derelict in their payment obligations.. In 2024 alone, Uncle Nearest paid nearly $9 million in loan payments to Plaintiff. And in 2025, the company made a payment of $7.5 million. These payments were made while Uncle Nearest worked in good faith to resolve the technical default—caused solely and entirely by the former CFO’s misreporting.

But for the fraud perpetrated by Defendants’ former CFO, Defendants fulfilled their monetary obligations to the Plaintiff. In other words, Defendants were, and are, victims of fraud—not perpetrators or conspirators.

Oh no, not Judge Meowser. She’s tough and isn’t swayed by “it’s not my fault.”

The Judge Speaks-

An emergency hearing took place on 8/7 and lasted 2 hours.

The Lynchburg Times has reported on this extensively.

The judge said, “I will not be giving an answer today, but it will come quickly.”

It was not disputed that Uncle Nearest is in default.

Nearest Green attorney said that the $10 million payment scheduled to the creditor this week will also not be paid on time.

The attorney admitted that Chapter 11 has been considered.

The judge said “it looks like you’re out over your skis.”

UN continues to lean into the “fastest growing whiskey company…” Keith Weaver suggested it’s a cash flow problem.

Keith said the CFO wasn’t fit for his role.

The judge noted that it was still the Weavers CFO even if the CFO was not correctly doing his job.

Keith noted that losing Fawn would be “catastrophic.”

Fawn was not in court, she was in Florida selling whiskey.

On cross-examination Keith admitted that the company was in default.

The judge said he will issue an order to preserve the collateral.

On 8/11 the Judge issued a gag order to all parties.

Well, buckle up, things are on fire.

Here are some interesting background things from the Receivership hearing. I have the court documents. Wheeeeeee!

The cumulative result of these documents is that Farm Credit holds a security interest in almost all of Uncle Nearest’s property.

On July 26, 2023, the Credit Agreement was amended for the sixth time. This amendment, unlike those that preceded it, stated that Uncle Nearest had committed multiple “Events of Default.” Farm Credit nevertheless agreed to waive these Events of Default and further increase Uncle Nearest’s revolving loan limit to $67 million “in reliance upon Uncle Nearest’s representations as to its success and strategic growth.”

On December 23, 2023, Farm Credit waived additional Events of Default in the parties’ seventh amendment to the Credit Agreement. But while Farm Credit was willing to waive these Events of Default, it was not willing to let Uncle Nearest avoid additional scrutiny.

The parties then engaged in a series of negotiations that ultimately resulted in an April 15, 2025, Forbearance Agreement. Under the Forbearance Agreement’s terms, the parties agreed there were multiple outstanding Events of Default, but Farm Credit promised not to exercise its contractual rights relating to these defaults for the duration of the “Forbearance Period” provided that certain conditions were met. Importantly, the Forbearance Period automatically terminated on the occurrence of a new Event of Default.

Shortly after the parties executed the Forbearance Agreement, Uncle Nearest began triggering new Events of Default by, among other things, failing to make multiple loan payments, including a $10 million paydown. As a result, Farm Credit filed suit, seeking to recover the more than $108 million Uncle Nearest owes in outstanding loans.

The Court will begin its analysis by looking to Uncle Nearest’s solvency and whether there is adequate security for Farm Credit’s loans as these are “the most important factors in evaluating whether to appoint a receiver.” . Starting with solvency, the Court directly asked Defendants’ counsel whether Uncle Nearest was solvent.. And although counsel was unable to definitively answer this question, he indicated thatUncle Nearest’s solvency was in question and that the business is experiencing cash flow problems.

Turning to whether there is adequate security for Farm Credit’s loans, the Court finds there is not. The lack of certainty surrounding Uncle Nearest’s solvency itself supports the conclusion there is not adequate security.

It is undisputed that Uncle Nearest’s revolving loan was increased by $24 million because of Senzaki’s misrepresentations concerning Uncle Nearest’s barrel inventory. Given that this $24 million was supposed to be secured by the illusory whiskey barrels, that these barrels do not exist strongly suggests that the loans are not adequately secured, particularly where almost all of Uncle Nearest’s other assets are already encumbered. Accordingly, this factor weighs in favor of a receivership.

The Drunken Mouse is the place that you go when you want to light your cigarette on both ends, and also can’t manage a business.

My thoughts and wrap up-

There is quite a lot to digest in this legal matter. I posted the “highlights” or lowlights if you prefer. While these are filed legal documents, it does not mean that it’s truth chiseled in stone. It’s jockeying for position.

That said, this doesn’t look very good for Uncle Nearest. The debt load is pretty high. That they sold futures at a discount, sold barrel inventory, and regularly infuse cash into the business to keep it running is deeply concerning, and the Uncle Nearest legal response makes no mention of these claims at all.

The Weaver’s not being able to make the latest scheduled payment is mind boggling. They’re in court fighting for their corporate lives, and outside of the lights of social media, their bluster is reduced to a fart in the wind. You can’t pay on time? Gawwwwwd.

Make no mistake this IS a distillery in crisis. Successful businesses do not tell a lender “oops sorry, have you ever kissed a rabbit between the ears?” Lenders can take your shit, and they will take your shit if you do not pay what you agreed to pay ON TIME.

I find it notable that the Weaver’s chose to address the most salacious claims, but not the more important things, like why are they in default at all, what about the futures? The barrels sold for cash flow? How a CFO could be at fault for everything? What does a CEO even do?

Placing the blame entirely on the now departed CFO is a move. While yes, CFO’s have power to do things, you’d think that one of the responsibilities of a CEO is to ensure that the CFO isn’t ratfucking you when you’re doing your book tour. Also, when cash strapped, one can see how a CFO would be rearranging the deck chairs on the Titanic… The judge apparently agrees.

An officer of a company is a representative of a company. Even an incompetent, or corrupt one. Companies often pay the price for the actions, or inactions of its officers.

This defense looks worse since, she once said something about hiring the best, most qualified people and then staying out of the way…. This interview was November of 2024. This was presumably after the CFO was fired.

There’s a Reddit thread about this, and keep in mind, it’s Reddit.

I will bet that the Enex club has some good whiskey inside. After cat business is done, will have to step inside to investigate

Most whiskey news just reposts what they’re told. Like, come on media, stop reposting statements that aren’t from the legal documents. ASK the questions that need asking, and don’t be just another outlet for propaganda. Very few news outlets have done anything but quote what the CEO has posted on IG. Quoting “Don’t blink” is not reporting.

I reached out to Fawn via DM asking for access to the documents she references in her video on IG. I’m no one, so a response was not expected. I asked though, but then I found them myself.

Based on the comments from fans on social media, I think the brand without the Weaver’s is cooked. If Uncle Nearest is not African-American owned, they lose the fans. If UN becomes a part of a major brands portfolio, the fans will not follow. What has made this brand special, and the way it’s been marketed, is that it’s “for us, by us.” There’s true power in that, and any potential buyer (it will not be Brown-Forman/Jack Daniel’s) will have to factor the fan base loss into any purchase price.

I wonder about the board of directors. They’re likely handpicked and can’t replace the CEO, likely understanding that Fawn IS the brand and without her exceptional sales skills and cult of personality, Uncle Nearest is reduced to just another NDP label on the shelf.

The lender has the option to declare the unpaid debt to be immediately due and payable. Fairly standard stuff really. They can also take possession of any/all assets, execute foreclosure and liquidation if you cannot pay up.

One of the benefits of receivership is that the lender will gain access to the unadulterated books. They will learn if the enterprise is worth more or less than the outstanding debt. If it’s less, you can safely expect liquidation. If it’s more, you can expect that they will seize the business and then sell it for a tidy profit. A pal of mine said this looks like a leveraged buyout. I agree with him.

This isn’t good for Forbes either, who not that long ago gave Uncle Nearest a $1 billion valuation. For context MGP has a current market cap of $632 million. And their stills are actually producing whiskey.

It doesn’t take a cat accountant for the mob to know something isn’t adding up.

We probably should have seen this coming, but we all likely fell under the spell of the story, and how joyful it all seemed. There were signs, which we ignored as blips in a company on a wild growth spree. The earlier lawsuit that saw Uncle Neartest pay $2.1 million for failure to pay for goods delivered in the Berlin Packaging case should have pricked our interest more.

But wait, sadly there’s more. A federal judge has ruled that sex discrimination, harassment, and retaliation claims brought by former employee Garcelle N. Menos against Uncle Nearest, Inc., and its co-founder and CEO, Fawn Weaver, will proceed to a jury trial. You can read this complaint here.

I am frequently reminded of something an old friend said to me many moons ago- don’t fuck with banks.

It’s foolish to say to your following that you’re negotiating when your ability to do so is diminished or non-existent.

I think that while Fawn is an excellent sales person (you cannot question this), acting as a CEO is an entirely different set of skills and she may not have strong management around her. Is it all her fault? No, of course not, but as the CEO, it is her responsibility and it’s hers alone.

I expect that the receivership will be granted, and that there could be some other revelations that will come to light, and it will not be pretty.

This affair showcases the power of effective story telling and how it brings people together who want to believe in that story so badly because it has so much meaning. Lawsuit? Nothing to see here, I was born for this, the bigger you get the bigger the target on your back, don’t blink, etc… Standing tall and being defiant is expected behavior from anyone backed into a corner, but it doesn’t mean what got you to that corner isn’t true. Fostering a Cult of Personality can take you places, until it doesn’t.

The Nearest Green story is such an injustice, righted generations later…. if this is the ending, it’s a real pity.

I will update this piece as more information comes out.

- Mickey Pinstripe