Uncle Nearest Receivership & Lawsuit : LIVE UPDATES

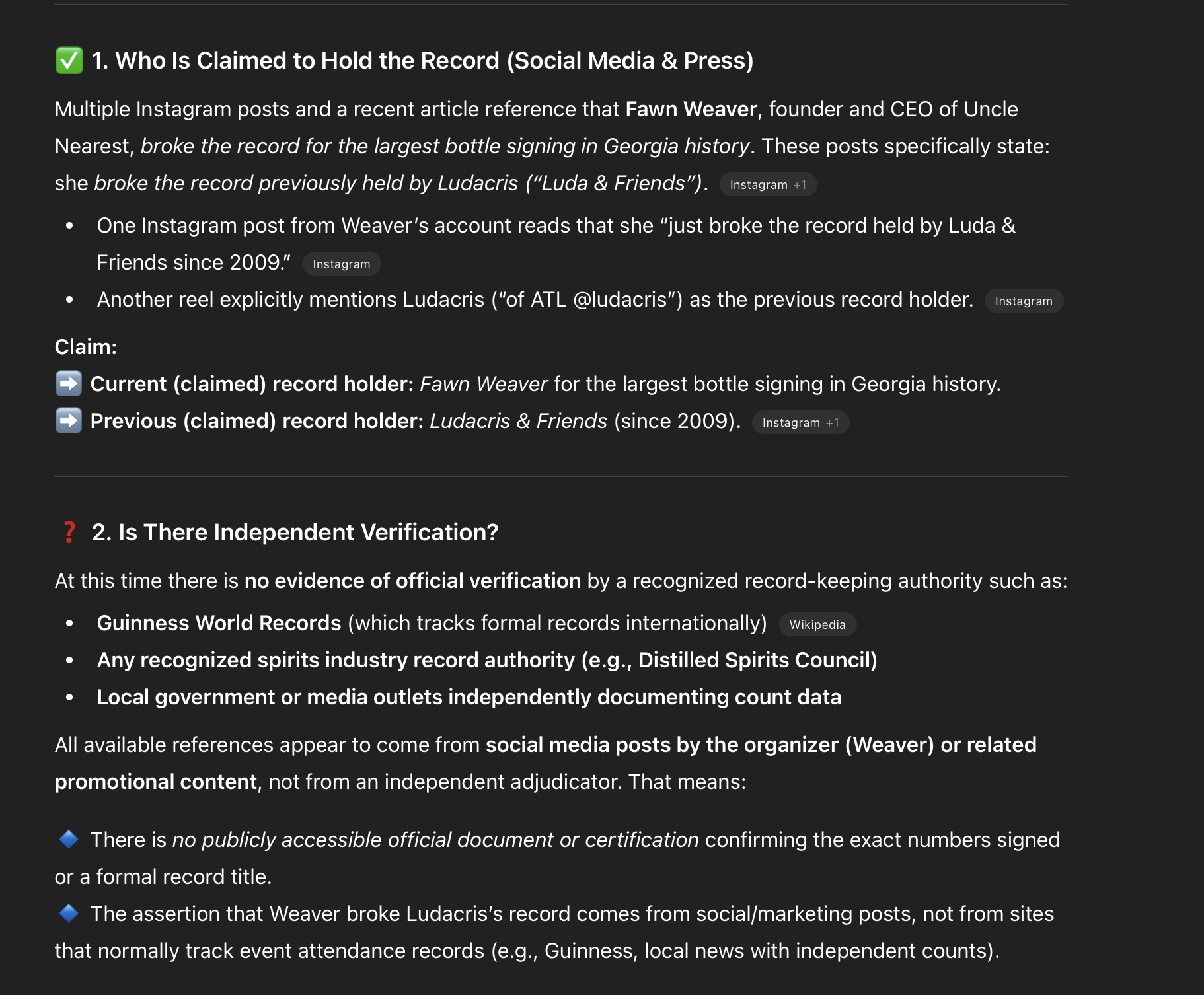

This is the LIVE UPDATE page for the ongoing saga of the Uncle Nearest Receivership which was ordered on 8/14. If you haven’t been following along, please check out this piece first. It’s a decent breakdown of how we got here. This piece here will be heavily seasoned with commentary and that will be italicized.

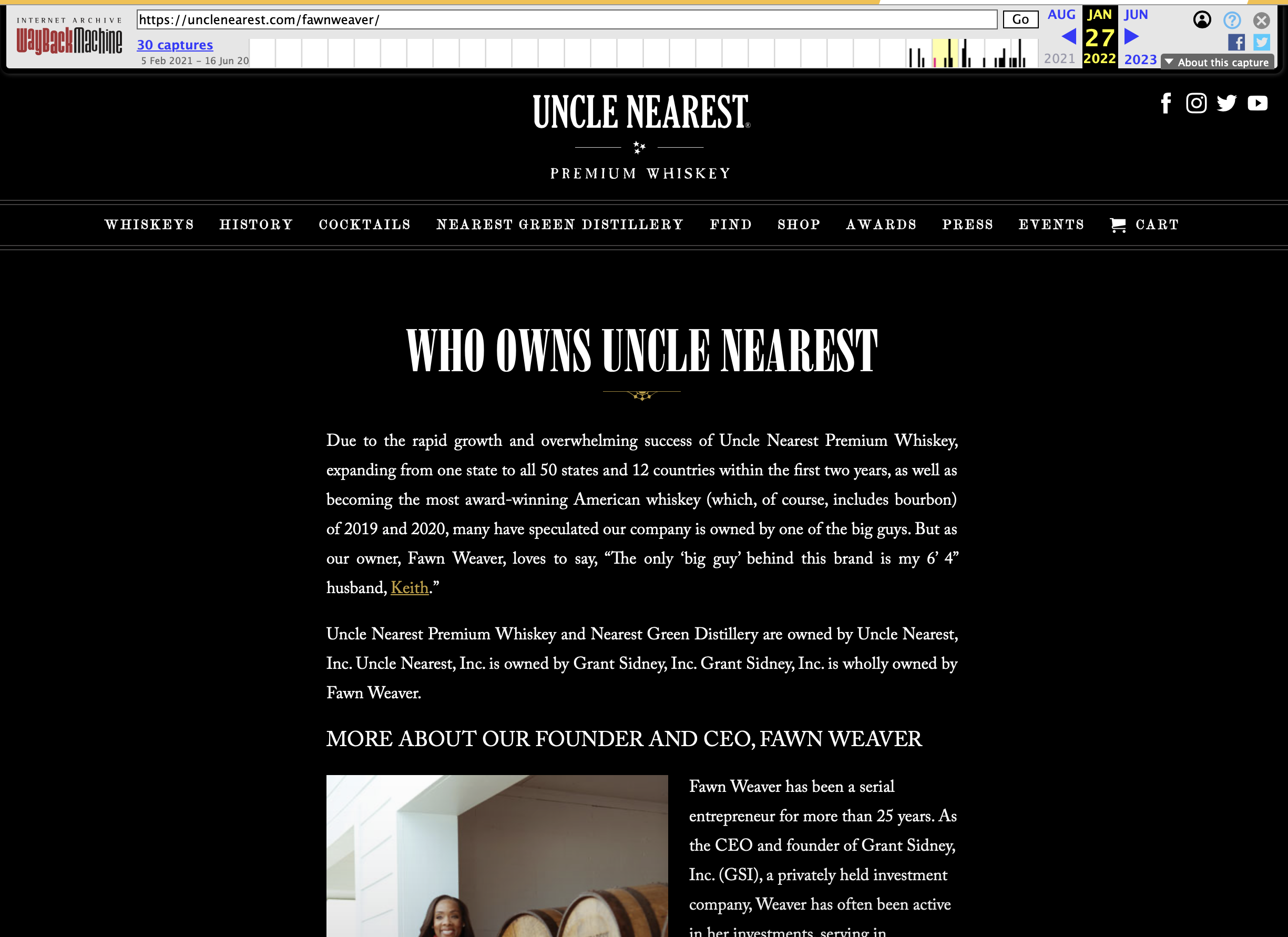

If you feel like sharing your story or have any tips feel free to contact me here. Your anonymity and confidentiality will be respected.

This is a real 4, not a Weaver “4”.

UPDATE 2/15-

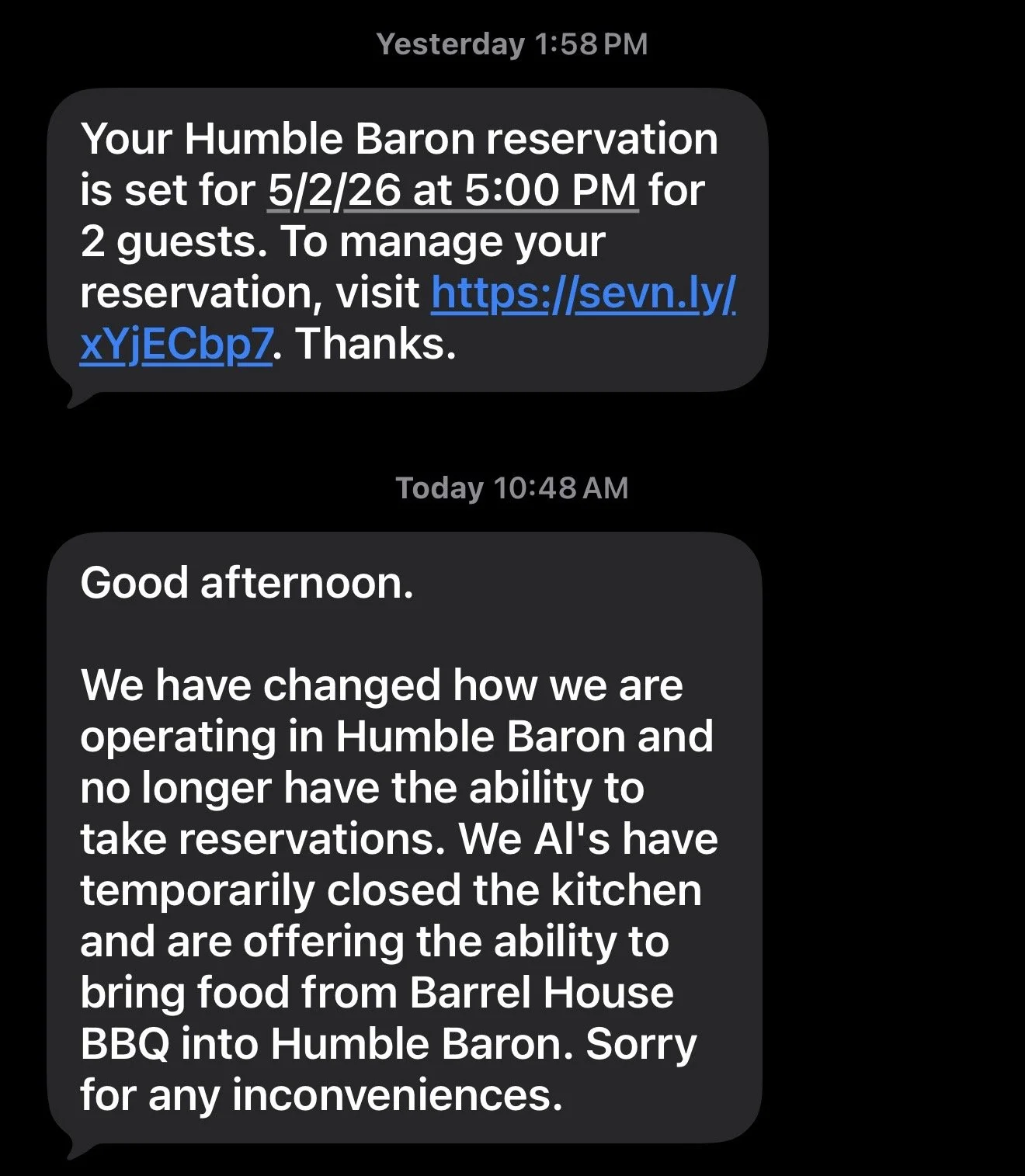

While Sunday with the Deceivers (TM) is going on with the usual “baba”, Keith mumbling lifelessly through the video, making redbeans and turkey legs, while having Grown Folk Mimosas and watching church on tv, Humble Baron has officially stopped taking reservations. “Christopher Moltisanti” received a cancellation notice of “his” reservation via text and email explaining how it “works” now (image below).

With paper checks being issued, and it being Presidents Day on Monday, I guess the employees will have to wait until Tuesday for their money, assuming the checks clear? Zelle, Ca$hApp, Venmo, PayPal, ApplePay, GooglePay….. JFC.

My jaw still hurts, but I’m on the mend, I’ve got some quick hits, thoughts, and questions for today.

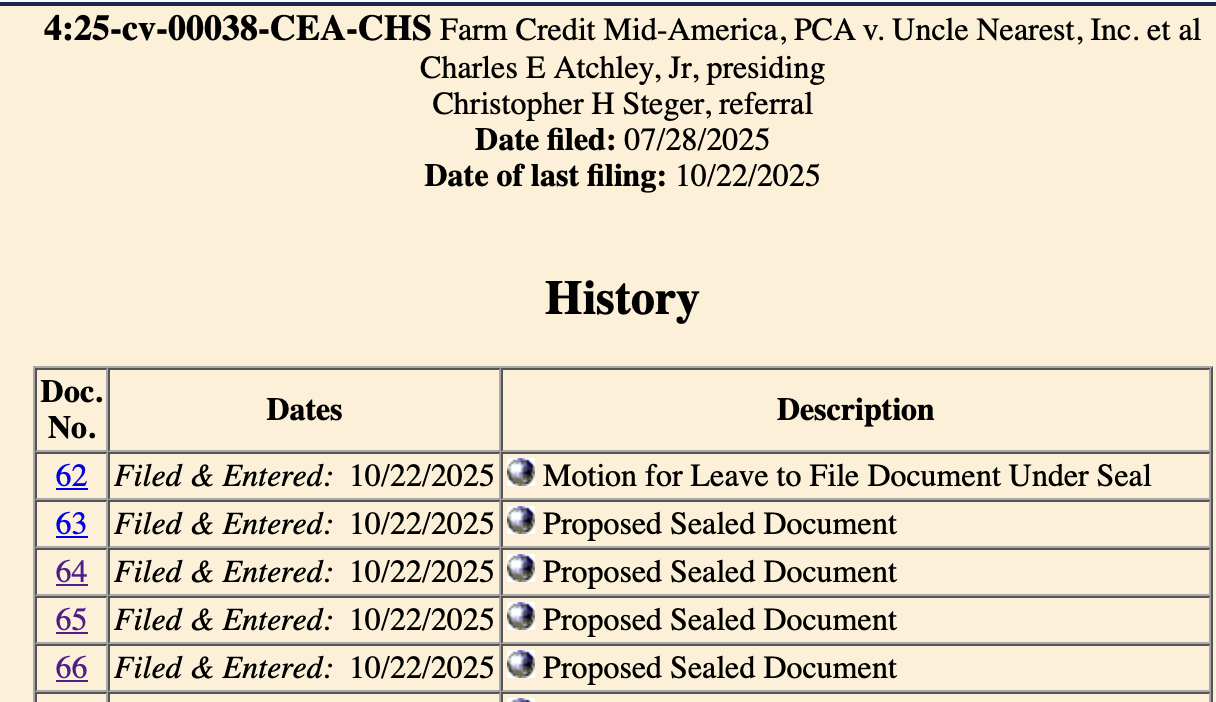

Here is the case docket information for the California case since it doesn’t yet come up in Google search.

UNITED STATES DISTRICT COURT CENTRAL DISTRICT OF CALIFORNIA WESTERN DIVISION.

Case No. 2:26-cv-526

ALTSHARES EVENT-DRIVEN ETF, on Behalf of Itself and All Others Similarly Situated, Plaintiff, CLASS ACTION

CLASS ACTION COMPLAINT FOR VIOLATIONS OF THE FEDERAL SECURITIES LAWS

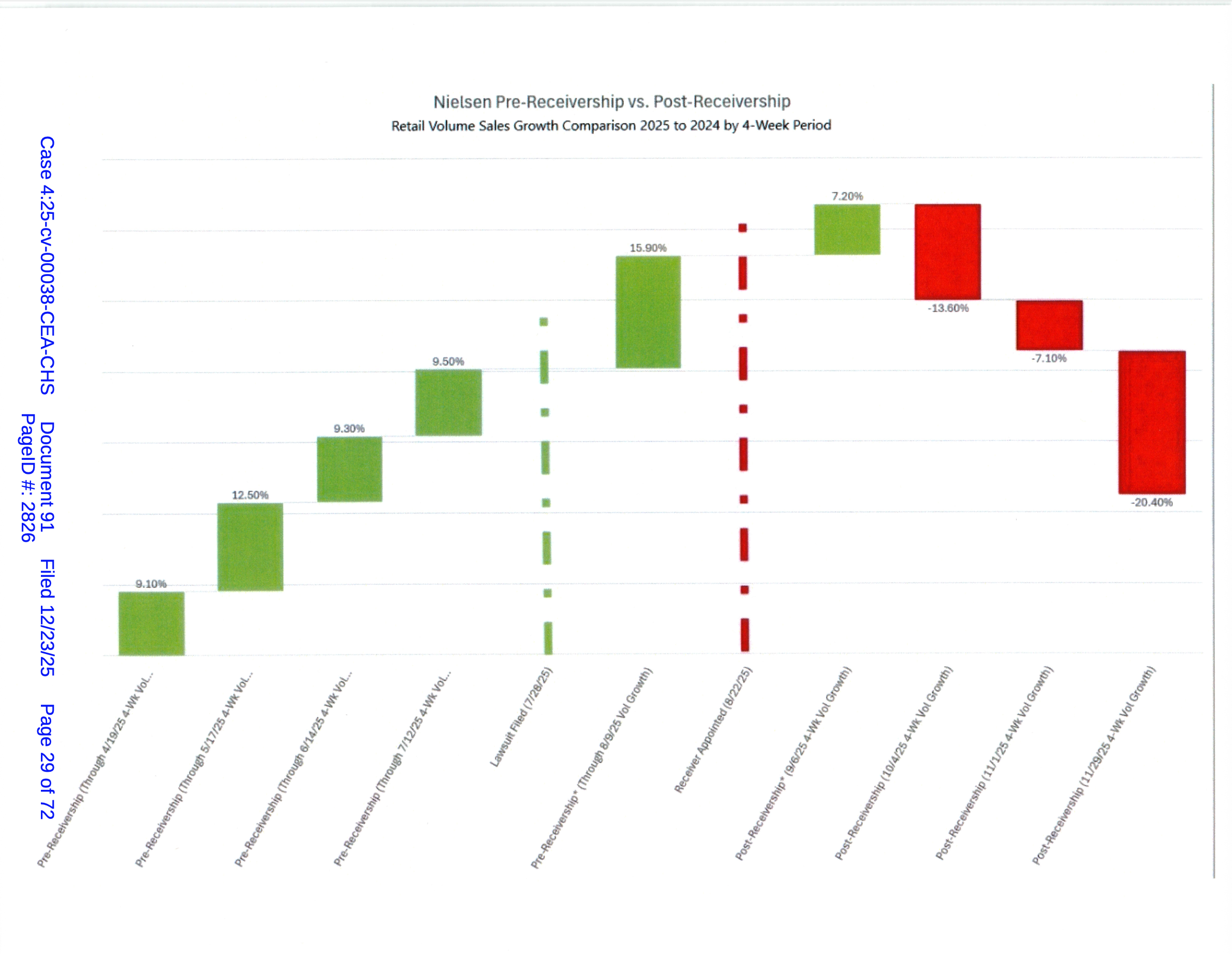

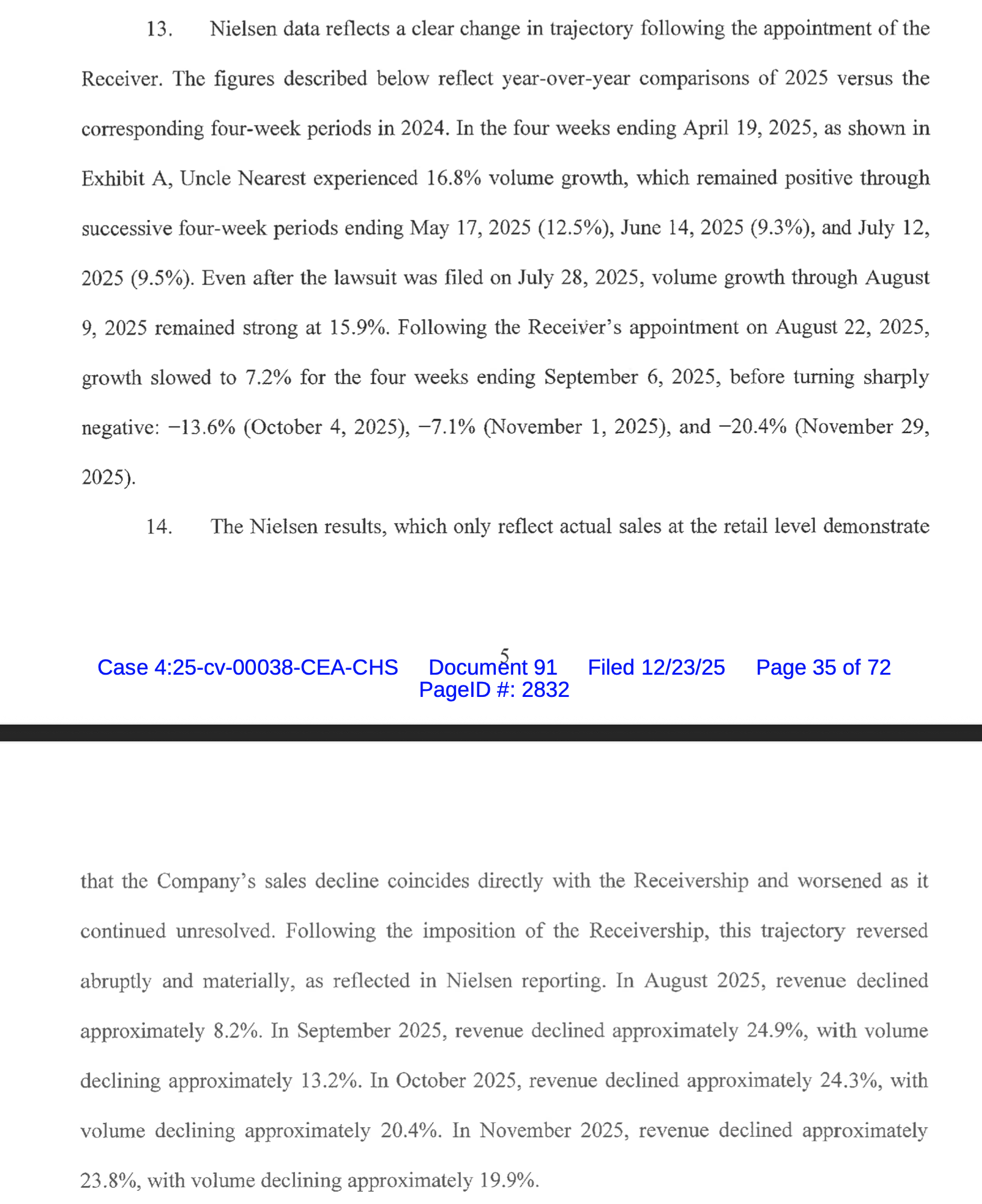

DEMAND FOR JURY TRIAL

vs.

ENDEAVOR GROUP HOLDINGS,INC., ARIEL EMANUEL, PATRICK WHITESELL, MARK SHAPIRO, EGON DURBAN, URSULA BURNS, FAWN WEAVER, STEPHEN EVANS, JACQUELINE RESES, and SILVER LAKE GROUP, L.L.C., Defendants.

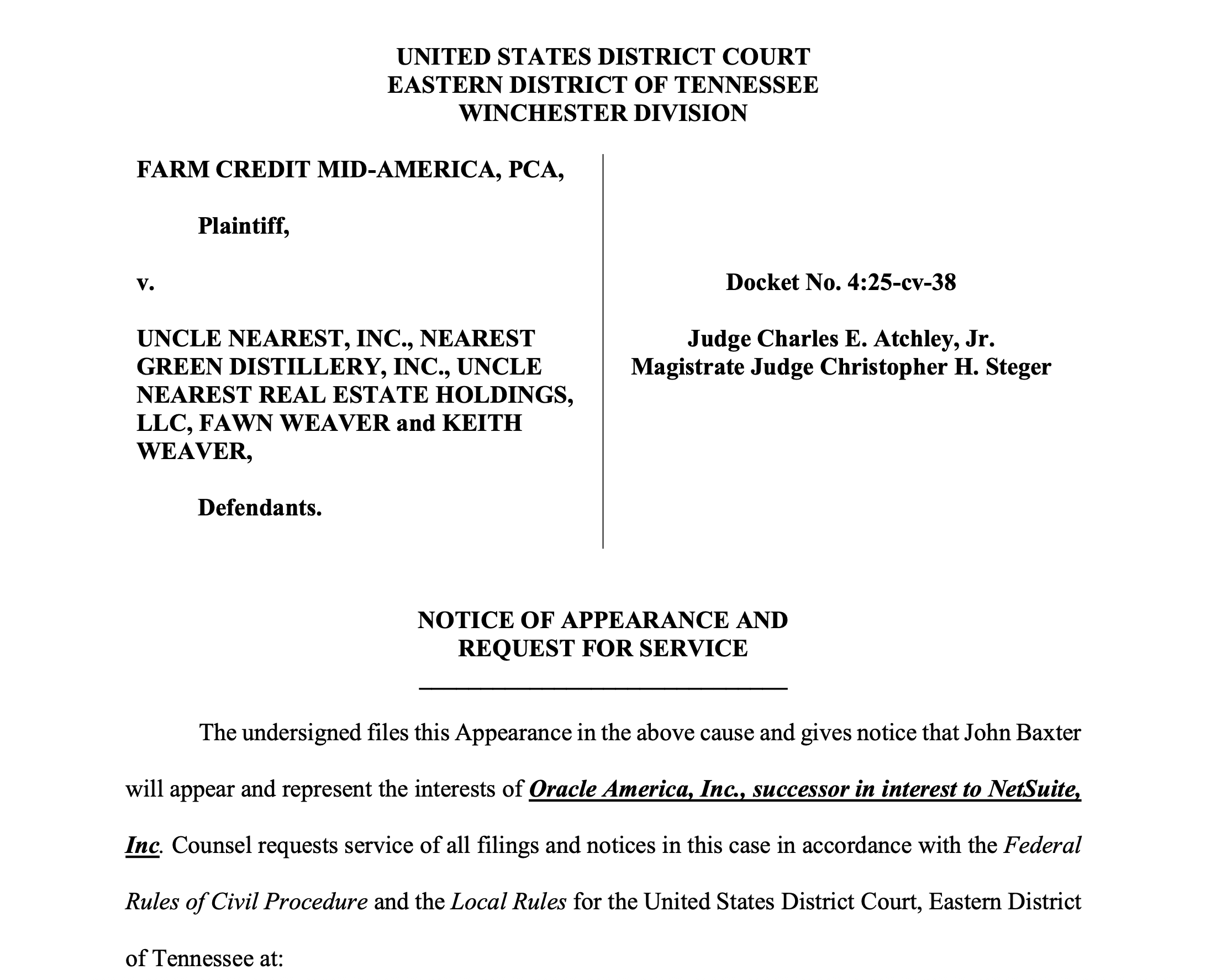

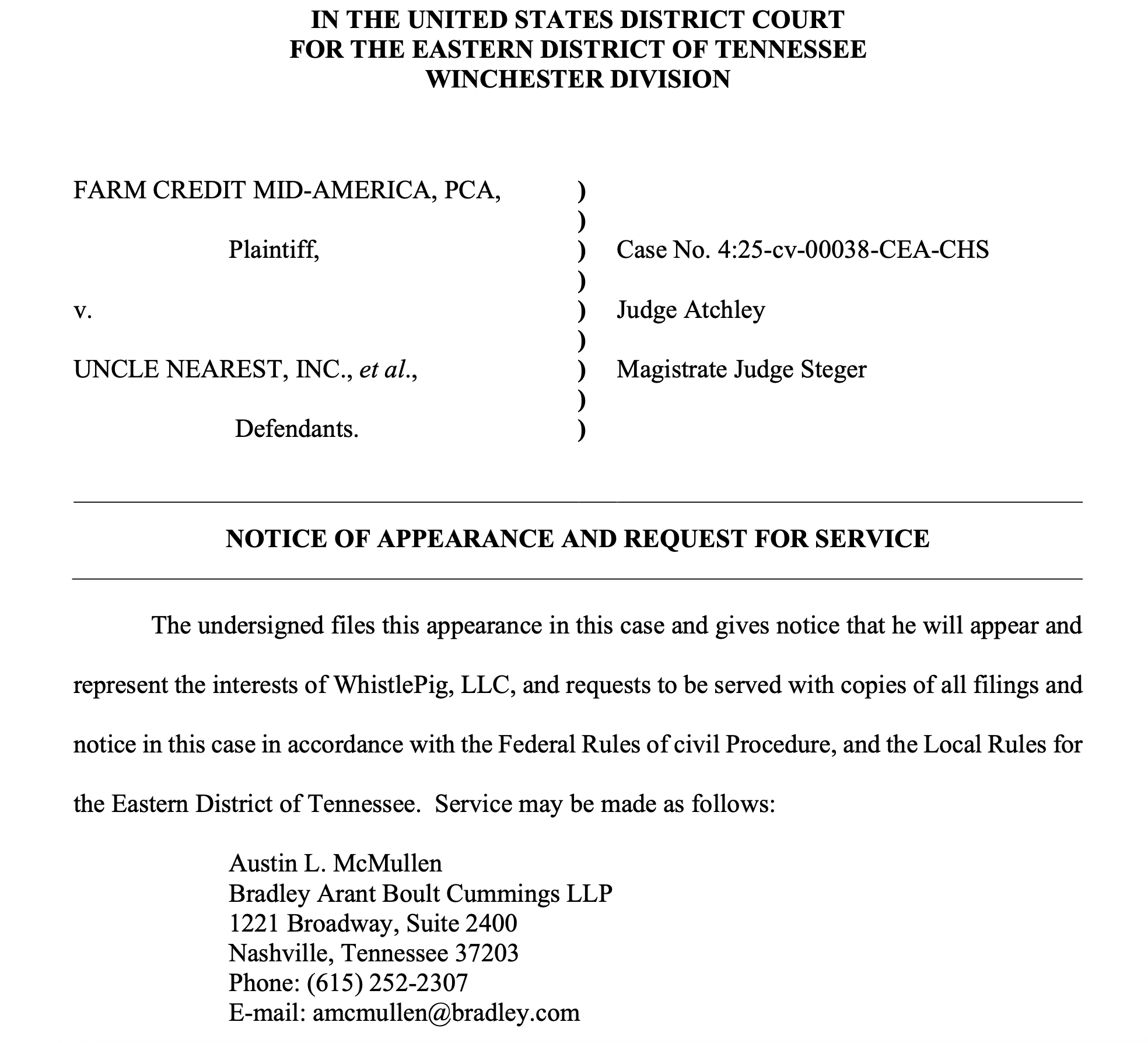

Fun fact, Patrick Whitesell who is a defendant in this fraud case, is also an investor in wait for it, wait for it, Uncle Nearest.

Fun fact, Egon Durbin who is a defendant in this fraud case, is also an investor in Uncle Nearest.

Fun fact, Ari Emanuel who is a defendant in this fraud case, is also an investor in Uncle Nearest.

Irony it would seem, is not yet dead and buried.

Fun Fact, Elon Musk was on the board too, but resigned in 2022 before the mess.

Fun Fact, Fawn liked to tell anyone who would listen that she and Elon talked regularly.

I made a glib remark about the whole “soror” thing and let me be clear. Sororities have social benefits, and I understand the value of these organizations. It’s infuriating when you didn’t earn it, but bought into it because of fame and other peoples money. So I apologize to the sorority folks out there, I didn’t mean anything towards you. I do not apologize to the culties who “soror” in the comments who continue to carry water for The Weaver (TM) and ignore all facts no matter how clear they are.

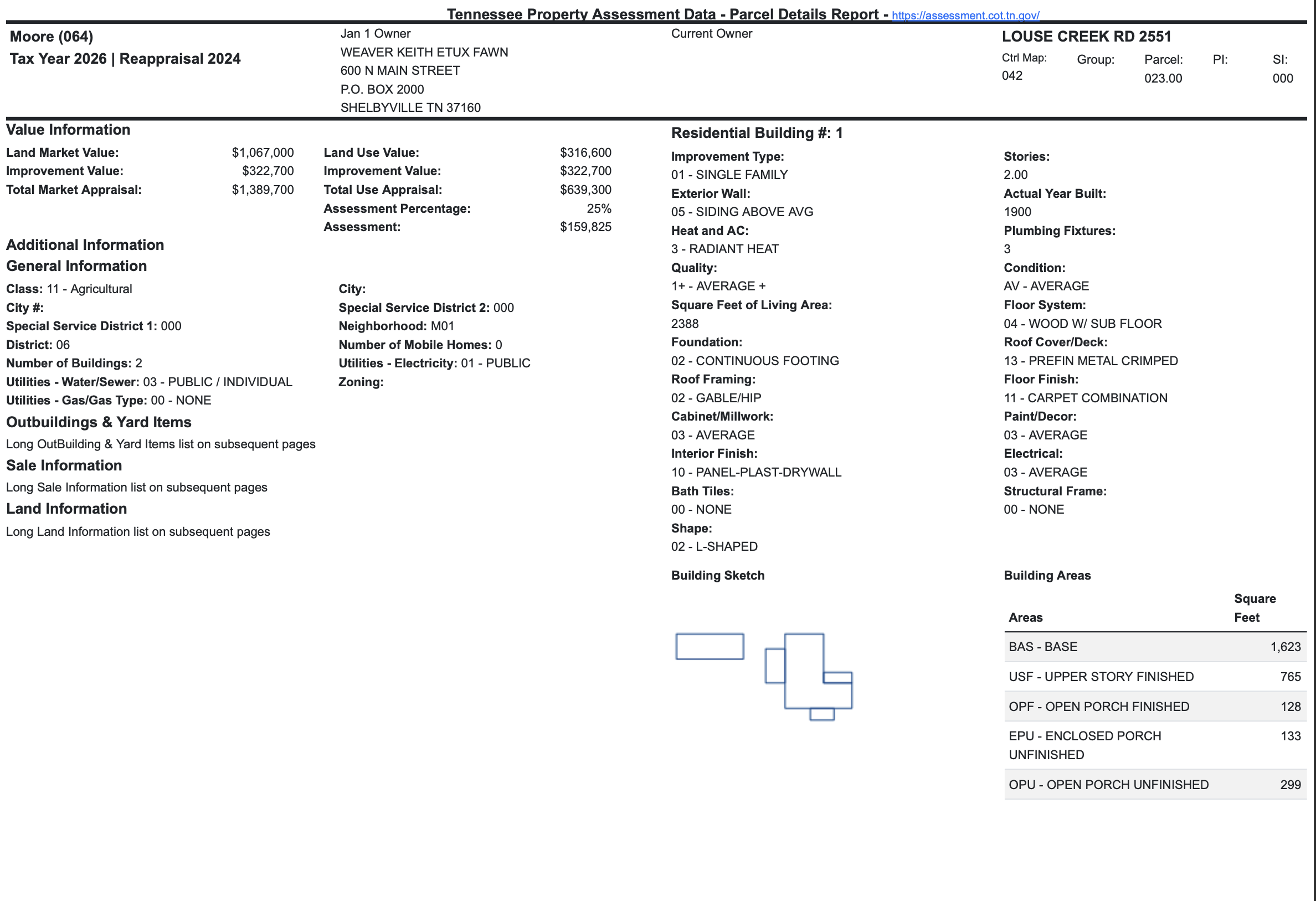

The Weaver (TM) property at HWY 82-S 1409 is still deeded to The Weaver Trusties.

Just wanted to say hello to the Rock Town folks, no really, just wanted to say hello.

Former employees of Uncle Nearest are having trouble finding work, with some of them reporting that they are actually being asked about their involvement in the UN debacle. As if any of the former employees had anything to do with this mess. Uncle Nearest on the resume (or CV if you prefer) is a gift that keeps on giving, kinda like herpes.

A pal said something to me via DM that I found to be important to share, as The Weaver (TM) mess impacts the industry at large, not just UN.

“This person/company has been the standard and example set before every whiskey startup in the past few years. I don’t know one whiskey marketing or PR director (I’ve seen both) who hasn’t been told, ‘do what UN does but better. Find a way…’ and I’ve even seen industry colleagues fired because they couldn’t compete with UN. So many were judged on a sham, not to mention the collateral damage along the way.”

The fact that people were expected to match Fawntasy Results is a real blemish on the industry. People in leadership should have known better, and many industry people have doubted the “realness” of UN for a number of years. Imagine getting shitcanned because you couldn’t beat fraud.

How will the judge receive the three part video series? I can’t imagine anyone is happy with that.

I’m still SO IRKED that the employees keep getting screwed by the unbothered and unmoved.

I’m pretty sure that the Weaver’s are exiting Tennessee. I doubt they’ll be back, even if they temporarily regain control of the company (no way that happens).

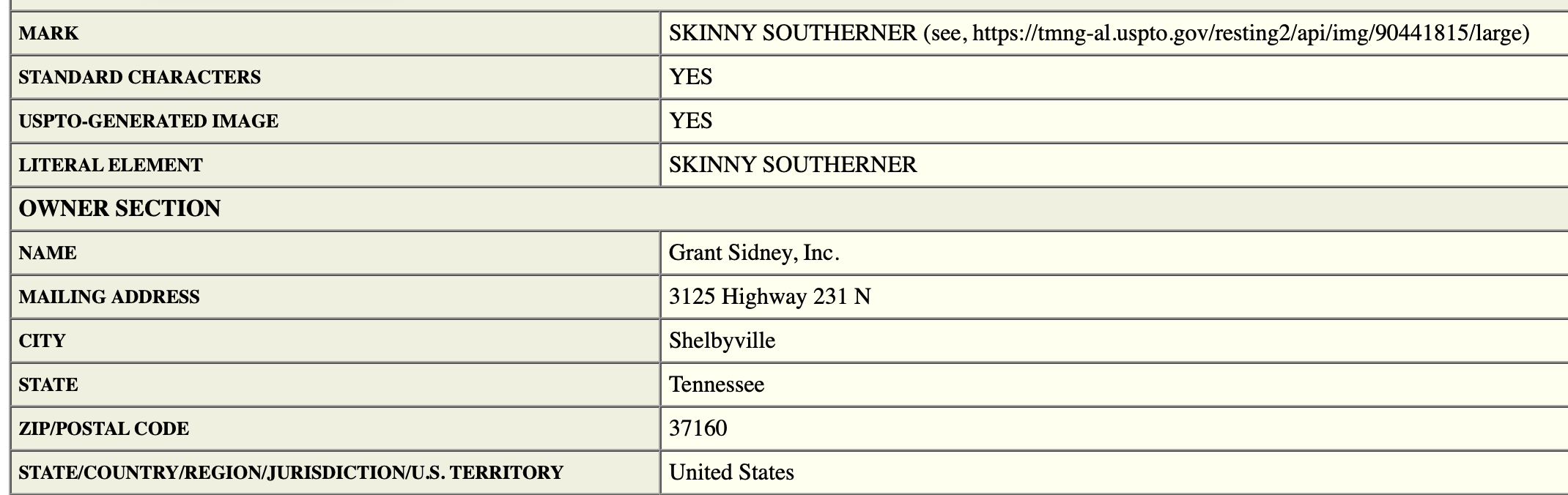

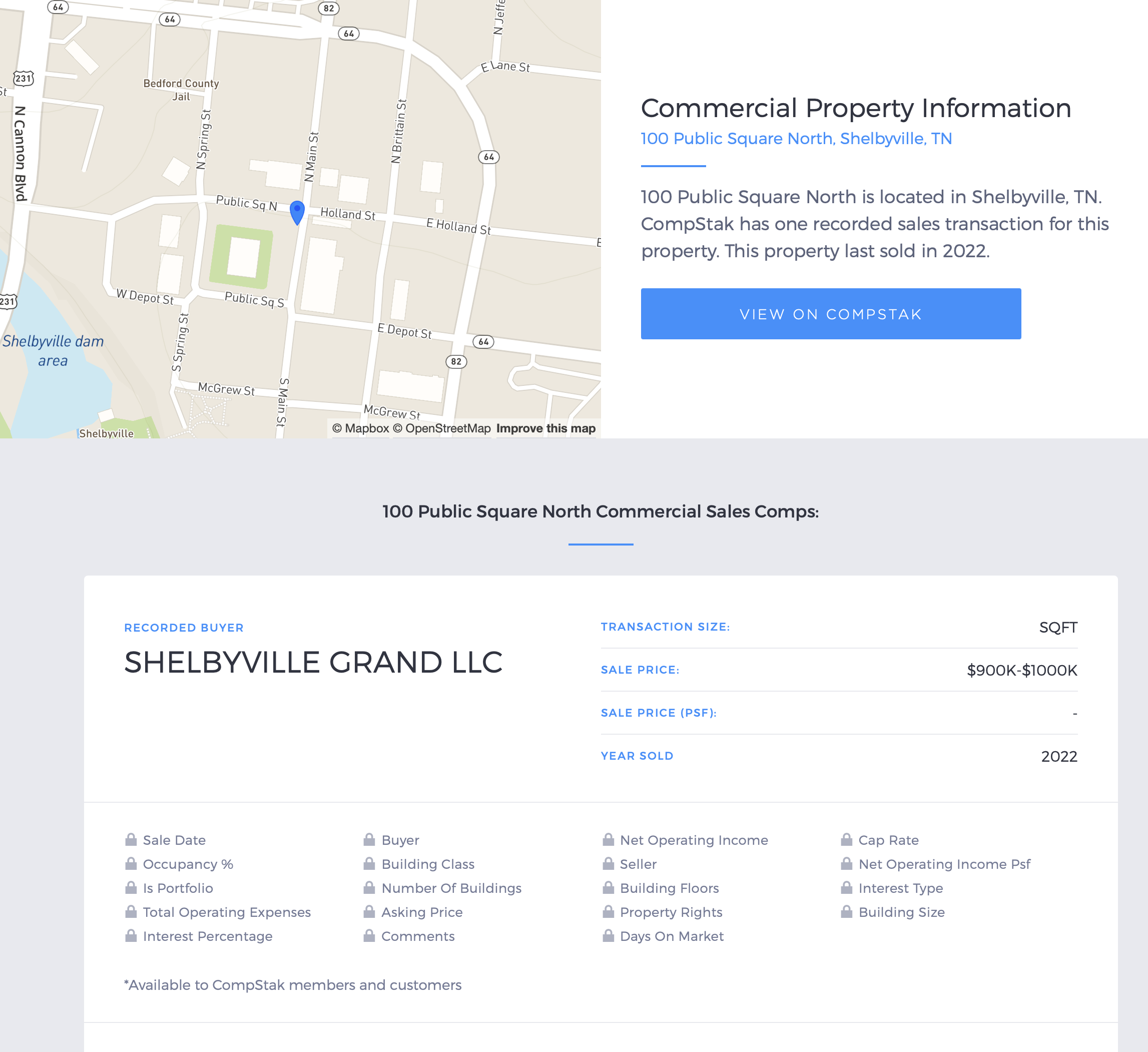

I fear that the “distillery” will be abandoned, and the label will end up somewhere else. A distillery that cannot make whiskey is valued at the parts of the Vendome still. This will not be good for Shelbyville, and that’s a real shame. This Weaver induced catastrophe will have a lasting impact on that town, and its residents.

Thankfully they didn’t have to make the drive from Newark.

Christopher and Adriana are disappointed but they understand.

No hidden messages here, just tired, sore, and want a Genny Cream.

UPDATE 2/14-

One of the dreadful things about having to take cycles of antibiotics is that you have to take them every six hours on the button. Which means, one has to get up at stupid hours in the morning to take them. I’m on a 10/4/10/4 cycle, so at 4am I took it, drank my water and then couldn’t go back to sleep. So I started playing on the internet. Why does this matter? Because there is a new lawsuit, HOLD UP HOLD UP WAIT A MINUTE, it’s not against Uncle Nearest, and no I’m not referring to the bombshell complaint that was lodged against Bardstown Bourbon Company.

So why is that on this live update page for the Uncle Nearest case? Glad you asked. I ask for you to indulge me for a moment or two.

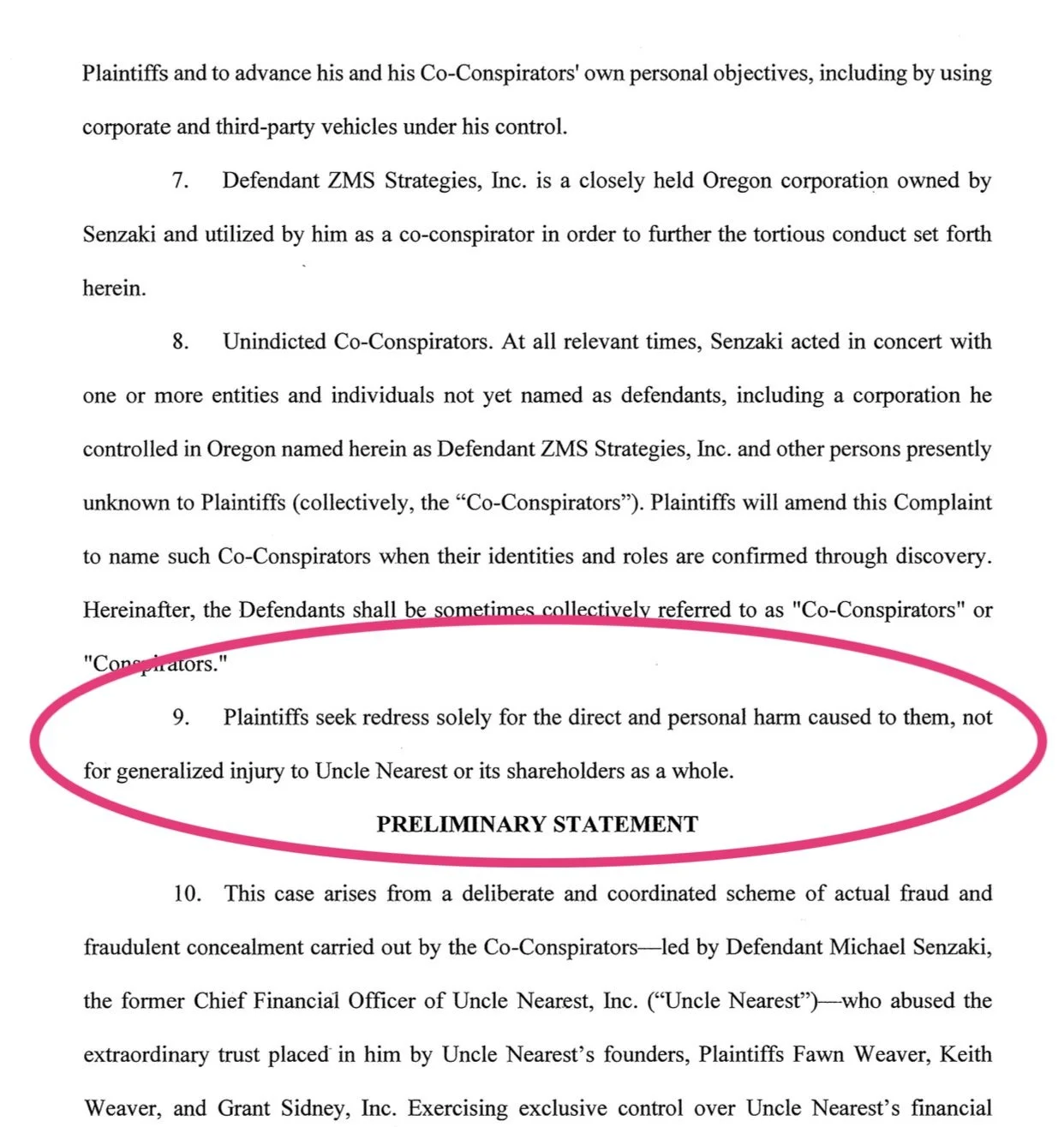

This brand new class action lawsuit was filed in California against Endeavor Group Holdings, Inc. (and its affiliates) in connection with the take private merger that occurred in 2025. The lawsuit was filed January 16th 2026. The plaintiffs claim that Endeavor misrepresented the fairness of the transaction and understated the value of the company, thereby pressuring shareholders to sell at artificially deflated prices. The case centers around Endeavor’s $27.50 per share buyout offer, which was criticized as unfair based on flawed valuations and concealed information about the post-merger surge in the value of TKO, Endeavor’s most valuable asset (yes, that TKO, WWE/MMA).

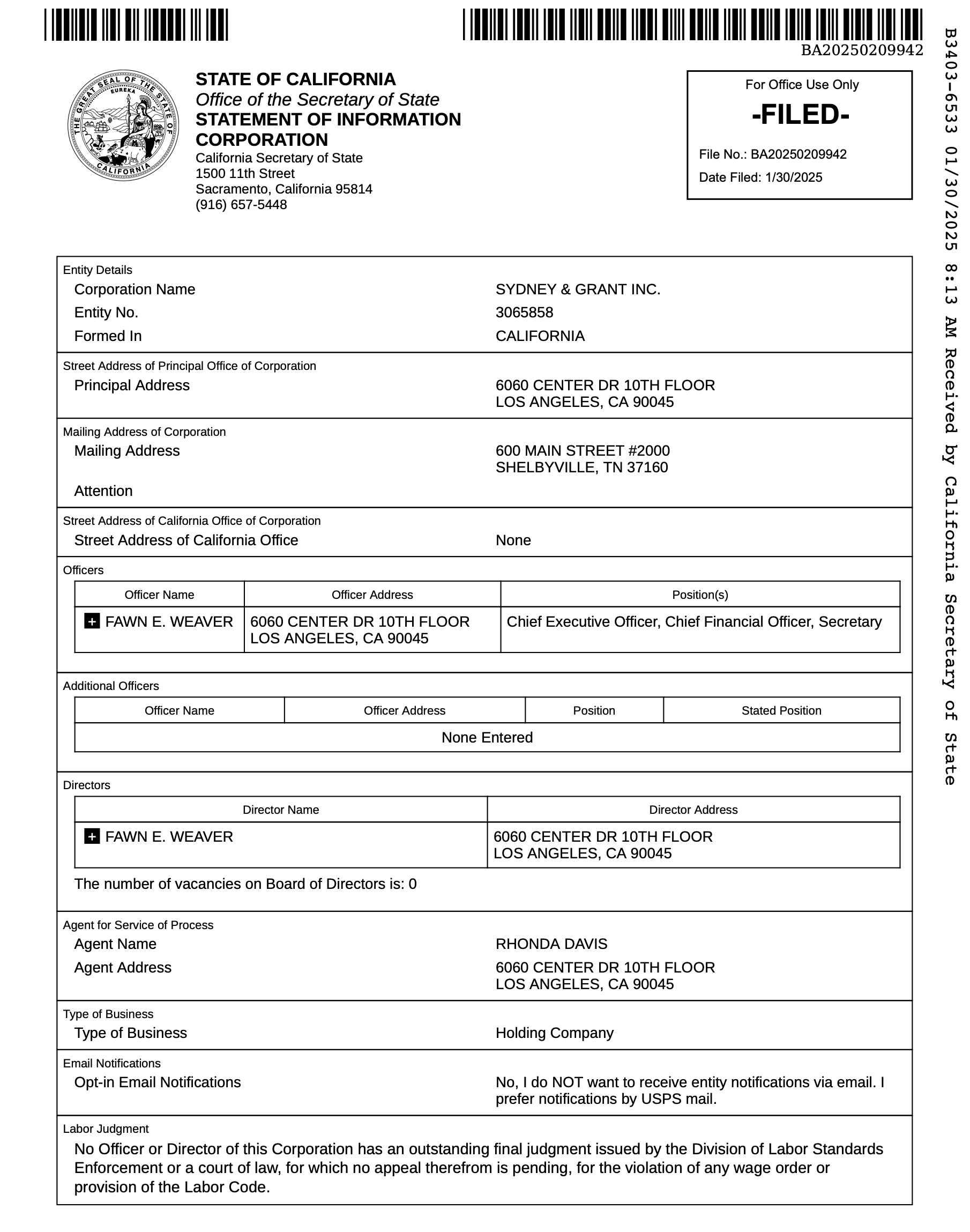

The complaint highlights that key players like Ariel Emanuel, Patrick Whitesell, Fawn Weaver, and other board members were part of a coordinated effort where insiders negotiated favorable terms for themselves, including equity rollovers and significant side benefits not shared by the public shareholders. The merger process was pushed forward under questionable circumstances, where minority shareholders were denied a true “majority-of-the-minority” vote, and essential financial information (especially about TKO’s rise in value) was deliberately left undisclosed to investors. Oopsie.

Fawn Weaver, as a member of Endeavor's board and the Audit Committee (2021-2024), is implicated for her role in overseeing the company during the period leading up to the merger. She is named as one of the defendants because the board was responsible for approving the merger terms, which the plaintiffs argue were unfair to public shareholders. Specifically, the failure to disclose the dramatic increase in TKO’s value after the fairness opinion and the tax savings that were diverted through amendments to the Tax Receivable Agreement (TRA) are central to the allegations, which ultimately claim that the defendants, including Weaver, failed to ensure transparency and accountability to public shareholders during the merger process.

This is likely not good for The Weaver (TM) because her position on Endeavor's board and involvement in overseeing corporate governance could make her personally liable if the court finds that she and the other directors misled investors or failed to fulfill their fiduciary duties during the merger process. Anyone notice a trend here? Her role faces a hard look as part of the board level failure to protect the interests of minority shareholders (now where have I heard this before?), especially given the lucrative terms secured by insiders while public investors were forced to accept undervalued buyout terms.

Is the claim asserting that The Weaver (TM) is entirely to blame? No of course not, they’re blaming the entire board. But it is interesting that she’s held two board seats, and both companies have ended up in court.

While I won’t be breaking down that lawsuit, I did read it, and there are so many common themes regarding The Weaver (TM) on that board of directors, and on the UN board of directors that I included it here.

No word on whether she remains unbothered, and unmoved.

Know what doesn’t pay the bills? Zero dollars or the Weavers.

UPDATE #3- 2/13-

Regarding Humble Baron employees- this enfeebled company that is run solely by the Weaver’s and not the receiver, will be issued paper checks, not today, not Saturday, not Sunday, but on Monday. These Cosplaying Moguls think they can run Uncle Nearest when they can’t even run a bar with a half dozen total employees. These “leaders” are unfit, inept, incapable, unqualified, inadequate, clumsy, bumbleheads. Venmo these folks their MONEY. You’re on your phone constantly, send over the ca$h.

UPDATE #2- 2/13-

While The Weaver (TM) was on her late night social media bender, payroll for Humble Baron was not met. I’m guessing Mr. Severini from Genesis will blame the receiver for it even though HB is not under his control. One or more Weaver’s will remain unbothered and unmoved that the few remaining employees probably won’t get paid unless Keith sells a car or something. I’m sure it’s just an oversight. A mistake. Senzaki’s fault. A plot to steal the company. Fun fact, Lamborghinis and Teslas do not have good resale value. Neither do real live horses.

Folks, I play around on this blog, I poke fun at the absurdity of what is taking place often. There’s banks, and investors and money to divvy up, but most importantly there are real humans that continue to get ratfucked by the Weaver’s and their ineptitude. I am baffled by the continued out of touch tone deaf social media presence of this cosplayer mogul who can’t even pay some poor bartender souls who need the money that they earned from WORK they already provided.

This kind of shit infuriates me so much. The Weaver (TM) says the team that has stuck by her is the TRUTH. Truth don’t pay the rent boss. Truth don’t pay for childcare, or healthcare, or gas for the car, the electric bill, food, water, heat. Know what does? Cash money direct deposited ON TIME as agreed upon in exchange for labor.

Unbothered, unmoved. Awful awful and awful. The culties won’t care, because “soror!” and all that crap. I care. The employees care. The Weaver’s do not. But hey, Sunday with the Weaver’s is coming up where Fawn will make a terrible cocktail, claim she invented it, snuggle with baba who looks like he wishes he had explosive diarrhea so he could have some quiet time alone in the bathroom, and then we can watch them make some food that others watching can't make because they haven’t been fucking paid.

Too fast, too loud, too much stimulation.

UPDATE 2/13-

I begin today with a deep sigh. I had oral surgery yesterday morning to remove two teeth in preparation for implants. Long story short, genetically soft teeth and 20 years of playing hockey is a bad combination. Kinda like The Weaver (TM) running a company. Anyway, I can’t talk for a few days, but these fingers can. I was going to go over a few things on my mind and show the beginnings of my deep dives on Kai and Alex Pineda (UN’s corporate chaplain), but The Weaver might have found some of that Columbian Addy, and took to the socials. So today, we will break that down.

There was a three part video series, the last one was super late, but the energy was still high. The videos were all at a frenetic pace, I thought I had changed the speed of the playback, but then remembered I wasn’t on TikTok and this was real speed. It sounds like one long essay with no punctuation, so I’ll break it up into indigestible parts with my usual seasoning below it in italics.

PART ONE- Recorded at 9:10pm.

“The post, so many of you been waiting six months to see, but I couldn't record it until I finally took the stand on Monday.”

Well, no not really. Many of us, this cat included, have been following the case in detail, and not just with what is publicly known via court records. But go on.

“They say Uncle Nearest isn't solvent, but the numbers don't add up. Every cash flow report we've gotten from the receiver shows Uncle Near's operating between cash flow neutral and cash flow positive.”

They being, the bank, the receiver, the 100+ vendors/contractors that weren’t paid prior to the receivership, the employees that were laid off, but yeah, all that adds up to a successful solvent company, go on.

“Debt balances include amounts that aren't even owed, and the same barrels once called missing to prove fraud are now being counted as 45 million in debt. That's not insolvency. That's a fundamental contradiction.:

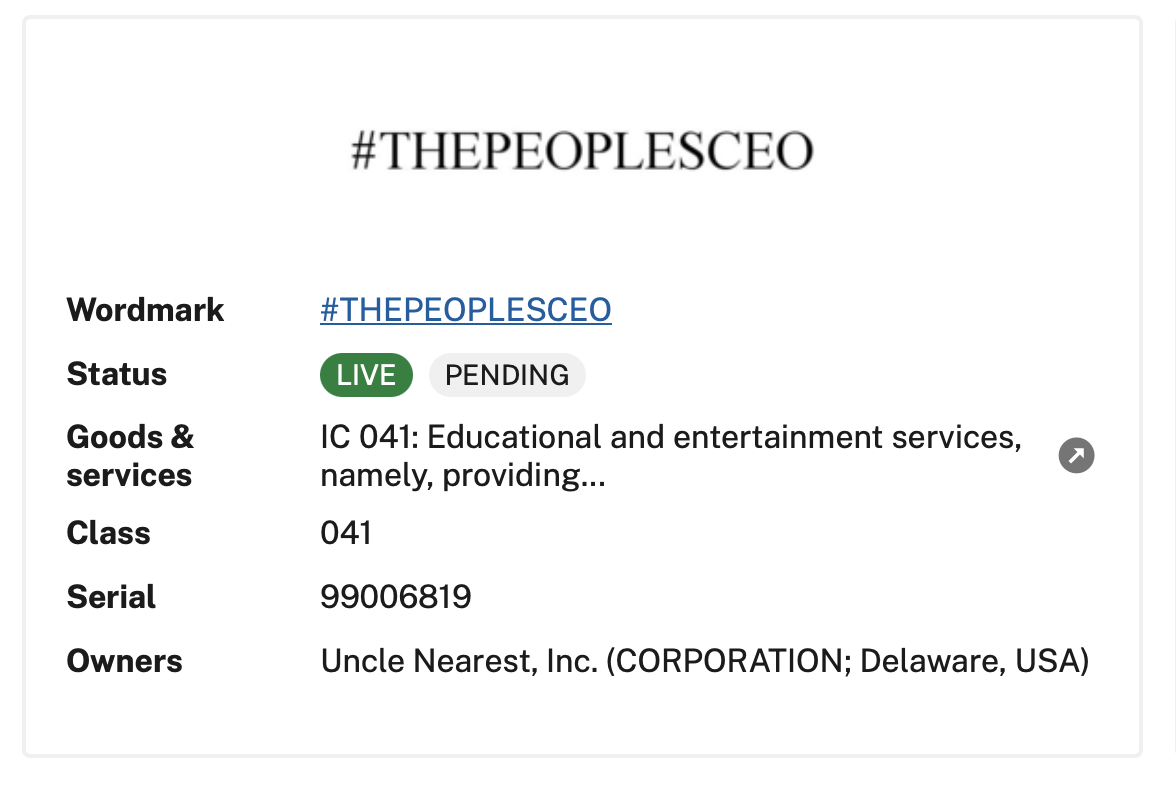

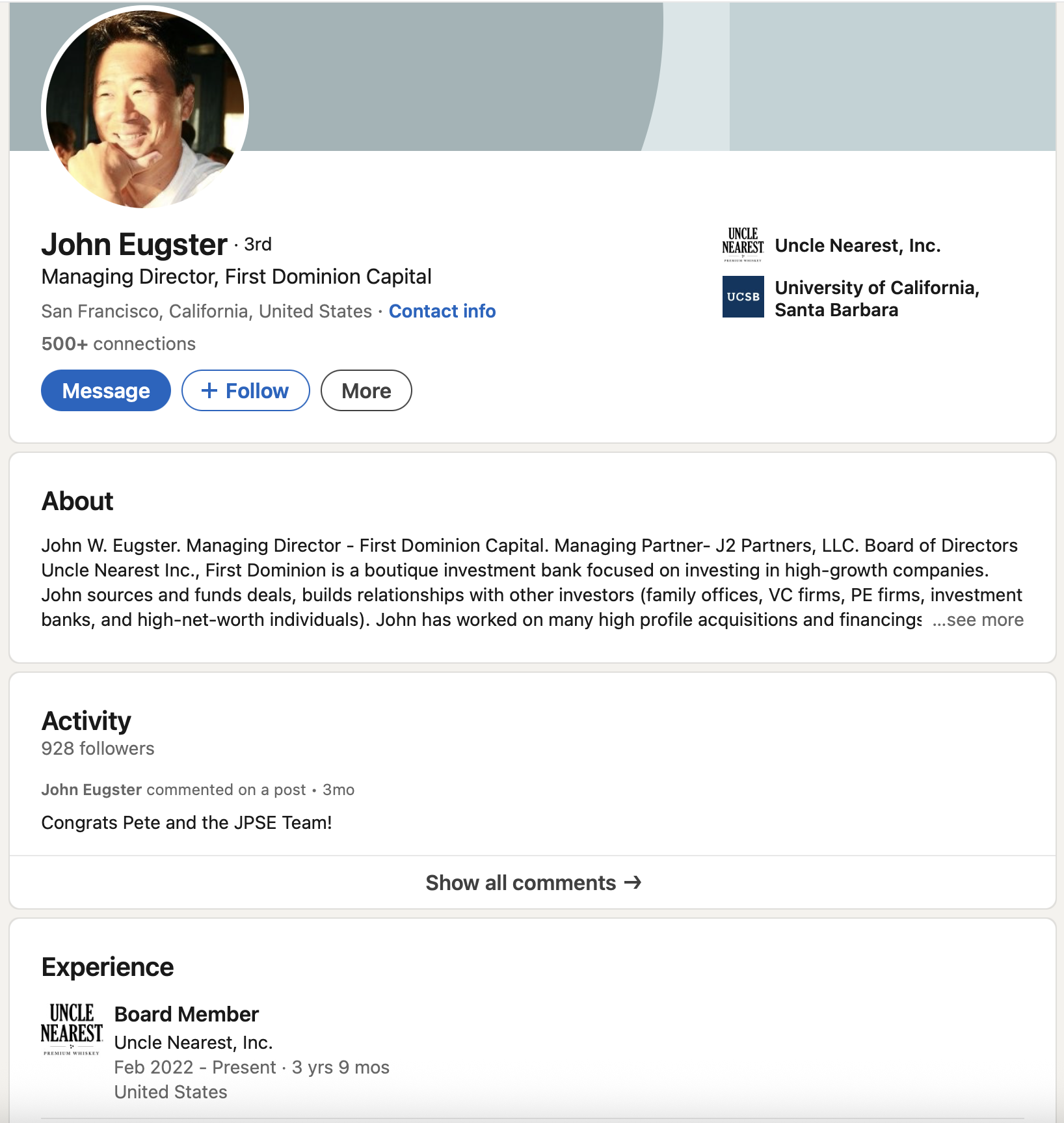

She used air quotes talking about the “missing barrels.” I’m pretty sure that The Weaver (TM) has accused Senzaki of inflating barrel counts that were “discovered” by Felicia Gallagher and that the “third party investigation” approved by the board of directors (Fawn, Keith, John Eugster) and also not “disclosed” to The Weaver (TM) to protect “impartiality” who also seems well versed in the “findings” acknowledges the “missing barrels.” Air quotes are funny. As for fundamental contradictions, it makes sense that there are, when one position is fact based, and the other is not.

“So how does that happen in a court appointed process that is supposed to be neutral? Let's get into it. This is nightcap with Fawn Weaver, I take hot topics, strip away the drama, politics, and gaslighting add truth, history, and a little bit of hope, served, straight up. No chaser. “

She will use this same promo intro in the next two videos.

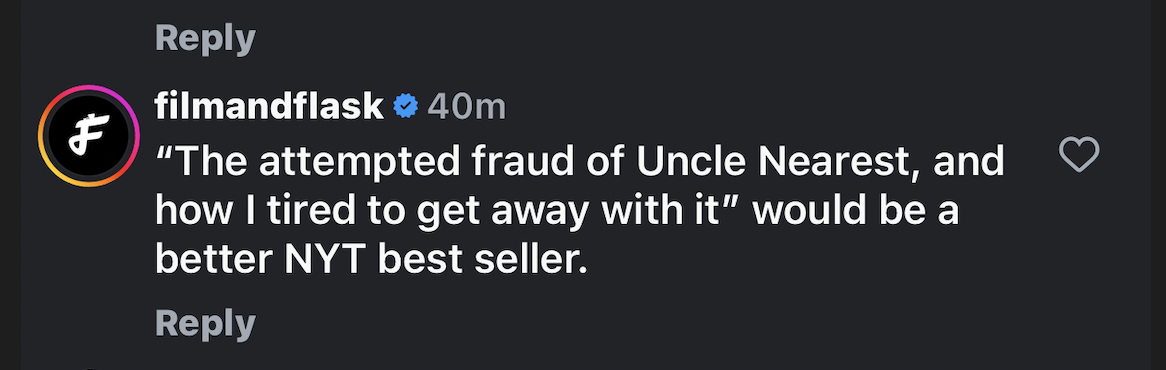

“I've been documenting what's been going on for my third New York Times bestselling book, and I didn't have a title till last week. The attempted heist of Uncle Nearest.“

I love this line so very fucking much. How is it a NY Times bestselling book when you haven’t had Chatgpt write it yet? Also, without using employee amazon accounts, company credit cards, and sock puppets to boost pre-sales, how will it make the list this time?

“First off, the balance sheet the receiver submitted to the court, but then didn't stand by it while on this stand, showed approximately 20 million tied to a convertible note related to the sale of my personal shares, and no structure to convert to equity in 2030. It shows 3.7 million supposedly owed to my holding company. $17 million, owed to UN affiliates. When asked what that was for, he says, I don't know. It was in the system when I got here, we just left it there. “

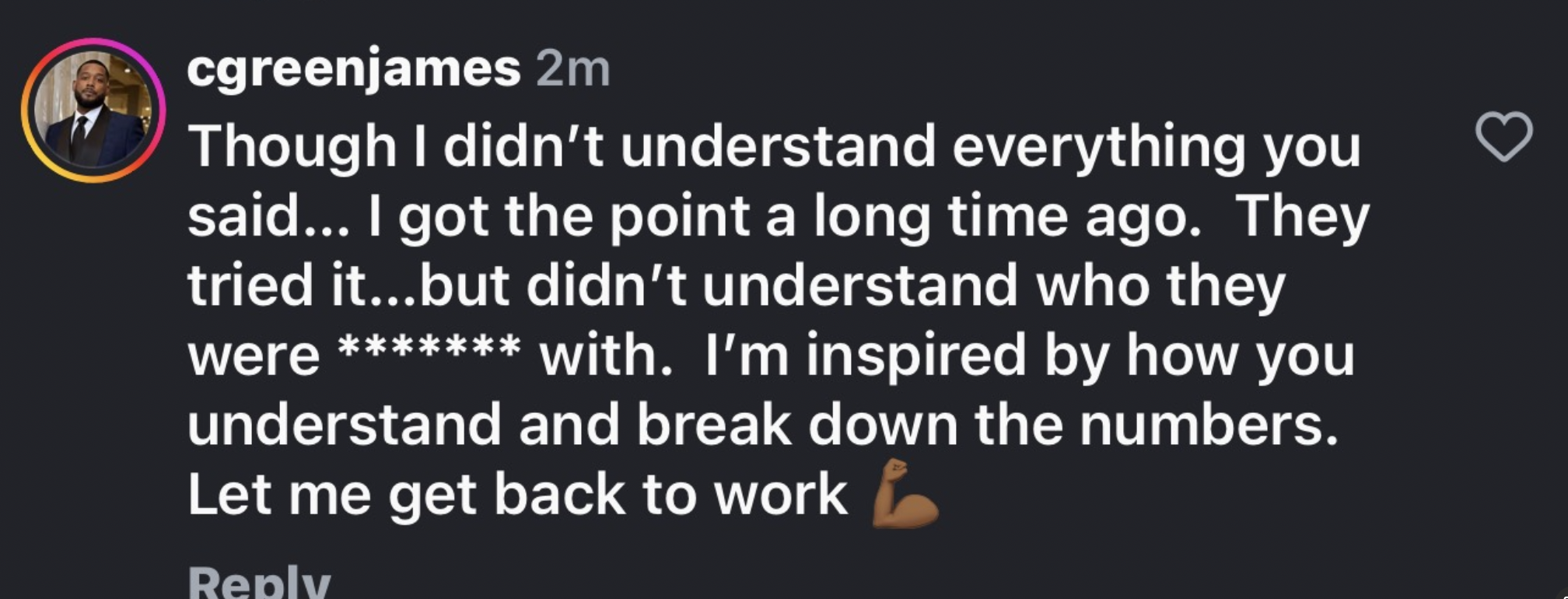

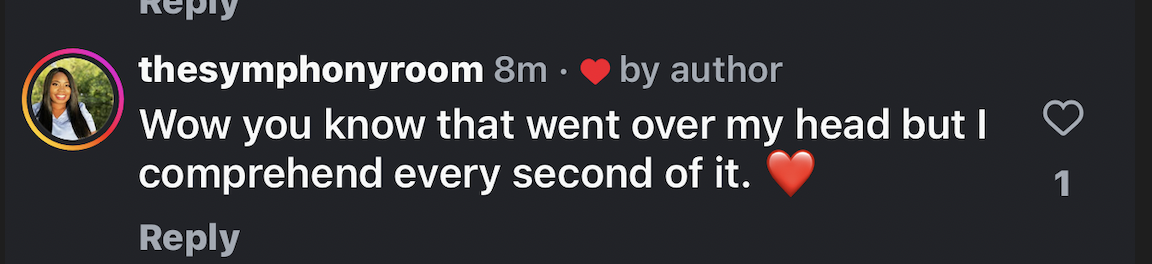

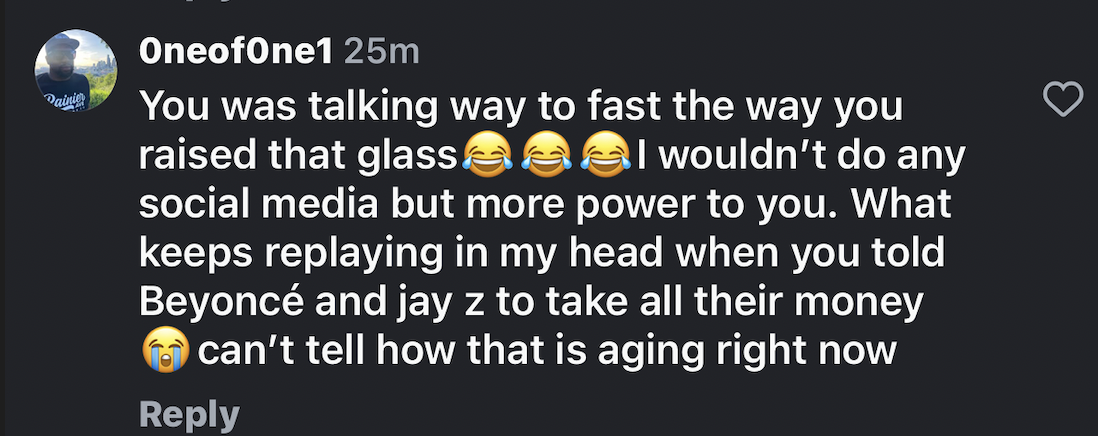

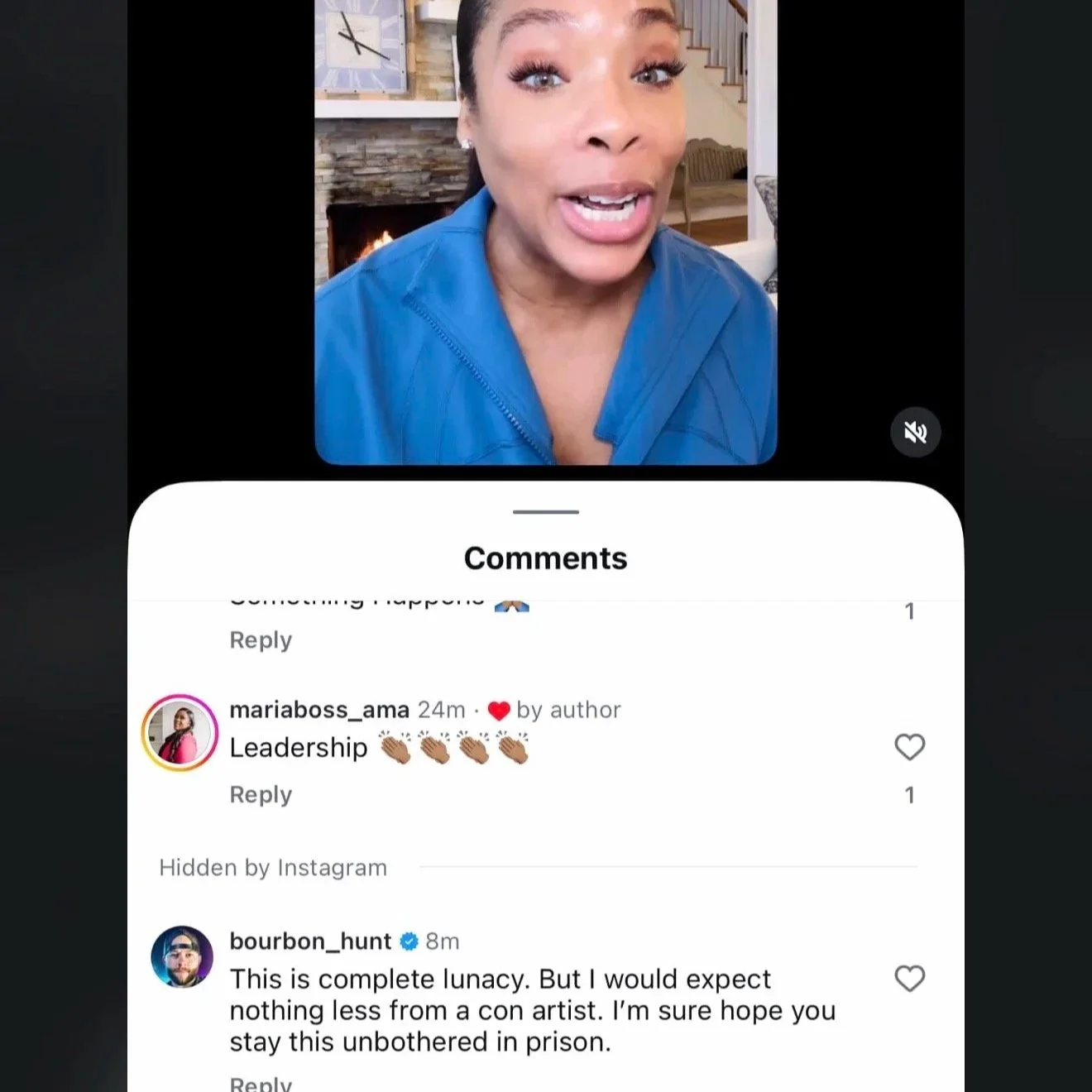

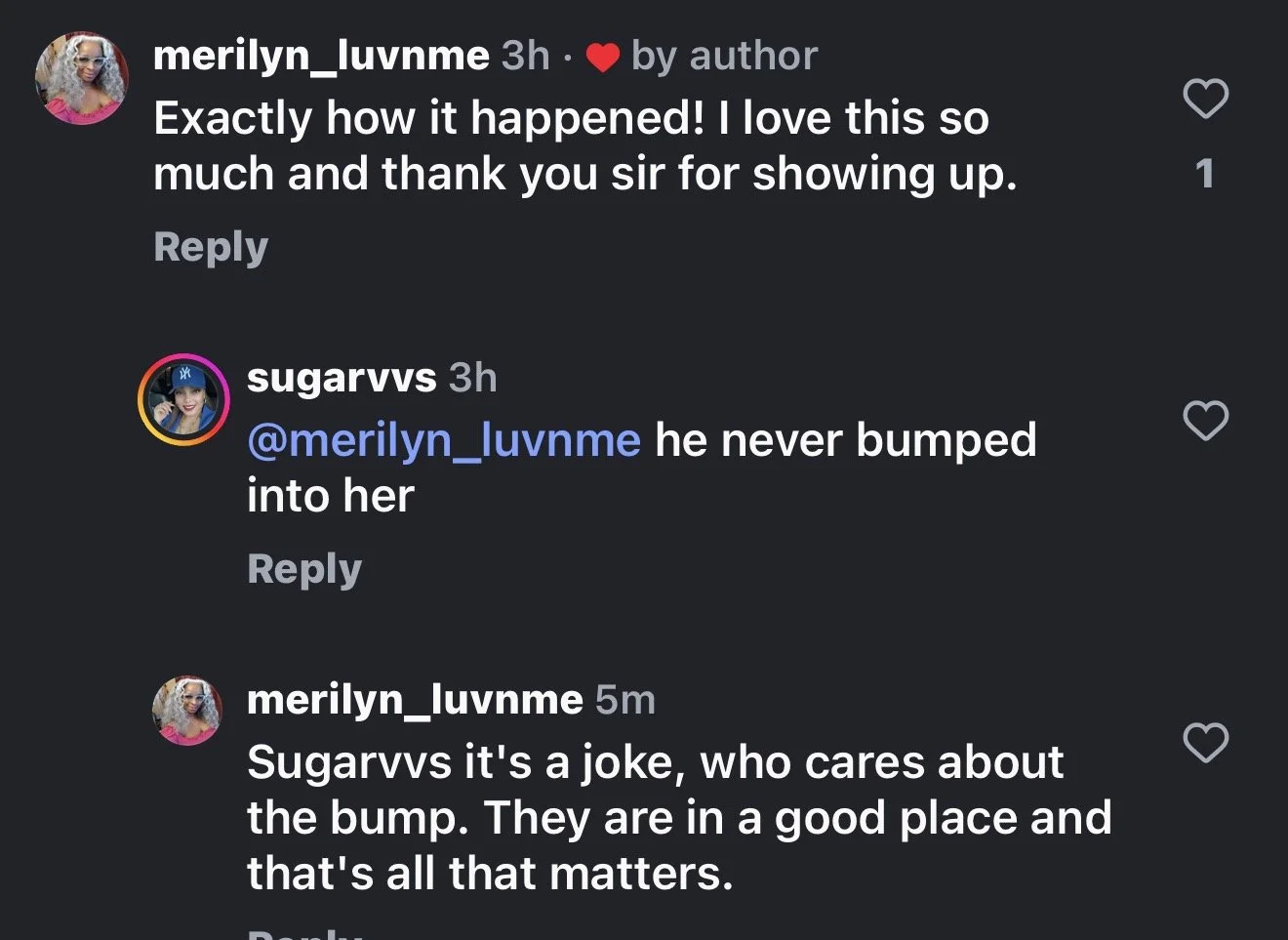

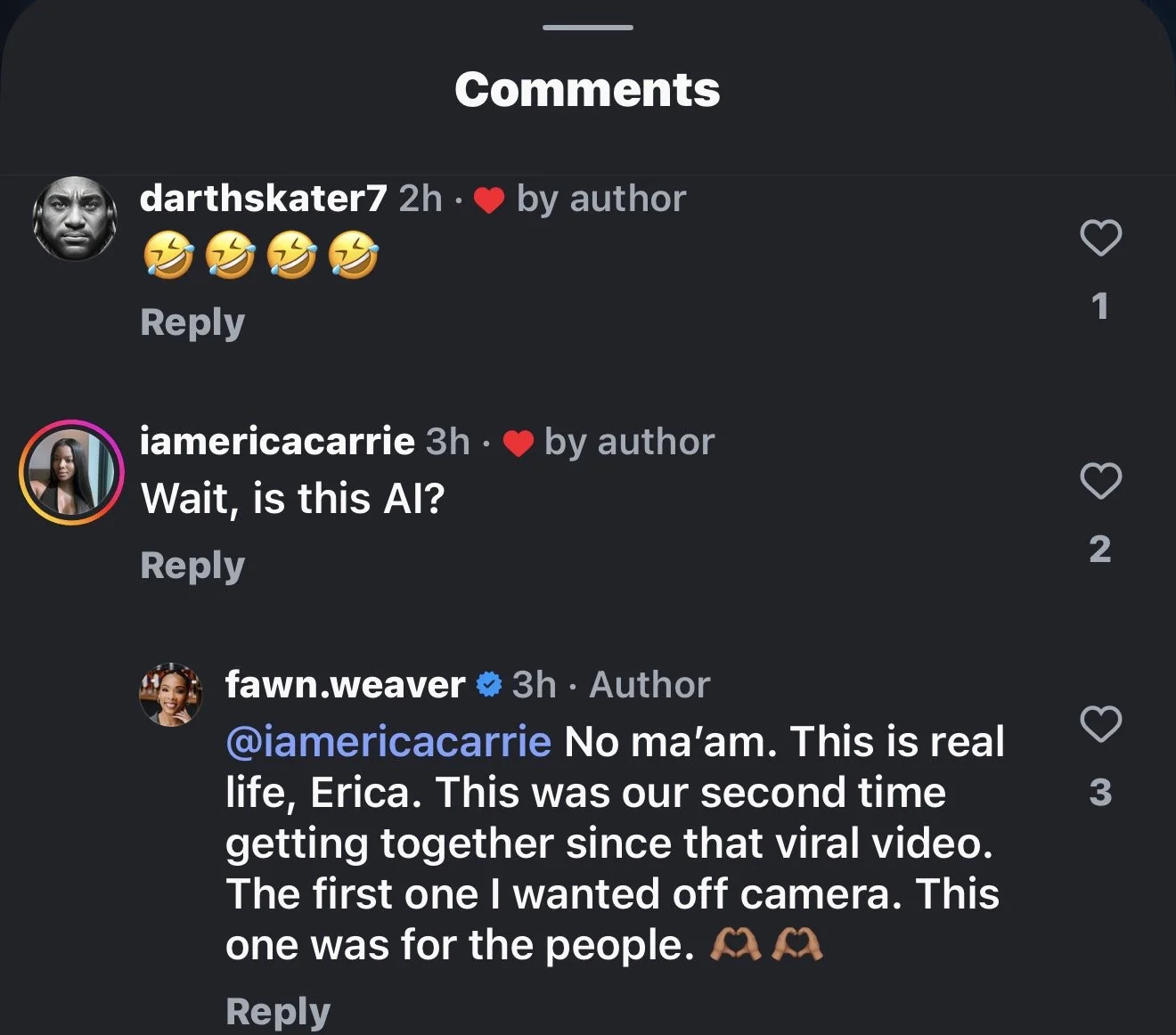

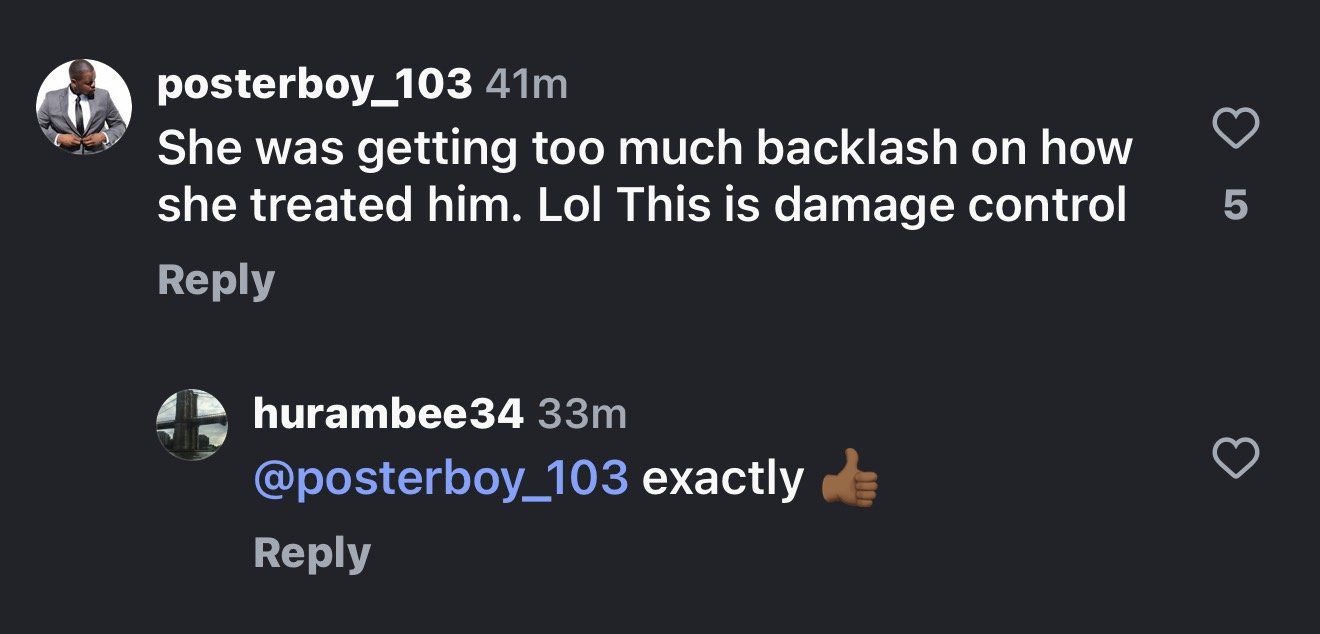

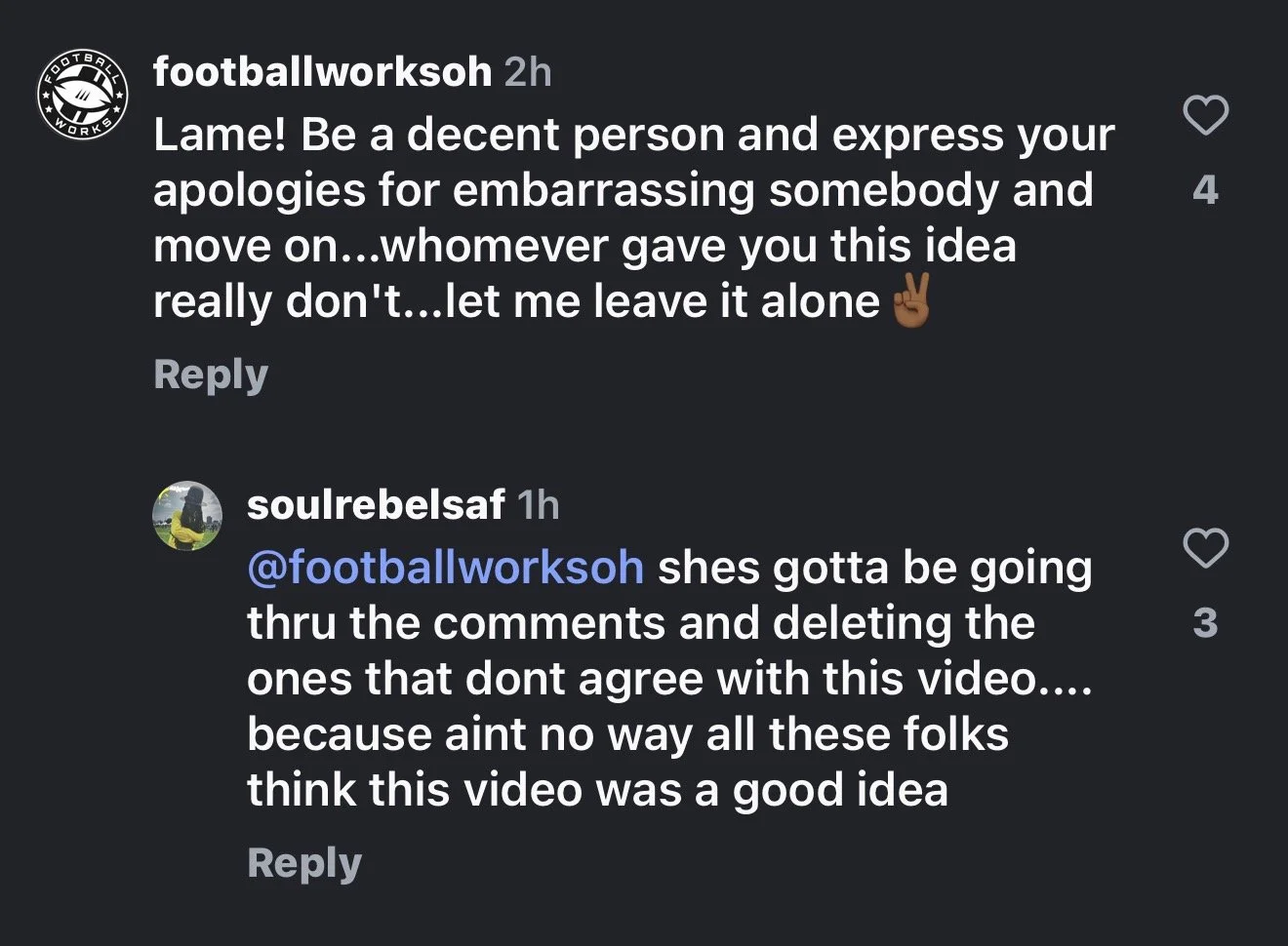

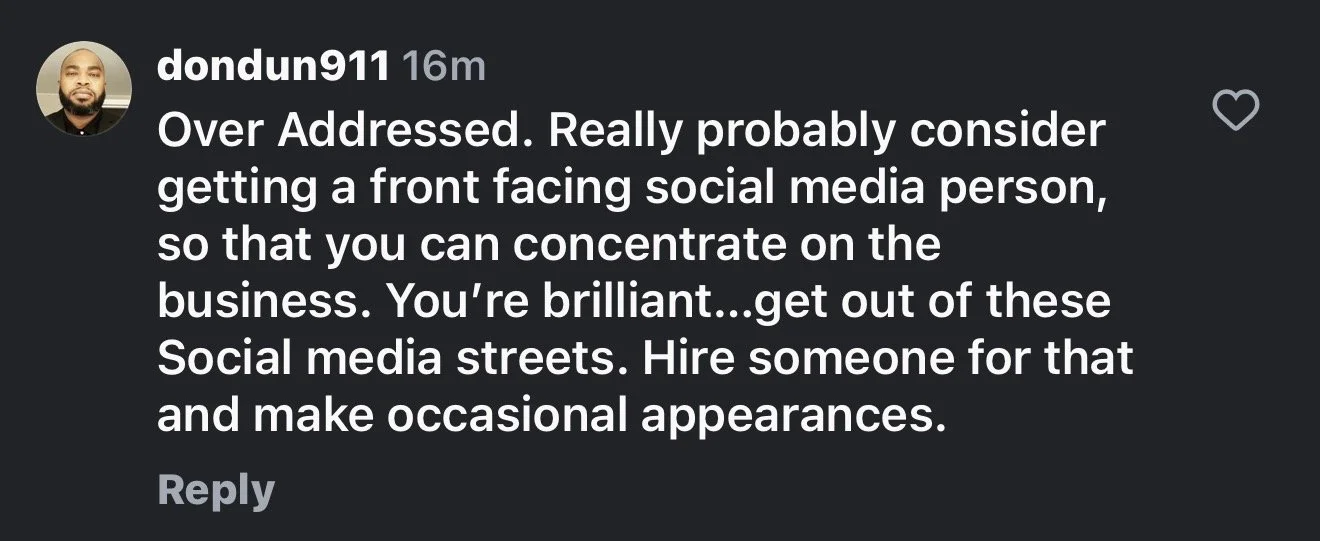

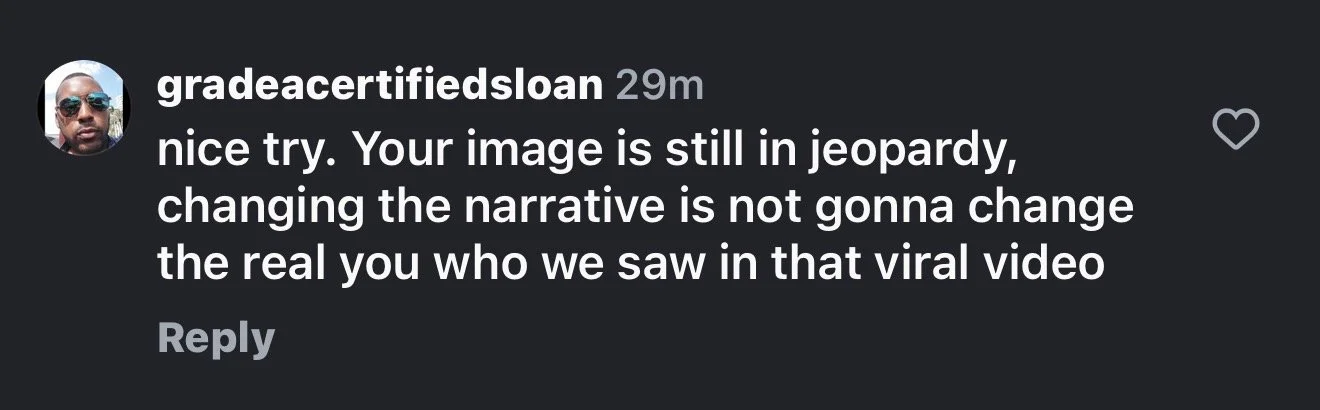

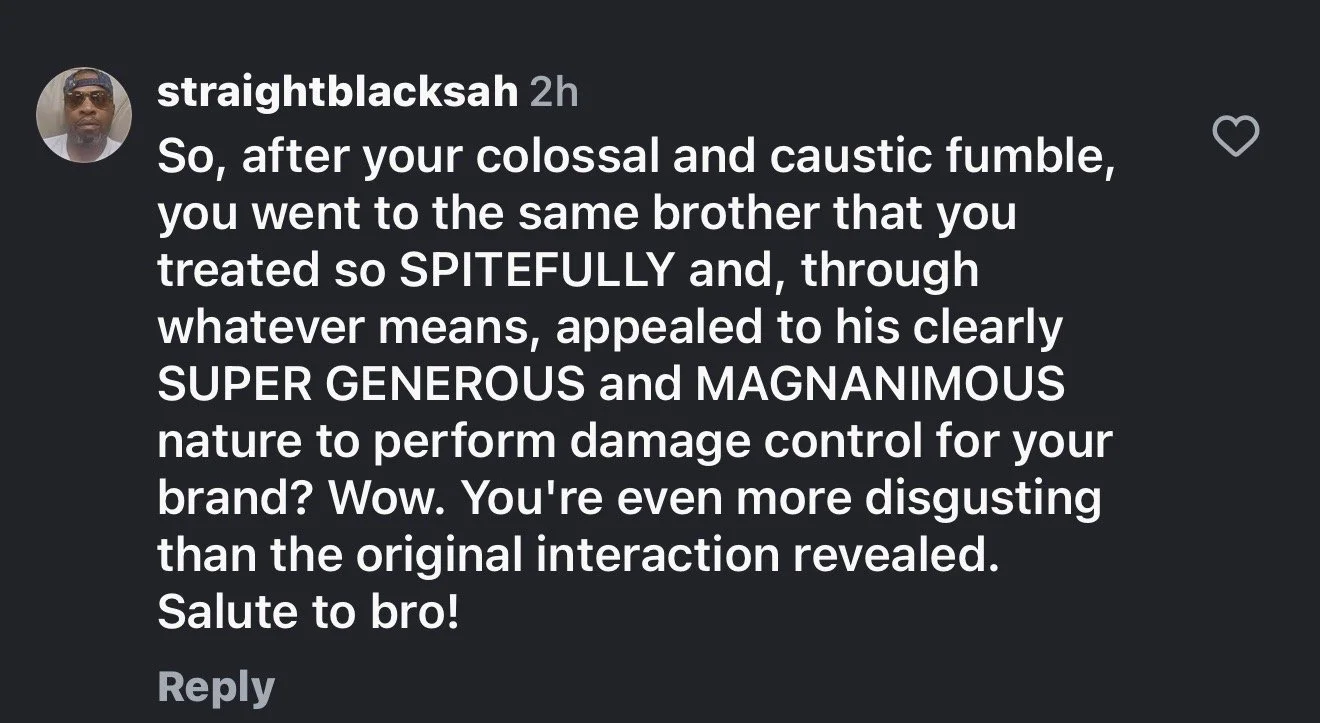

This was a lot of gobbledygook. Not much more than a word salad that is fat free, gluten free, additive free, and flavor free, The Weaver (TM) does things like this a lot, it’s flooding the zone, and it is intended to overwhelm you and cause the cultie brain to go “oh yeah, that makes sense” when it does not in fact make sense. Case in point in the comments to her video below.

“You know, those combine this $40 million of the debt. Six months in, the receiver admitted, at Monday's hearing under cross examination, that he nor his team has sent confirmation letters to verify whether the debt being counted is actually owed.”

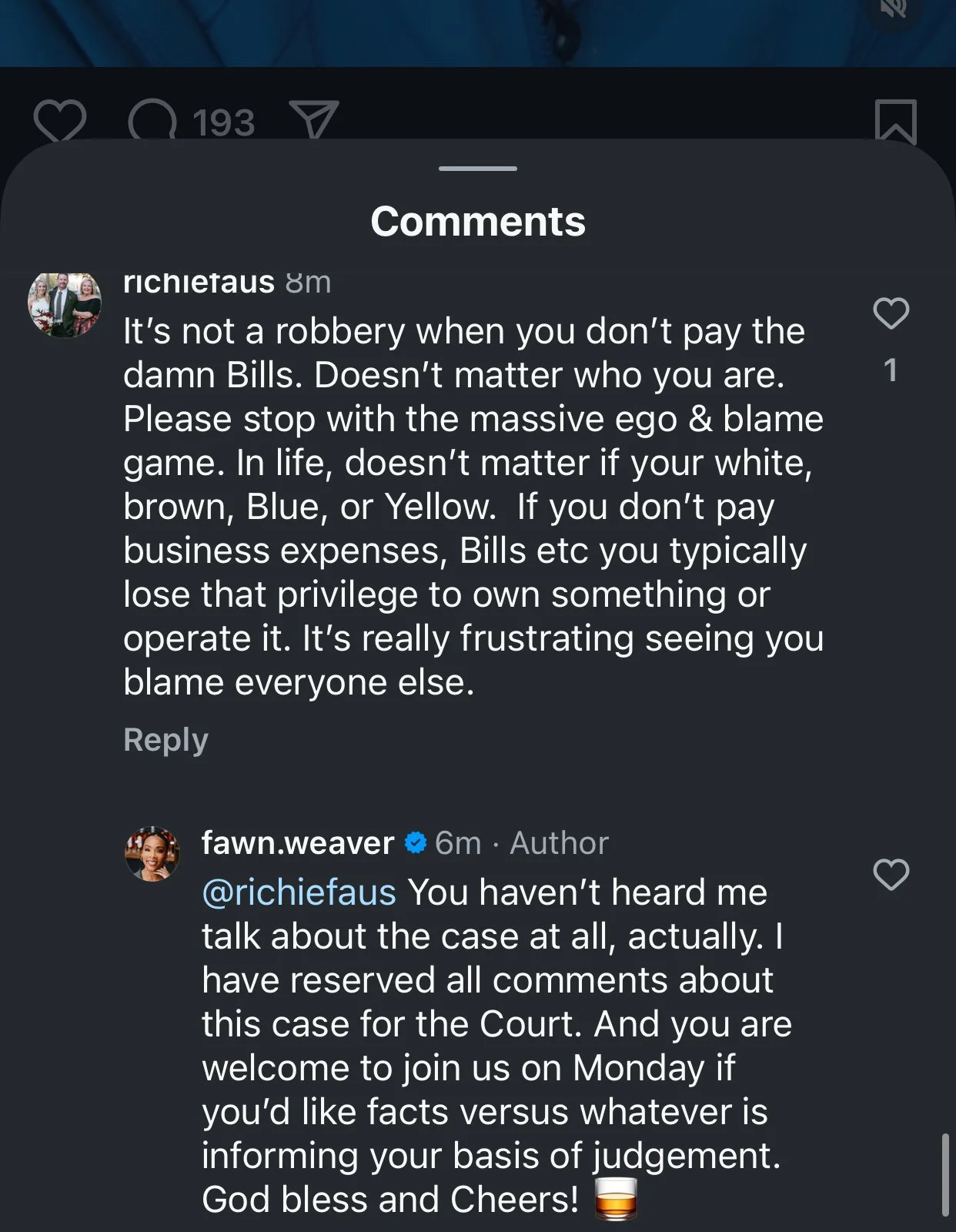

Let’s just say that I expect to see a lot of things from the transcripts that she won’t have mentioned, so I expect that this is her framing things in her favor. I mean Cap’N Phillip doesn’t have an IG to respond, he’s doing what he does professionally and carefully. Trying to unwind the mess that’s been done to this company since 2018 is not easy. We are six months in, and yeah, that’s a lot of time, but is it? Do you need to send a confirmation letter that a debt is owned when a company sends a demand letter demanding payment?

“Then there's the 45 million debt for the missing barrels the receiver testified as now due related to barrels we financed on a forward purchase contract. He admitted his decision to stop paying storage and taxes almost 25,000 barrels is what triggered the acceleration by many, many years.”

I’d like to see his statement of testimony on this, because I think what triggered things by many many years is The Weaver (TM) not paying the debts owed, and running the company straight into the receivership.

“Now let's talk about the so called refinance process. The stated focus of bringing in an investment bank so early was to finance the debt. But as the receiver admitted under cross examination, there was no business plan created. The process began in mid November. Letters of intent were required by December 19th, four weeks later, a super wide net was cast. That signals distress, and distress tells the market, bid low for all the assets. “

I mean sure, other than the very public bank lawsuit, the receivership, all the court document revelations, the investors being furious, no cap table, made up sales numbers, the receiver must have caused the BroFundMe’s to lowball offer.

“Meanwhile, the bank is paying the receiver approximately $500,000 a month. Yep, half a million dollars a month in controlling all of our sales and marketing budget.”

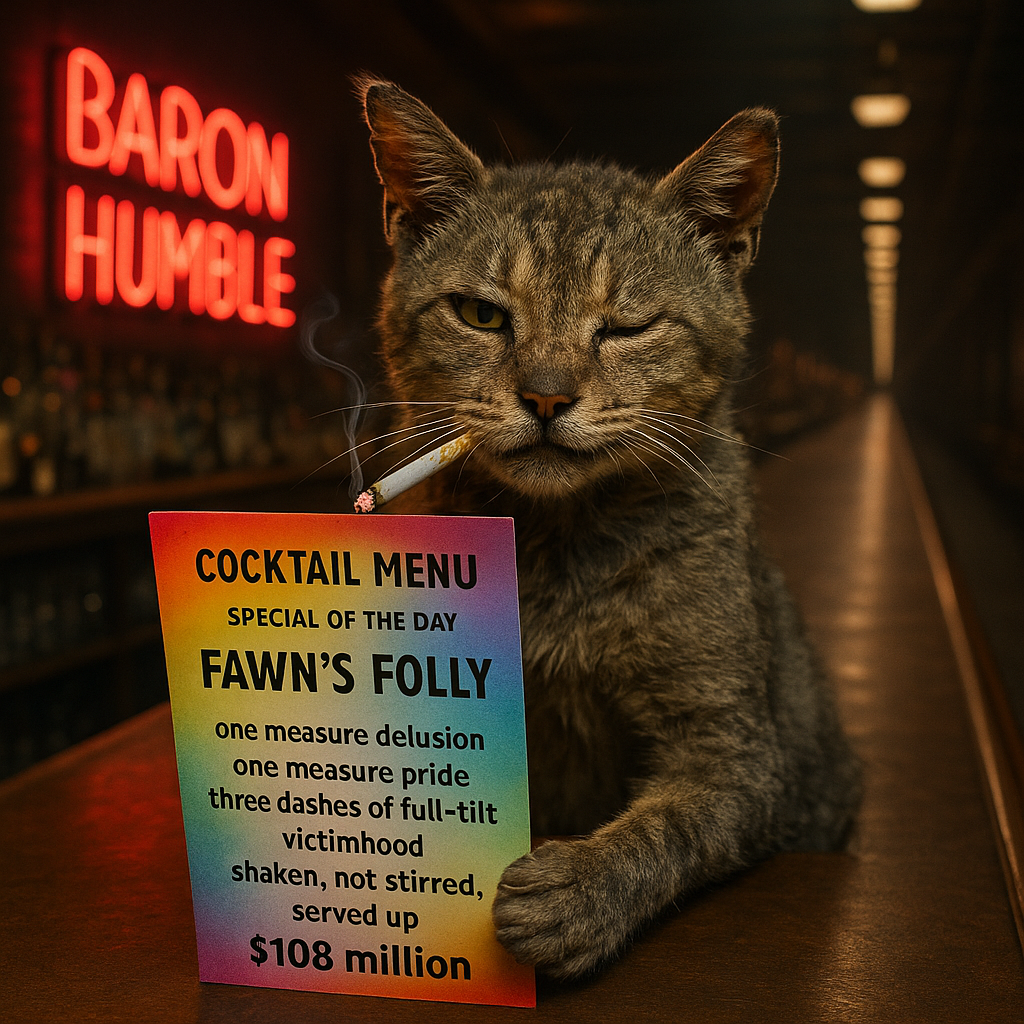

While it is true that the bank is pouring a shit ton of money into the receivership, which is keeping the lights on by the way, the bank has already stated that they aren’t micromanaging the receiver budget in any line item veto manner. This money would “poof” immediately upon the receivership being ended. Sure it’s added to the UN bill to the bank, but what’s a few million more when you owe $108 million that you can’t pay already? Especially when the bank forecloses on your stuff.

“When the judge granted the receivership, he said he would only tolerate it for as long as it was necessary. He made clear that a material change would allow any of us to request a termination.”

True. This is how these things work.

“A receiver is charged with maintaining status quo, when an otherwise successful and growing business, with financial challenges that could have been overcome by collaboration, experiences a precipitous decline immediately after the appointment of a receiver? That's a material change.”

Remember folks, this was not a successful business, but sure, she can try to paint this picture to the judge. A good friend of mine has always said, successful bars and restaurants don’t go into bankruptcy. I’d say the same would apply here.

“When a bank is granted an emergency receivership by claiming 21 million in barrels that are missing, that are now miraculously found, and you tell the court that Uncle Nearest was in default for 18 months for a payment missed in January 2024. But don't tell him that it was actually paid February 1st and 16 million more during that period, part two is coming.

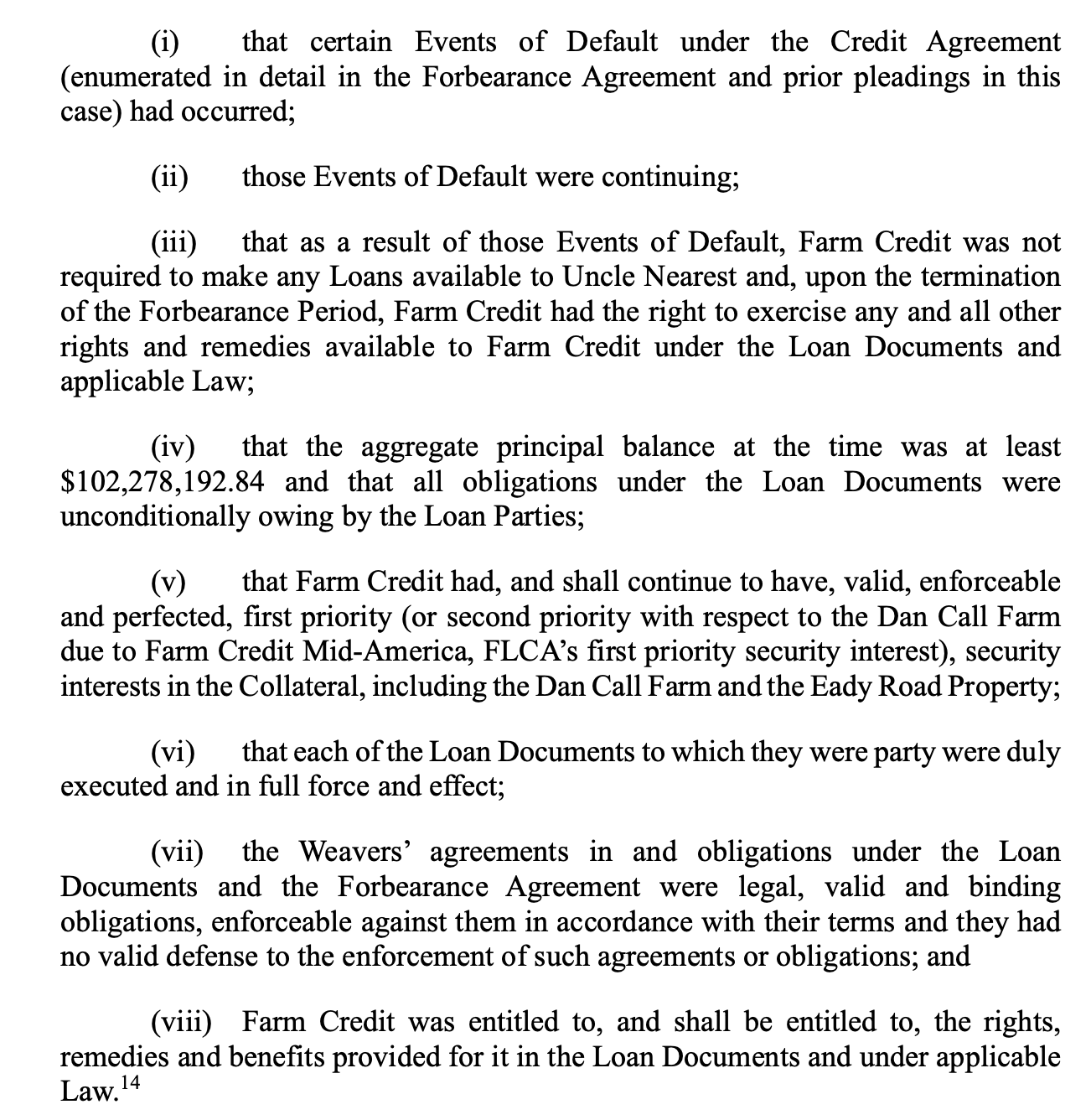

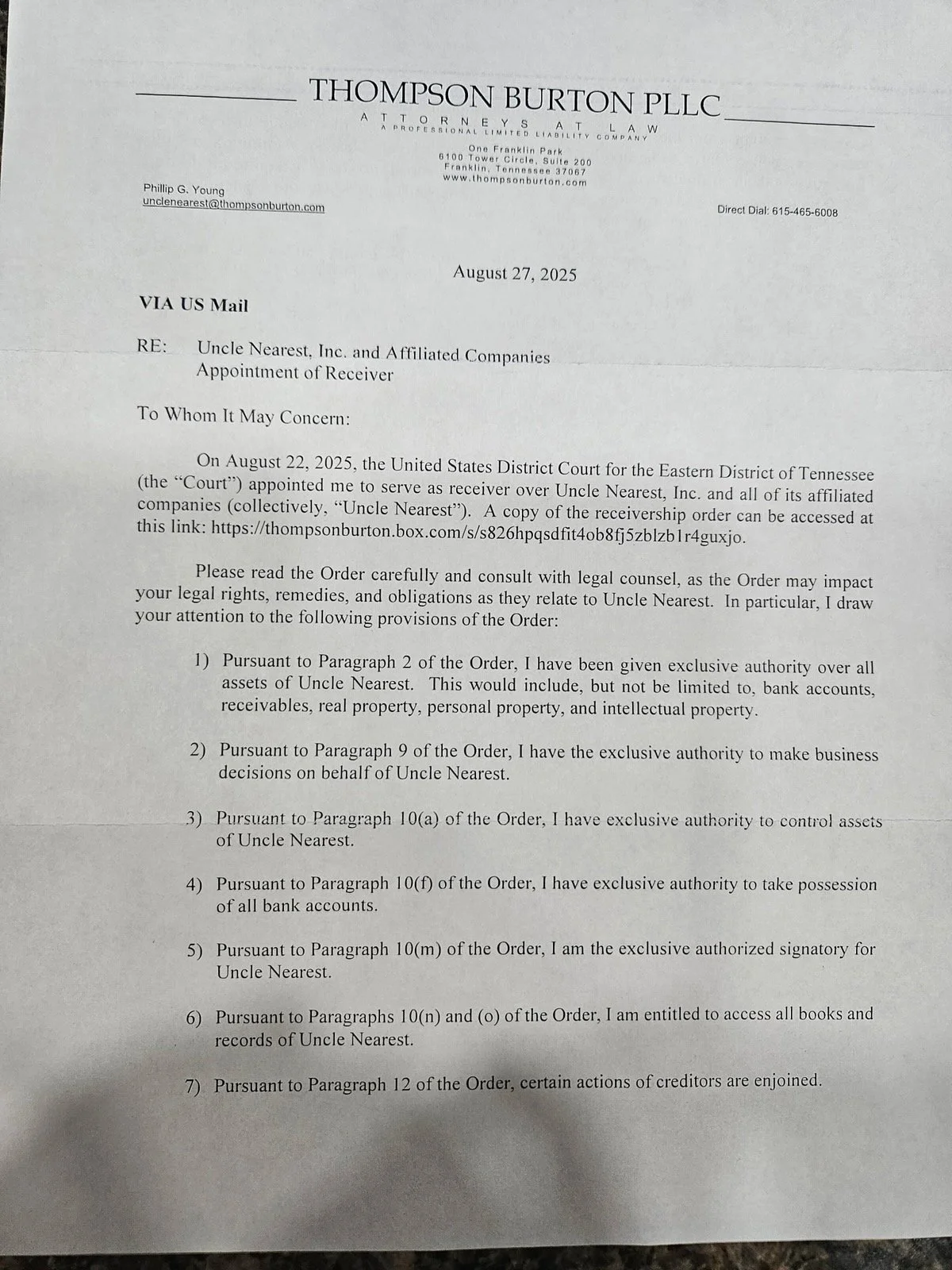

They didn’t file because of the barrel discrepancy, that was only part of it. Mostly the defaults on the loans, then negotiating the forbearance agreement, defaulting on that…. Let me just pull some quotes from the August receivership ermergency hearing transcipts..

FARM CREDIT ATTORNEY- “We signed the forbearance agreement, they make the payment. There was a payment to be paid at time of execution. That payment was made. “

JUDGE- “That was seven and a half million?

FCA- “Seven and a half million dollars, your honor. “

FCA- When the forbearance agreement was executed the money was paid, but then almost immediately they’re in default because they haven’t delivered any of the doucments, or done, you know, hit the milestones that they were supposed to hit under the forbearance agreement. The rub that really got us here today, the kind of straw that broke the camel’s bak, there was a 10 million dollar payment that was due June 16th. We had a meeting with them that Friday afternoon. We were sending wire instructions.

“Is the payment going to be made?”

“Yes. Yes. Yes.”

FCA- No payment made.

JUDGE- So forbearance agreement goes down April 15, 2025. Now after that agreement tell me what they’ve done to default.

FCA- So they failed to meet the January 16th payment under the forbearance agreement. There’s actually another payment that’s due next week. So I would say that’s an anticipatory payment default. I can’t imagine that ones going to be made.

JUDGE- How much is it?

FCA- $10 million. There are, you know, no interest payments that have been made. They’ve missed the quarterly installment payments on the term loans. THey’ve missed the amortization payments on the RELOC. We still don’t have monthly financial statements. We don’t have the borrowing base certificates. We still don’t have year-end financials for the fiscal year ending 12/31.

JUDGE- (To Rocky King, the Weaver’s attorney) Mr. King are you going to pay that 10 million next week?

ROCKY- Me personally, your honor? No, i’m going to be a little shy. We do not have that to pay next week. At least that’s my understanding as of right now, because it’s stacking.

They didn’t have the money prior to the receivership, they don’t have it now. Let’s get to part two.

REDBULL GIVES YOU WIIIIIIIIIIIIIIIIIINGS.

PART TWO- Recorded at 12:30am.

But the the receiver's supposed to be a court appointed neutral. But the bank pays them approximately half a million dollars per month. The bank controls our ability to bottle product and ship it to you. Toasted barrels rolling out now instead of last October, because the bank did not believe limited time offerings sell.

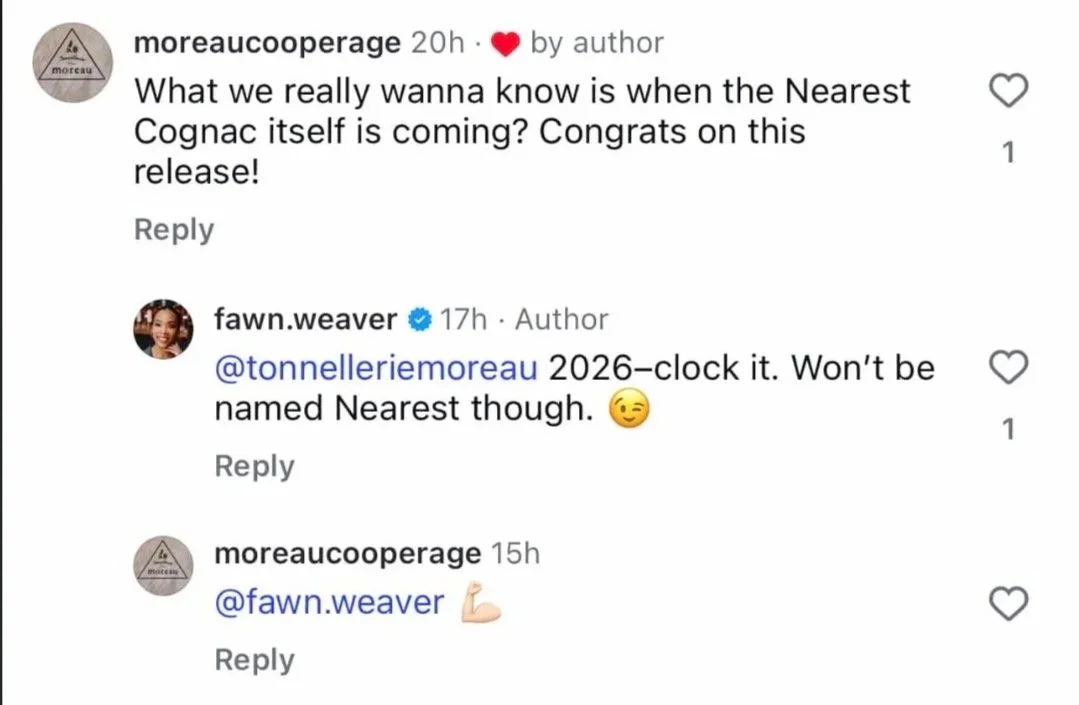

The bank doesn’t control these things. The receiver does though, and if he runs a cost to benefit ratio on an LTO and the juice isn’t worth the squeeze, then he kiboshes it. Any LTO release would involve The Weaver (TM) traveling to sign bottles, often. That cost counts. LTO’s are good money makers for some companies, and it’s probably true they work well for this one too. However, that doesn’t move the product that sits on shelves that have a quarter inch of pigeon shit on them they’ve been sitting so long. Selling through an LTO doesn’t make the store order more core product that they already have a ton of. Sure, they’ll order another LTO when it's available, but that’s not paying the debts off. The focus on Toasted, or cognac, or Copium finished LTO’s are not going to magically turn the company into a cash flow, debt paying concern.

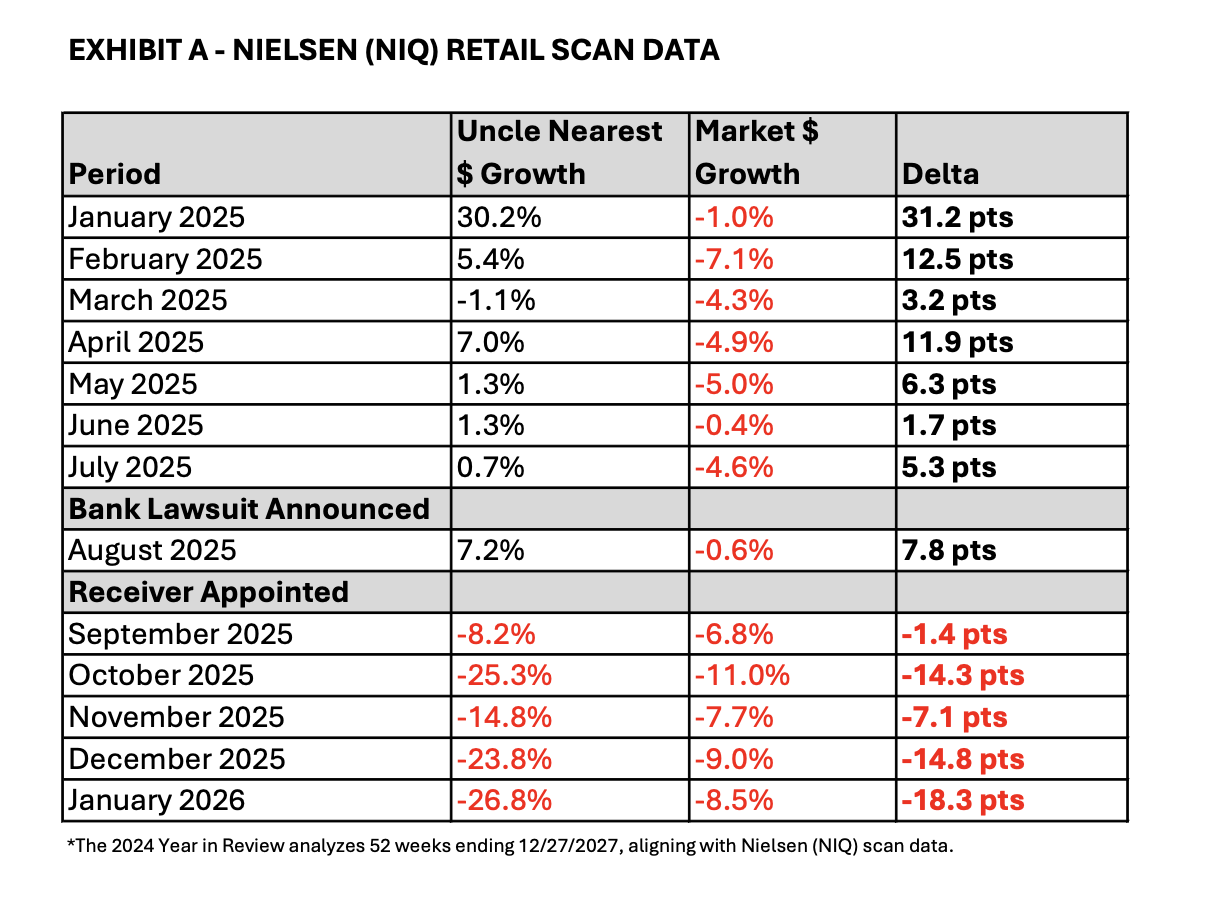

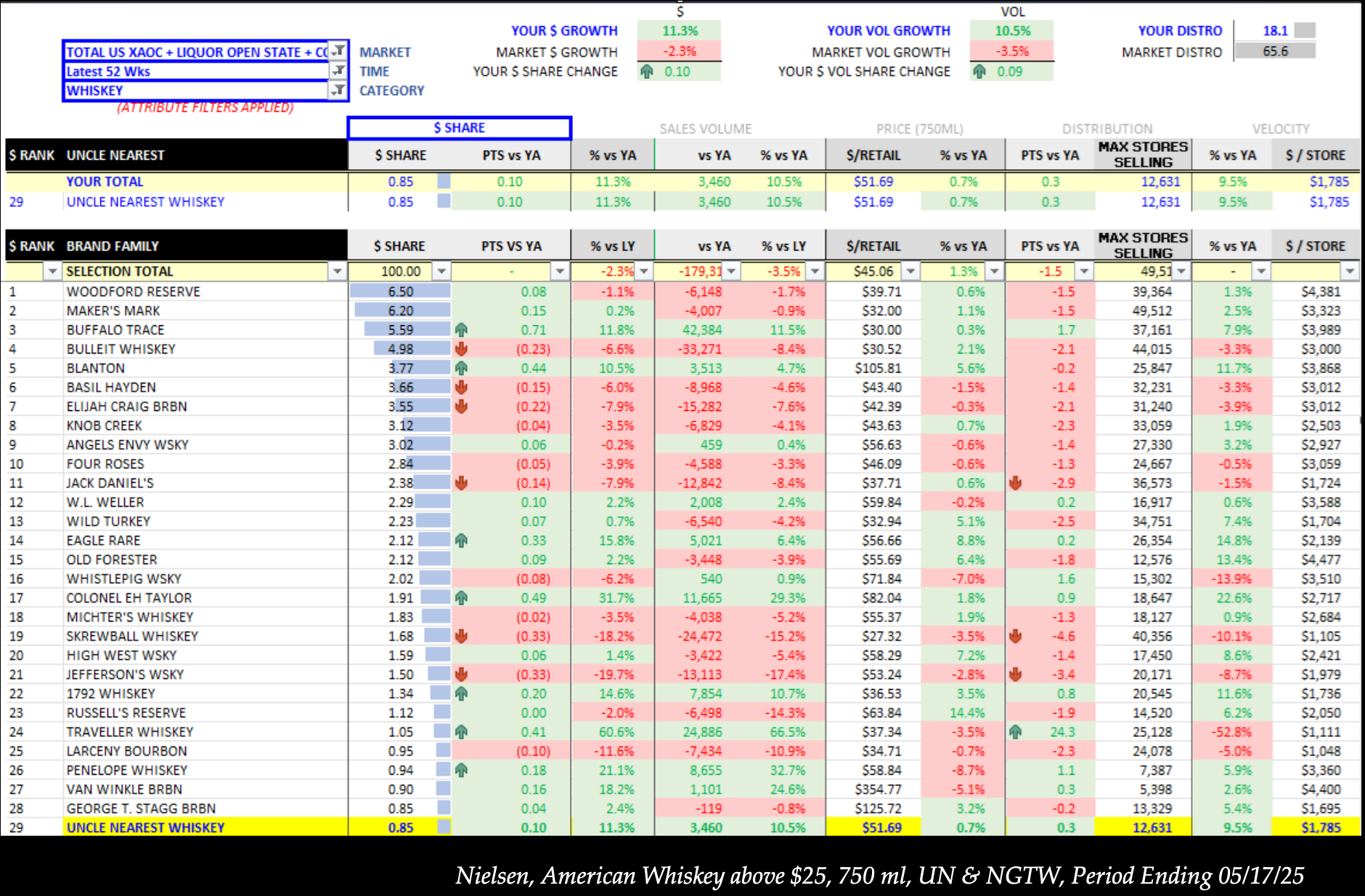

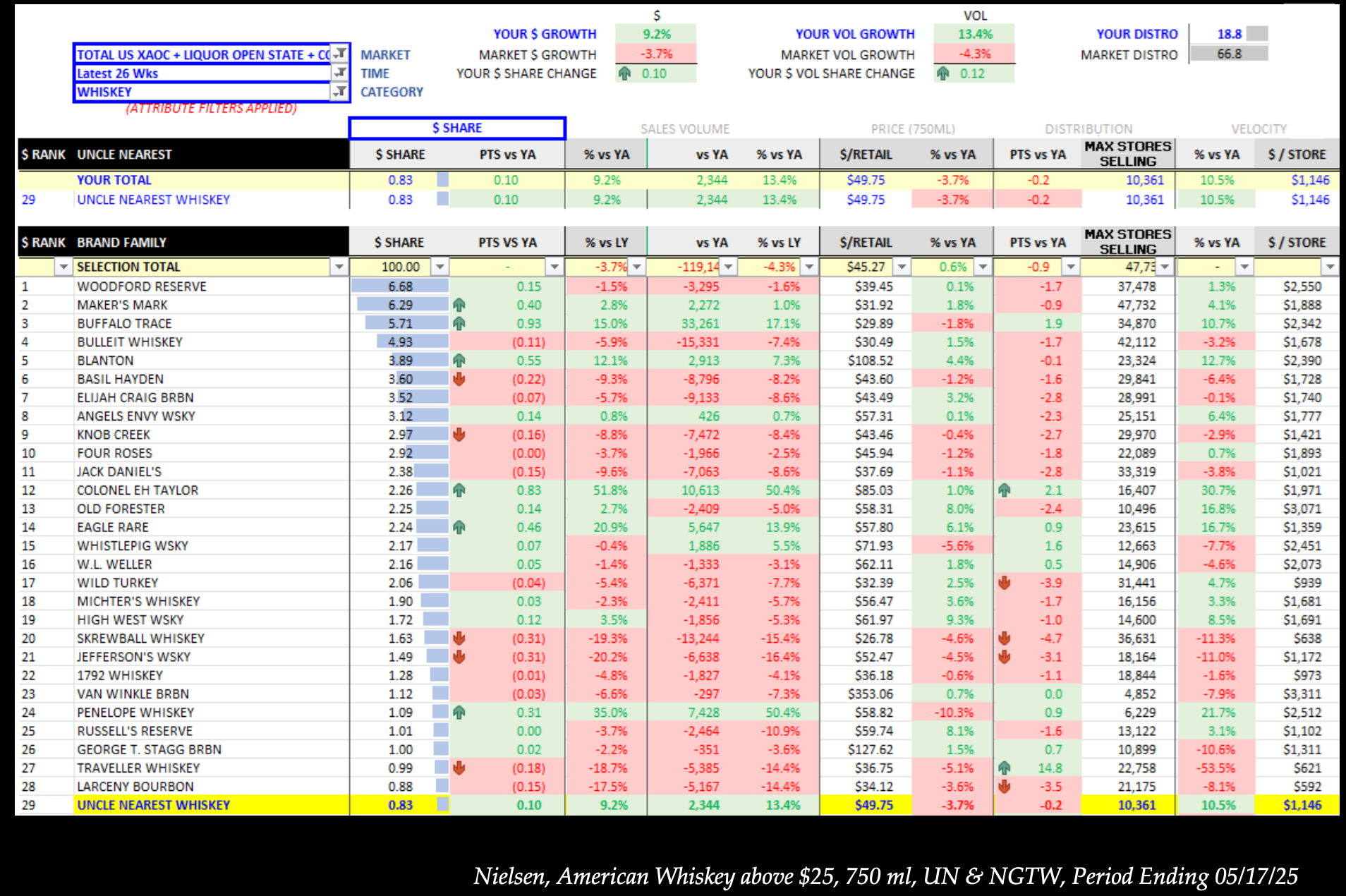

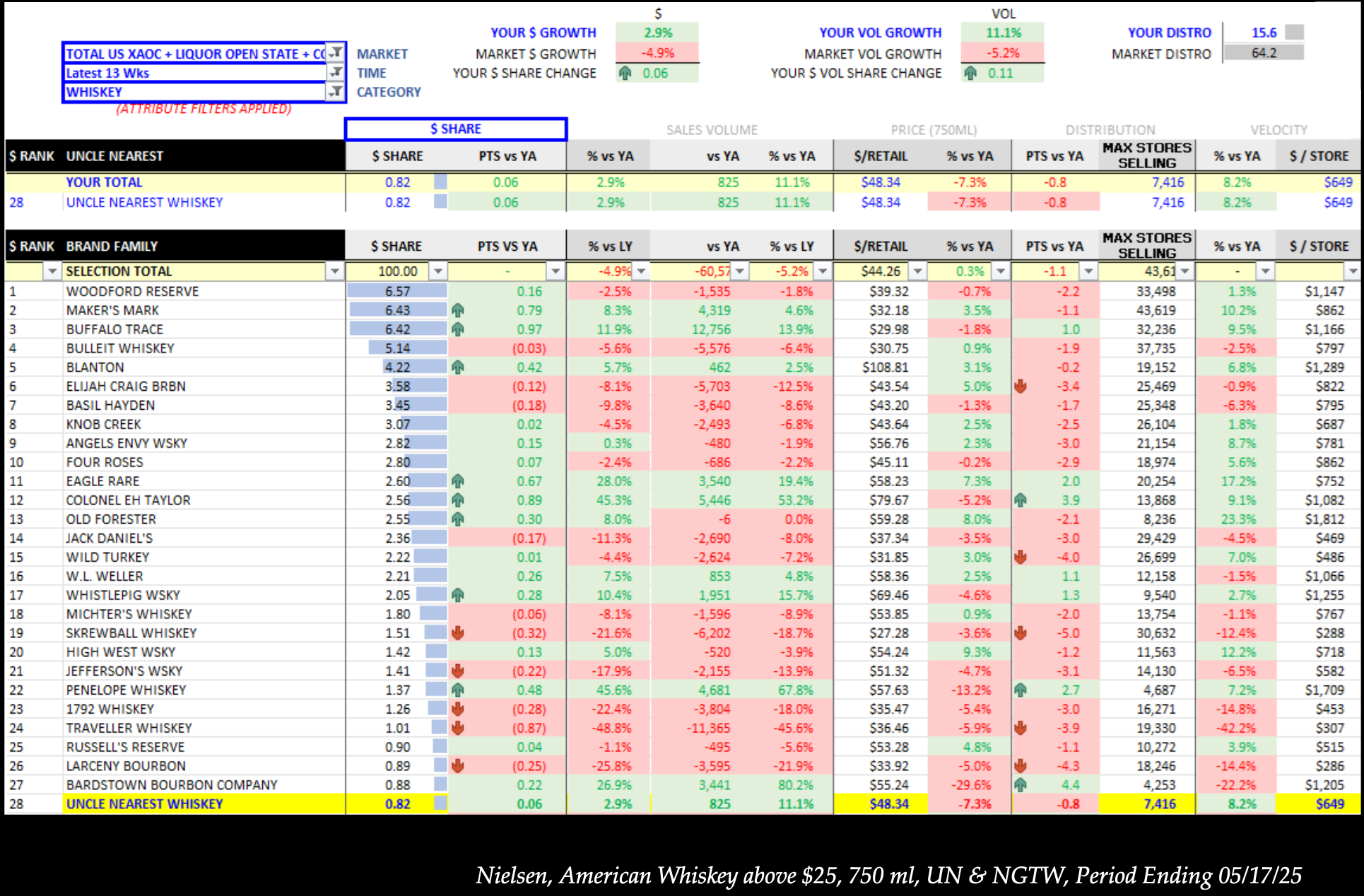

“Out of stocks of Uncle Nearest 1884, in September, and October, happened because they cut our bottling capacity by 75%. New York waited for months. Texas had to get product from Indiana. At one point, it became clear, the operational constraints, being posed, would impact revenue in our Nilsen results. But the Uncle nearest team pivoted, every roadblock we adjusted.”

I’m expected to believe, as are you, that out of stocks occurred barely a month into the receivership? Look, I’m prone to occasionally falling out of a stupid tree and hitting every branch on the way down, but even after that I’m not dumb enough to buy what The Weaver (TM) is selling here.

“Then when our sales in our Nielsen decreased, the bank and receiver attributed to a loss of demand. So they create the conditions and then cite the outcome for the court? Sounds an awful lot like those 20,000 missing barrels they've now miraculously found, only to book them as debt without recognizing the fair value of the assets.”

The demand decrease is because it tends to decrease after the holiday quarter for almost all spirits. Also, another reminder that the missing barrels were before the receivership and even if they didn’t book them as debt, you still owe $108 million that you have failed to pay..

“How can they do that? Well, it all came out in the court this week, so... let's get to it. This is Nightcap with Fawn Weaver, where I take hot topics, strip away the drama, politics, and gaslighting. I add truth, history, and a little bit of hope, served, straight up, no chaser. This is part two of a three part series, the attempted heist of Uncle Nearest. “

She says this so fast, it’s impressive.

“Using that demand narrative as the backdrop, nearly six months into the process, five months into the receivership, the claim was made for the first time last week that Uncle Nearest was losing a million dollars a month when the receivership began. Yet, five weeks after the appointment, the receiver filed, the company was operating as a going concern. Mathematically, both cannot be true.”

This is how investigation works. You take over a distressed business, and on the face of it, it doesn’t look that bad. You say so, to calm the investors, the creditors, the employees. It’s not a lie, it’s reassurance that the business is now in competent hands, stand by as we work, and we will update the court as required. In time, after looking at the books, and reconstructing the previous deleted years, you have an oh fuck moment when you realize that what you’re being told by management (Hi Kate!) isn’t true. So then you revise things, and your opinion changes, and then you report that to the court as you're required to do. The receiver wasn’t lying, he was reporting on the rosy numbers he was being given, until his team was like hold up Cap, shit stinks in here.

“The $1 million figure came from an initial aired 52 week run rate model that his finance consultants ran. After our former CFO's departure on October 2024, discovering over 7 million in unaccounted for debt excluding Farm Credit, we reduced operating expenses by 40%. Then another 20%. Painful, but done, before the receivership.”

The same CFO who was still working at UN well into 2025. The same CFO who was the CFO at Grant Sidney prior to UN being founded. Also, those cuts probably didn’t apply to The Weaver (TM) travel, glam squad, social media, and bottle signing budget.

“The 52 week run rate included legacy payments, and more than 2 million extraordinary expenses tied to the legal and finance consultants in negotiating with the bank. And the independent third party investigation into our former CFO and his team.”

If you paid the bills you wouldn’t have spent that $2 million negotiating (again) with the bank?

“Once those were removed, every 13 week forecast since has shown neutral to positive cash flow.”

Nothing about Kate making the numbers work? Hi Kate.

“The CFO of our longtime payroll and benefits provider testified that, contrary to the receiver's statements about payroll being in jeopardy, the company, under my leadership, since they became our PEO in 2019, had never once been at risk of risking payroll.”

How many shares or options does Genesis hold I wonder? The receiver probably looked at the acknowledged payroll debt (remember they were paying the old stuff first, while accruing new payroll debt to Genesis), and went oh shit, we don’t have the money for that. Probably unaware of the agreement UN had with Genesis, which was probably not well papered.

“As late as January 12th, the receiver told him the company was cash flow, neutral, and positive, once his fees were removed. Something our reconstruction reconfirms. He also testified that the receiver said there was significant value in the brand, and that he was working toward transitioning it back to the Weavers. “

There is value in the brand, no doubt. Just not enough to cover the debts.

“He testified the receiver told him repeatedly, I need to transition this back to the Weavers. That is what the receiver was saying privately, January 12th. Two weeks later, insolvency was claimed publicly. While staring directly at the receiver, the CFO of the payroll company said, When you're intentionally lied to, and my world is a CPA, it's called fraud. I feel like Mr. Young committed fraud.”

Note that he didn’t say he DID commit fraud. How one feels isn’t the same as fact based accusations.

Are you all ready for part 3? Also not a doozy, but a snoozy.

3:30 am, still going….. nothing outlasts the Fawnergizer Bunny.

PART THREE- Recorded after 3am, posted 3:56am.

“Is anybody still awake for the part three of the three part series? I don't know why I'm awake. I should have done this tomorrow.”

Sorry, I wasn’t awake for part three, I was out of Ripped Fuel.

“So let's jump right in. This is nightcap with Fawn Weaver, where I take hot topics, strip away the drama, politics, and gaslighting, and add truth, history, and a little bit of hope, served, straight up. No chaser. “

This is my favorite part of her videos, when the broadcaster voice comes out.

“For the last six months, I've been silent about the case. That was intentional.”

I’m sorry, WHUT? She’s claimed twice that the gag order was off (it was only one gag order), and hasn’t stopped talking about the case. Follow the Case. Social media reels that when posted cause my brain to hurt, an ill-advised civil suit about Senzaki which was simply to get her allegations included in the bank lawsuit. She has never stopped talking. Talk talk, talk talk talk… so much talk that I wonder if she’s ever heard real silence in her life? Has Keith since knowing her? Also, people that lie about the smallest dumbest things in the face of provable evidence will also lie just as casually about the biggest things.

“Nothing I said publicly could risk being interpreted as influencing the court or interfering with the process. I've only given two interviews since this case began, and those were this week, because I could now point to the record since my voice is finally on it. “

I mean, you were warned about speaking on the socials about the case. The court literally gave you a fucking gag order. The receiver alleges that The Weaver (TM) has been actively trying to undermine him in a variety of ways.

This seems like a good spot to take a little break from the video breakdown for this little nugget of news-

The Weaver (TM) has told some staff that near the end of March she plans to embark upon a Thank You Tour after the receivership is lifted and she’s back in charge. She’s going to see the folks that stuck it out and stuck by her side.

“I won't answer any legal related questions here because I don't care about defending. I care about winning. Speaking of the record, I wrap this series up with something a bit humorous.”

Funnier than running your company into receivership and then blaming everyone else on the planet and never taking accountability for literally ONE thing? Please, go on.

“The bank introduced a pre receivership 13 week cash flow, showing negative 6.4 million. That it said, we prepared. And the days leading up the hearing, there were a flurry of filings filled with inconsistencies. We asked for three days, the judge gave us two, so we prioritized. We made our record. Under cross examination, the bank's financial consultant admitted nearly every line item in that document was identical across 13 weeks.”

A horse walks into a bar, the bartender asks “say, why the long face?”

A man finds a genie in a bottle. Genie grants him three wishes.

Man- I want to be Rich.

Genie- Granted.

Rich- I want a lot of money.

“Bottom line is, none of those numbers were real. That was a formatting template. During my testimony, the actual 13 week cash flow covering the same dates was admitted into evidence. That report showed positive cash flow, a swing of approximately 7.7 million over the upcoming 20 weeks using their exhibit, and four weeks of the actuals were also positive.”

I think she’s claiming that the numbers were wrong and hers were right, but the submitted numbers were a template that didn’t have the numbers, so in the absence of the numbers, her numbers must be trusted as Gospel. Am I doing this right?

“Seven witnesses testified over six hours. I asked to go last. No prepared testimony, no scripted questions. The judge gave me a little leeway so we could wrap the day up. I looked squarely at the receiver and the bank, and I said, If they want to prove fraud or misappropriation, by all means, please do.”

I’ve learned a lot of hard lessons in my life, and one of them is not to dare people to do the thing you’re most afraid of.

“You have access to every record that exists, but until you can charge me with something or actually claim something against me, do not kill my company in the process.”

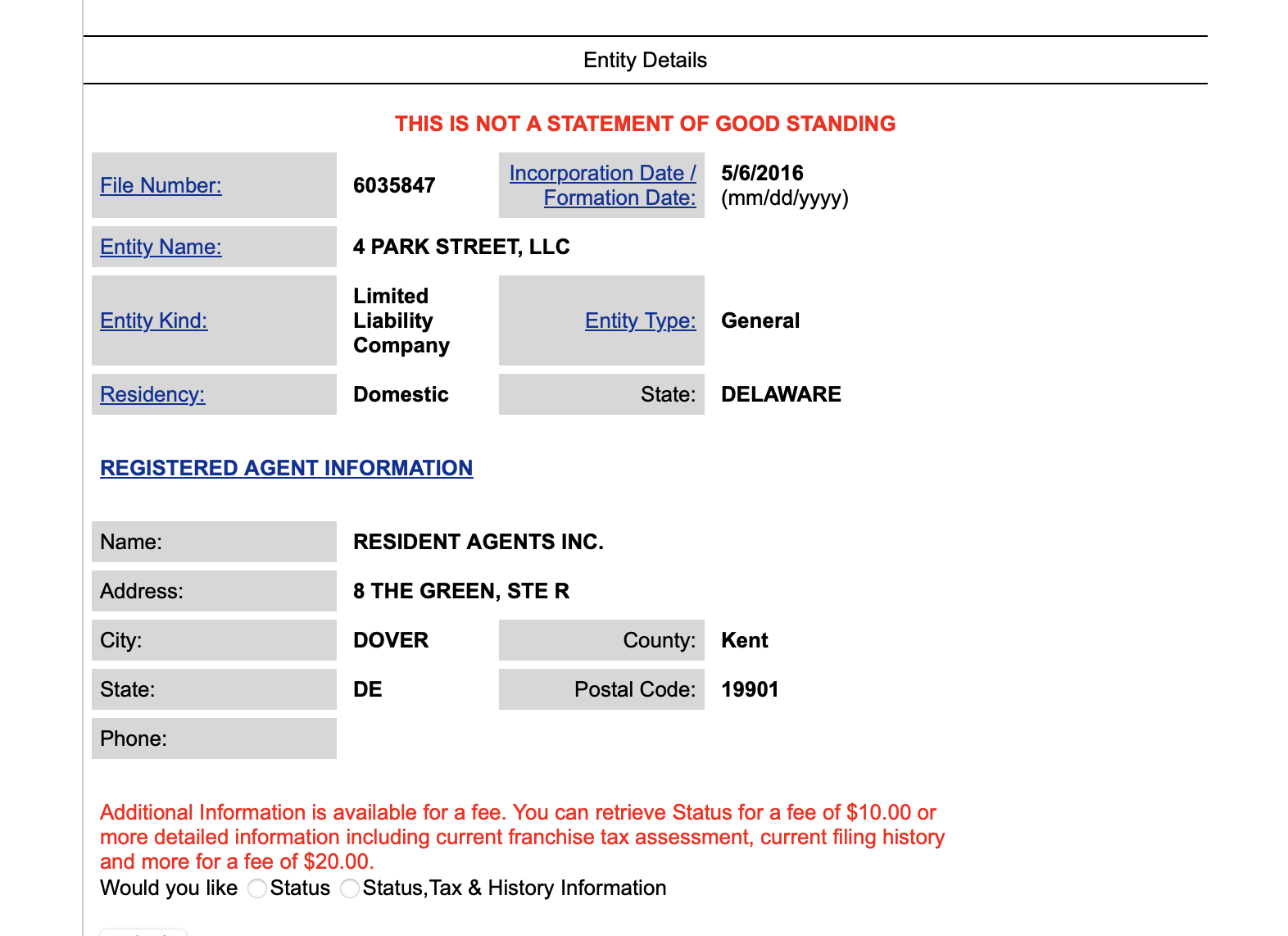

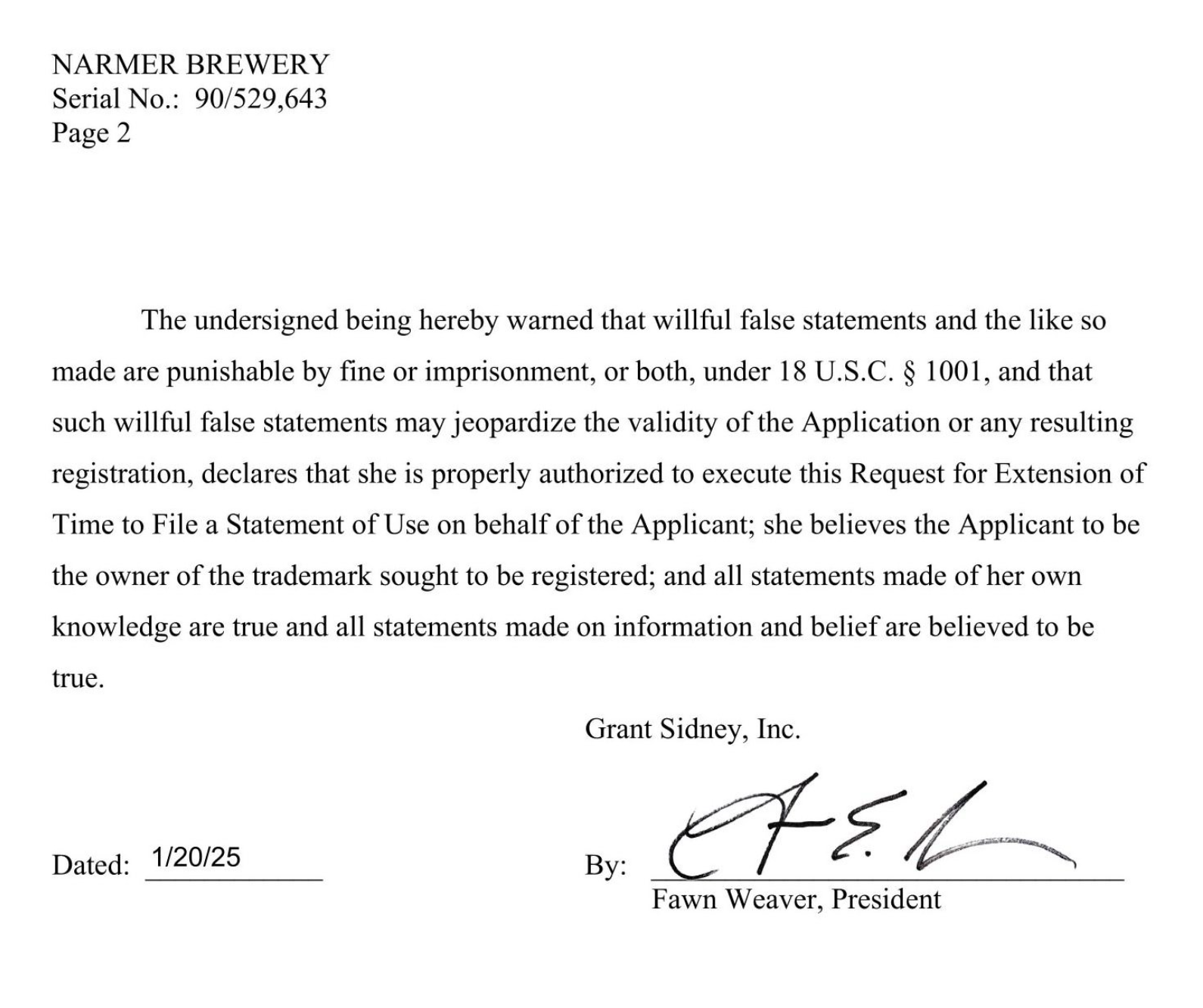

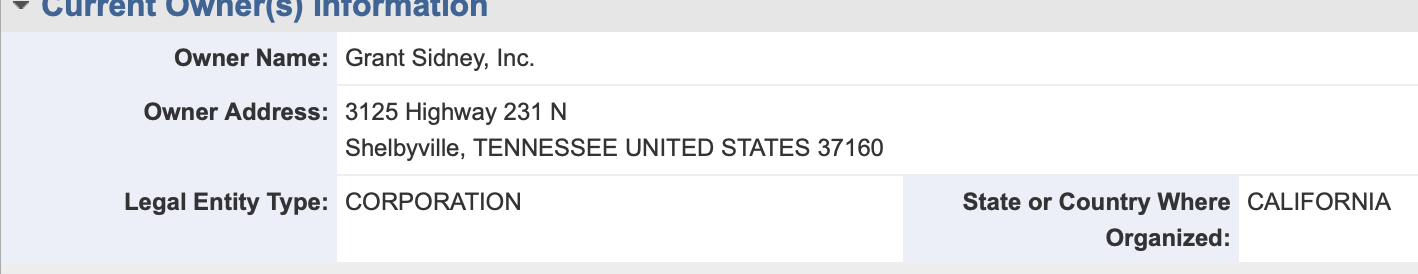

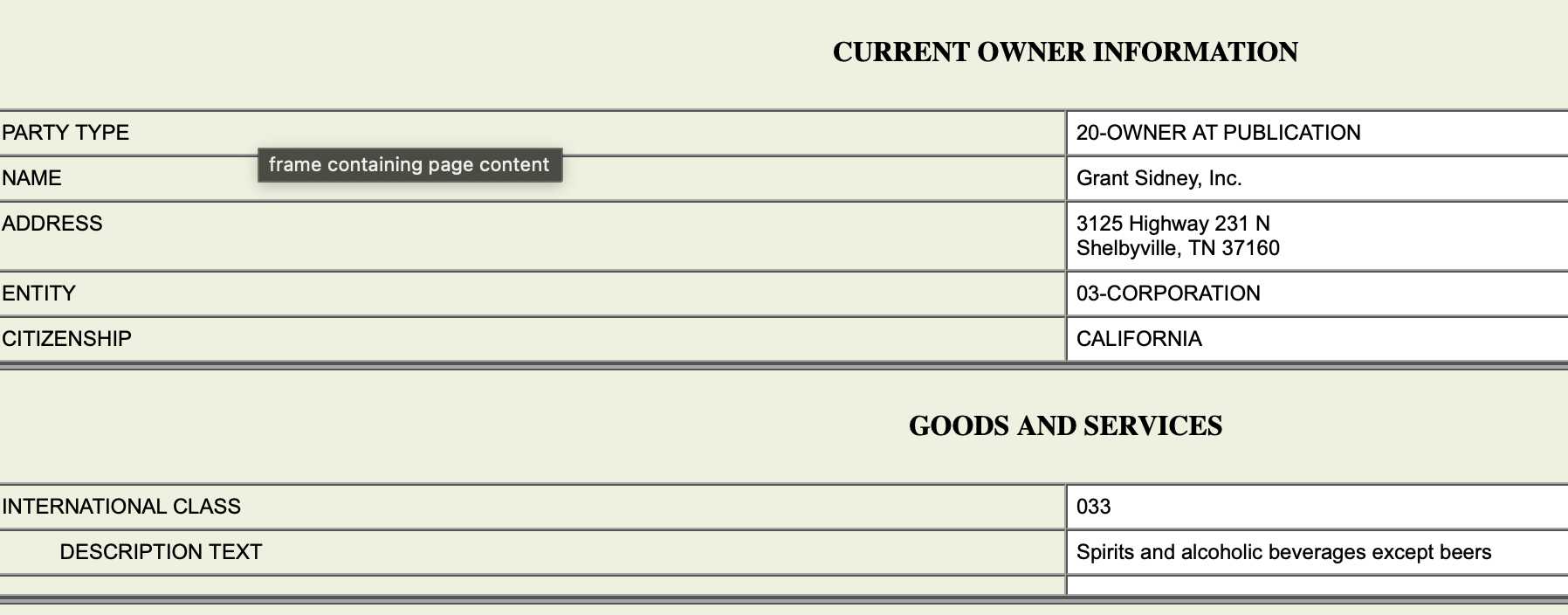

Not all the records, that’s why the receiver wants Grant Sidney included in the receivership, so he can see the Quickbooks that belong solely to Grant Sidney. Know who else has seen those books? Senzaki.

“If the bank wants to make sure they have what they have protected, leave the receiver and monitoring. Continue doing the third party investigation our board began pre receivership. Please, by all means, because it's the only way I will clear my name that you have slandered and smeared. “

Easy solution for The Weaver (TM), withdaw the motion to remove the receiver. Also, ma’am you’re the reason you’re in court. You asked for this! What is it you want now?

No notes.

Better title than “If I Did It”

“The receiver's counsel declined to cross examine.”

We will know more about this in May when the transcripts become available, but I’m guessing the bank had something to say? Or were they filibustered out too? Also, why cross examine if all the rakes have been stepped on?

“The judge closed it by saying, I haven't made the decision, but if I were to terminate this receivership, that stay goes away. If there are wolves at the door, they're coming in. And my inside voice was audible. I yelled out YES! “

There’s something very very wrong with this person. I’m not a doctor, but damn.

“Oops, I'm sorry about that, judge. Because I understood what he meant, and I do. “

Do you though? Is there literally anyone in your life that loves you enough to tell you that you’re in trouble?

“But I would rather face challenges that are visible than fight battles behind hidden processes.”

The Weaver (TM) is going to be in a lot of court rooms should this receivership end anytime soon. Her proposed Thank You Tour will be short lived at best, as the lawsuits will pile up.

“Under, Tennessee law, the standard is balance sheet solvency, assets versus liabilities. At fair market value. Uncle Nearest certainly meets that legal standard. “

Trust Me Bro.

“Additional filings are due in the weeks ahead, and then we expect a ruling shortly thereafter, possibly as early as three or four weeks.”

Yep, true. And i expect the ruling mid March. Since both sides didn’t even get to the “inclusion” part of the hearing, all the arguments for and against will be filed through the court (this is good, since we won’t have to wait 3 months for transcripts!) unsealed of course.

“Once the hearing transcripts have been made available, I'll let you know. “

Follow the case still hasn’t been updated since 1/20.

“It'll be good reading. I love y'all. I appreciate you. They call me the People's CEO, and I'm going to bed. Cheers. “

Part of this is probably true.

UPDATE 2/12-

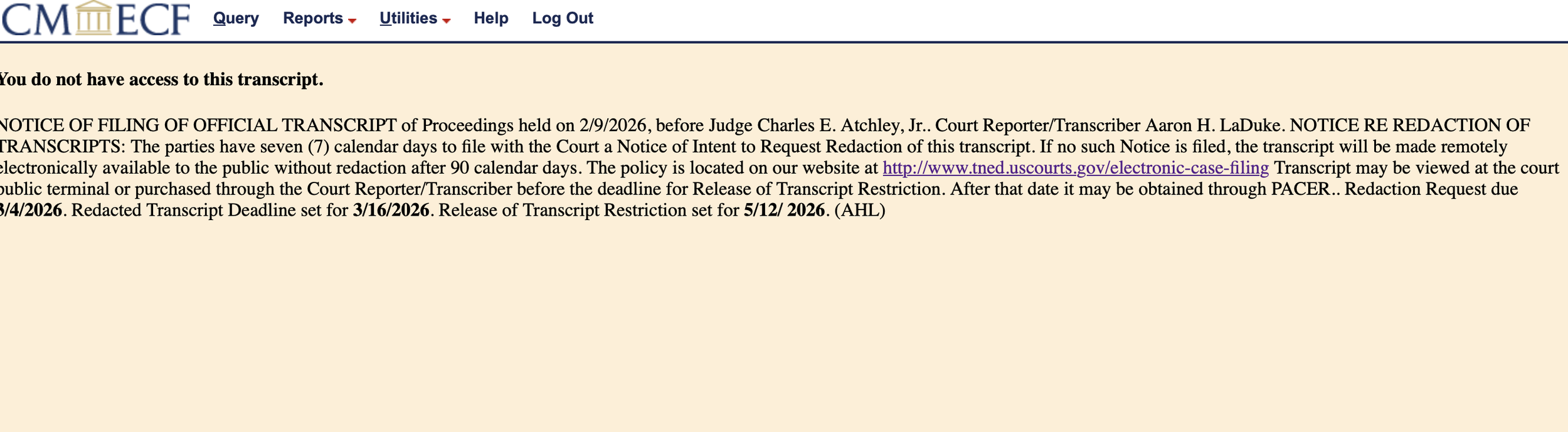

Baby update for today. Pacer just had the transcript posting, image above. Calendar alert set for 5/12/26 for release via pacer. Which reminds me, the transcript from the first hearing is available. BRB.

This is how I imagined the scene.

UPDATE 2/11-

First up, we have a report FINALLY, from someone that was in the court room. I will not be reposting their story.. First, it’s their work. Second, it’s their livelihood, and thirdly it’s behind the paywall. Sign up for $1 for the month. Contribute to the media if you can.

I will be breaking down some key parts of it however, cuz I’m snarky, and I’ve got afternoon cold brew. Let’s go.

Michael Collins who is the Meowvants (TM) attorney didn’t submit his exhibit list (thought he did Sunday night?) and brought up some things that the Bank/Receiver hadn’t viewed.

Lil Oopsie.

The Meowvants (TM) claimed they were attempting to refute (line by line) the allegations they were facing, and were again focused on the lack of time for the task at hand.

There’s too much evidence. Of course you don’t have time to create a story for each thing.

Michael Collins said “We’ve been drinking from a fire hose.”

Bruh, have your pity party elsewhere with all the junk that’s been filed from your clients.

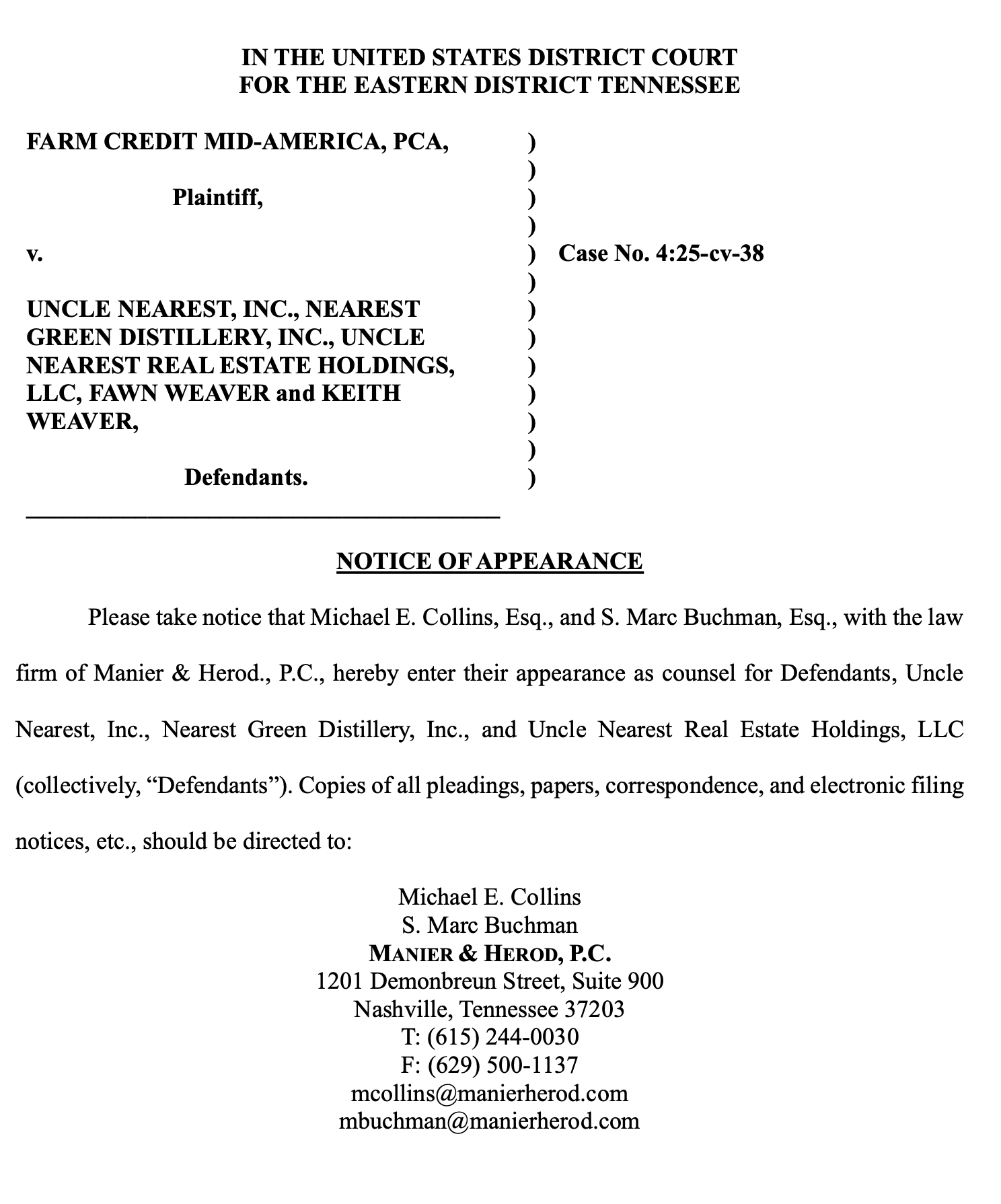

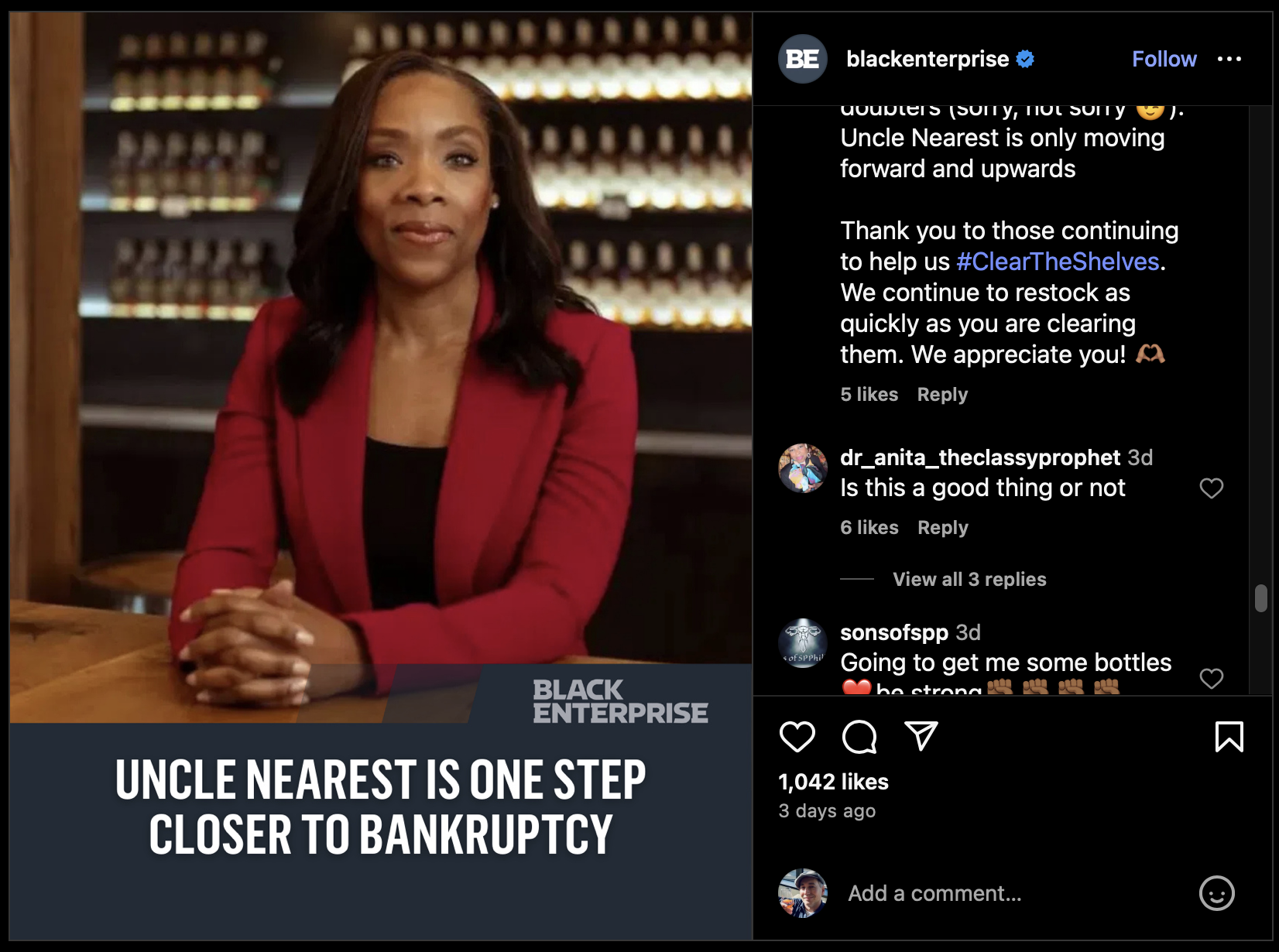

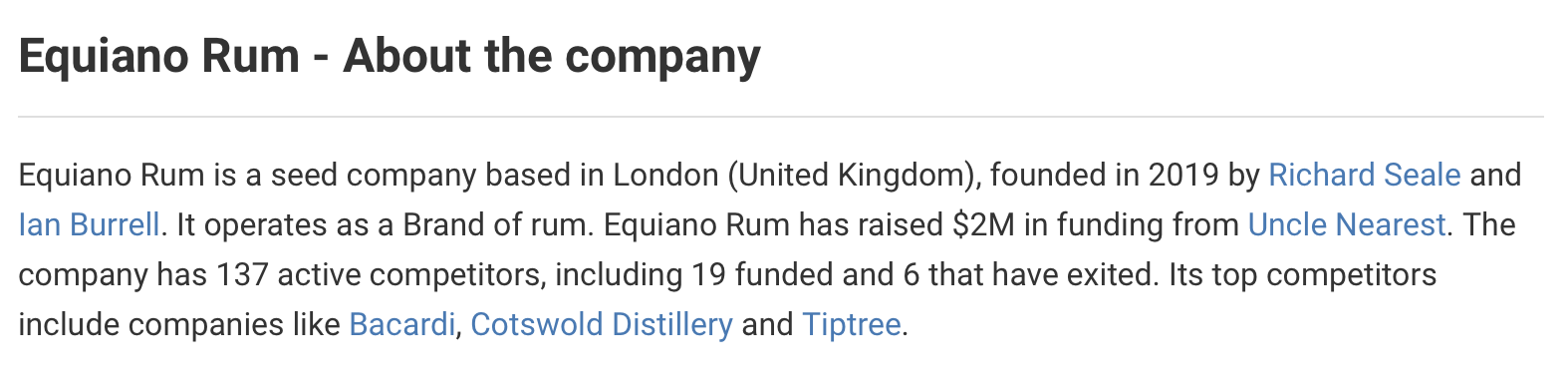

Cap’N Phillip revealed that Advanced Spirits has called in their debt last week. Forty-Five Million US American Dollars.

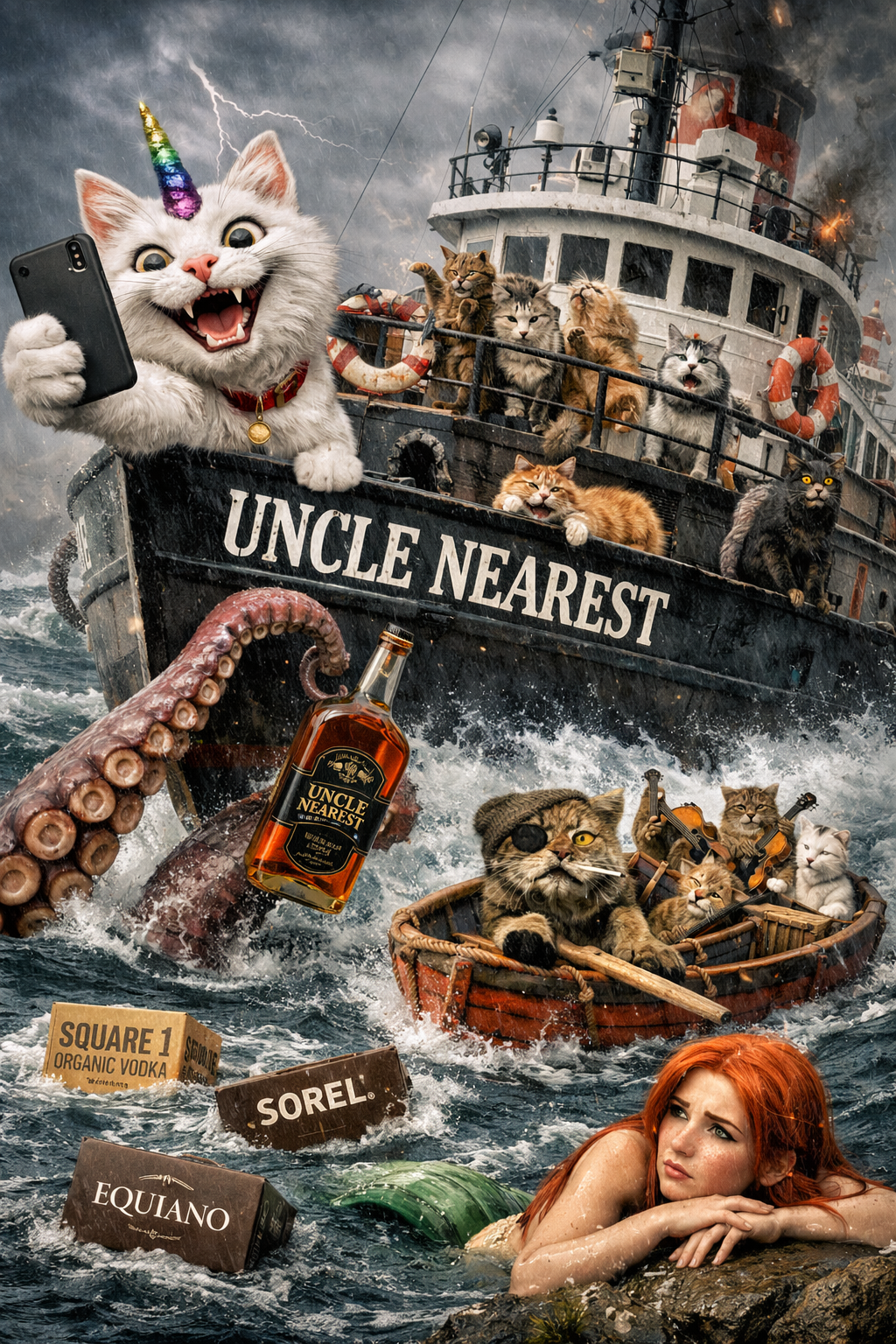

Pretty sure this is less than a good thing. This makes the total debt at approximately $210 million. Looks like The BroFundMe’s are gonna need a bigger boatful of suckers.

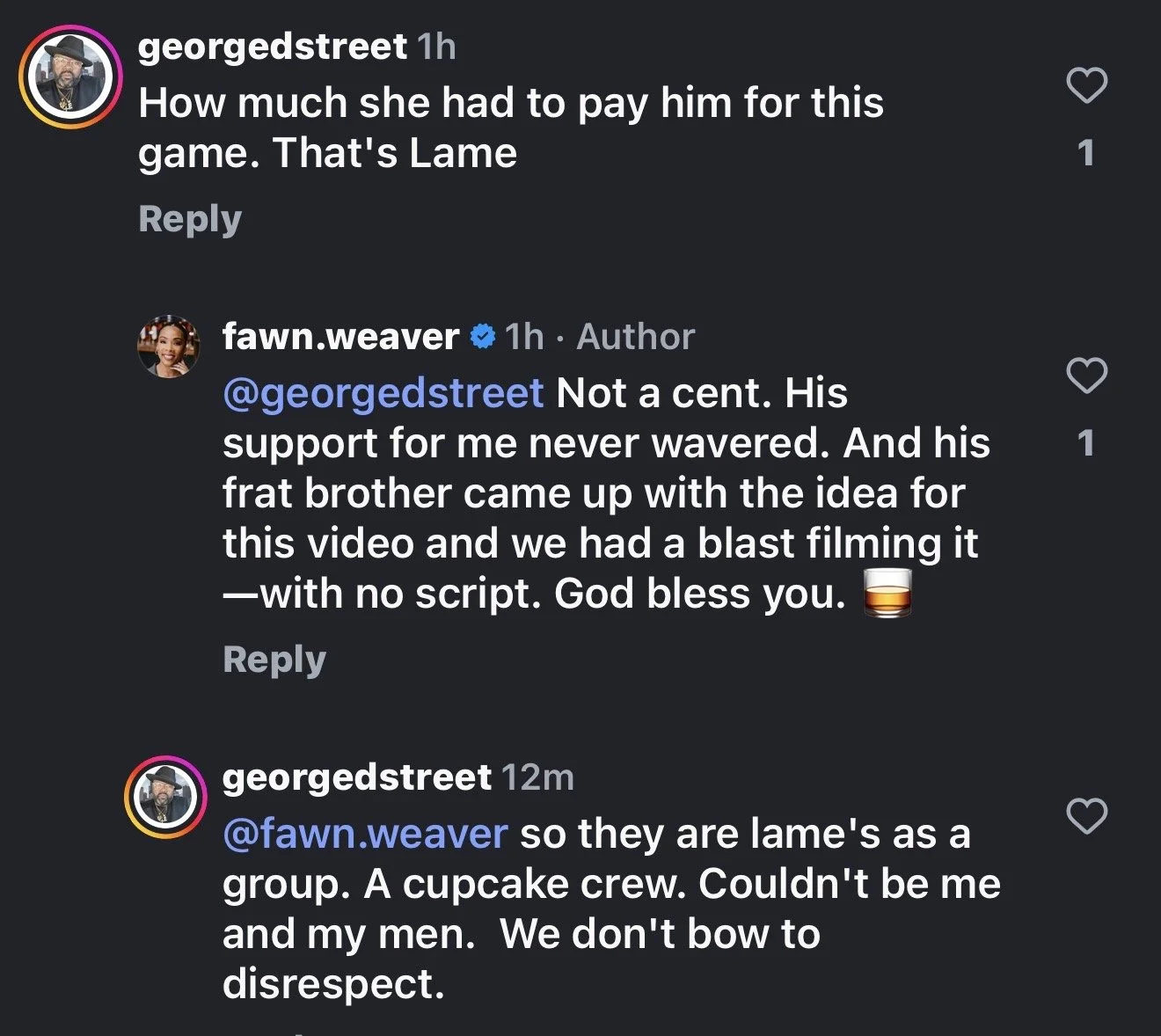

The Weaver (TM) claimed multiple times that Advanced only asked for the immediate payment because she wasn’t in charge. She claims she had been successful at balancing these debts to creditors through the good relationships she had with those companies.

Ermmm. I wonder how many of those companies miss all of the broken promises from The Weaver (TM). While they aren’t getting paid from the receiver, at least they know where they stand. Also, by successful she means she’s been good at bullshitting them all.

The Weaver (TM) testified, and was the last to do so for the day.

Were drinks being served in the courtroom? I know I woulda needed one.

She threw some propaganda out there, of course, I mean achievements.

Her rebuttals are more or less what she’s said publicly and in filings. All UN’s problems are because of the receivership. Cratered sales, demand letters for payment, low valuations etc..

I forget, is the receiver the one who hasn’t paid taxes since 2018? Is the receiver the one who defaulted on three loans, negotiated a forbearance agreement, then defaulted on that too, didn’t pay the bills to the tune of millions of dollars, lied to investors, cooked up sales numbers in Fawntasyland, fired a CFO who may be bad and then kept him on another half-year and change? Ma’am, this man is here to clean up the mess, not the cause of said mess.

The Weaver (TM) claimed that “we cut the fat, we cut no muscle” and the receivership has cut muscle.

I’m sure all of those laid off employees love hearing they were the fat and not the muscle, but one thing we all have learned by now, The Weaver (TM) cares about one human being only, and it ain’t Keith.

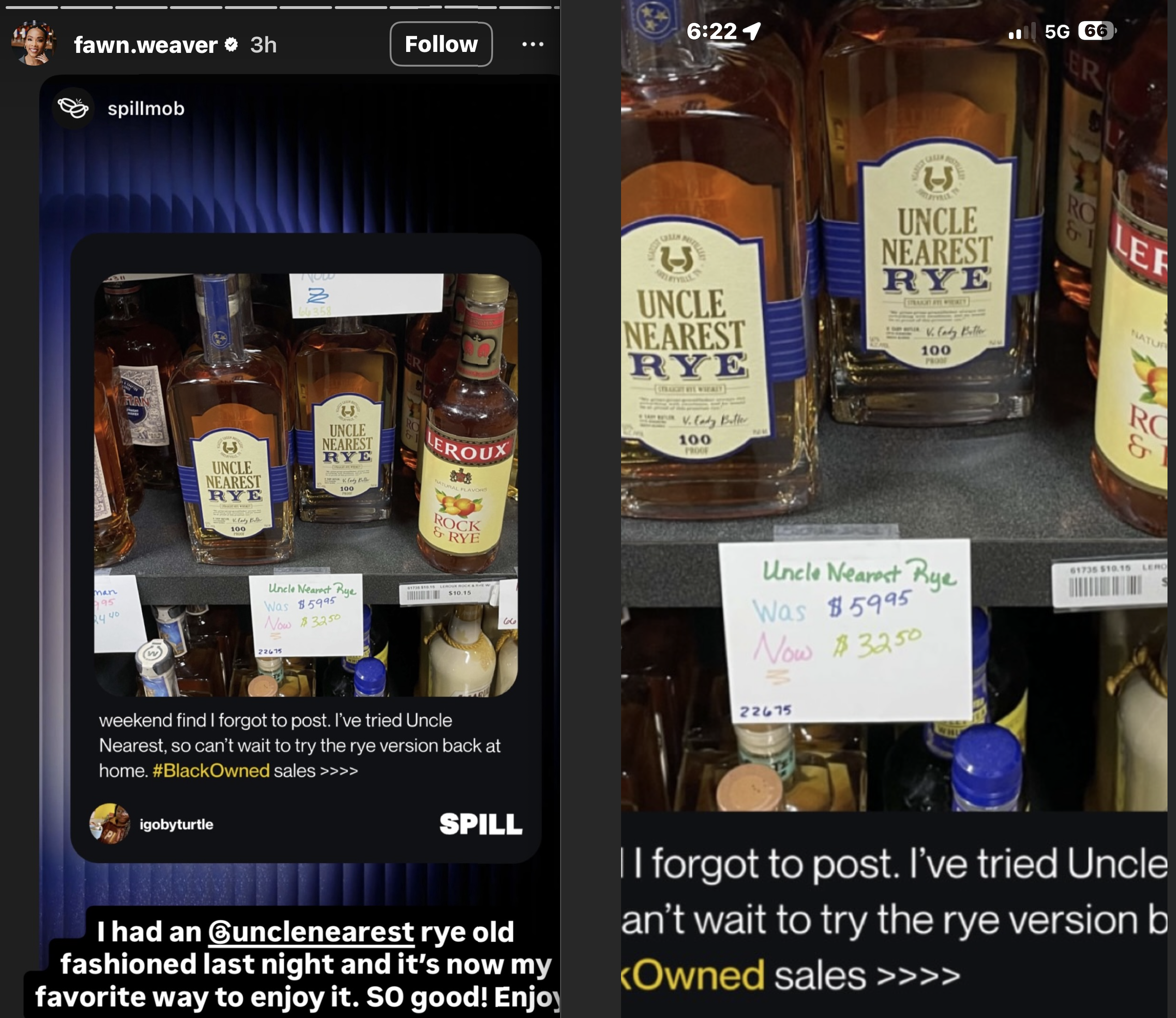

The Weaver (TM) who was probably hopped up on Copium, stated “If I went to the Courthouse steps and said UN is back in my hands, every store with UN would sell out.”

I mean where to start with this one? The delusion? The insanity? She still thinks Clear the Shelves would solve the problems? Myself and many others have debunked the Clear the Shelves campaign. Even if some magical being bought every single bottle, not a dime of that comes to the company. THat money was already spent, and if the judge grants inclusion, we may find out exactly what it was spent on.

The attorney for Farm Credit perhaps had the best response. “But that wouldn’t make the debt go away would it?”

No notes. Bravo Demetra Liggins, BRAVO.

Anthony Severini (remember this name, he’s in the Menos lawsuit as Fawn’s whipping boy) said “When you’re intentionally lied to as a CPA, that’s fraud. And I feel like Mr. Young (Cap’N Phillip) committed fraud.”

During the Army McCarthy hearings in the 1950’s, Joseph Welch said “"Have you no sense of decency, sir, at long last?" To claim that the receiver committed fraud in regards to Genesis Global, who he has made very payment to on time, is beyond the fucking pale.

There was no rulings, other than what we know, the receivership continues as is unless otherwise ordered.

The judge closed the proceedings with a soft warning. He reminded that if the receivership is ended, the stay on lawsuits is also removed. He dropped a good line (not quite Hamlet quality), “If there are wolves at the door, they’re coming in.”

Lions, tigers, bears, wolves, a few honey badgers are all gonna want to take a bite or two

Latin is fun for the whole family. Even the square ones.

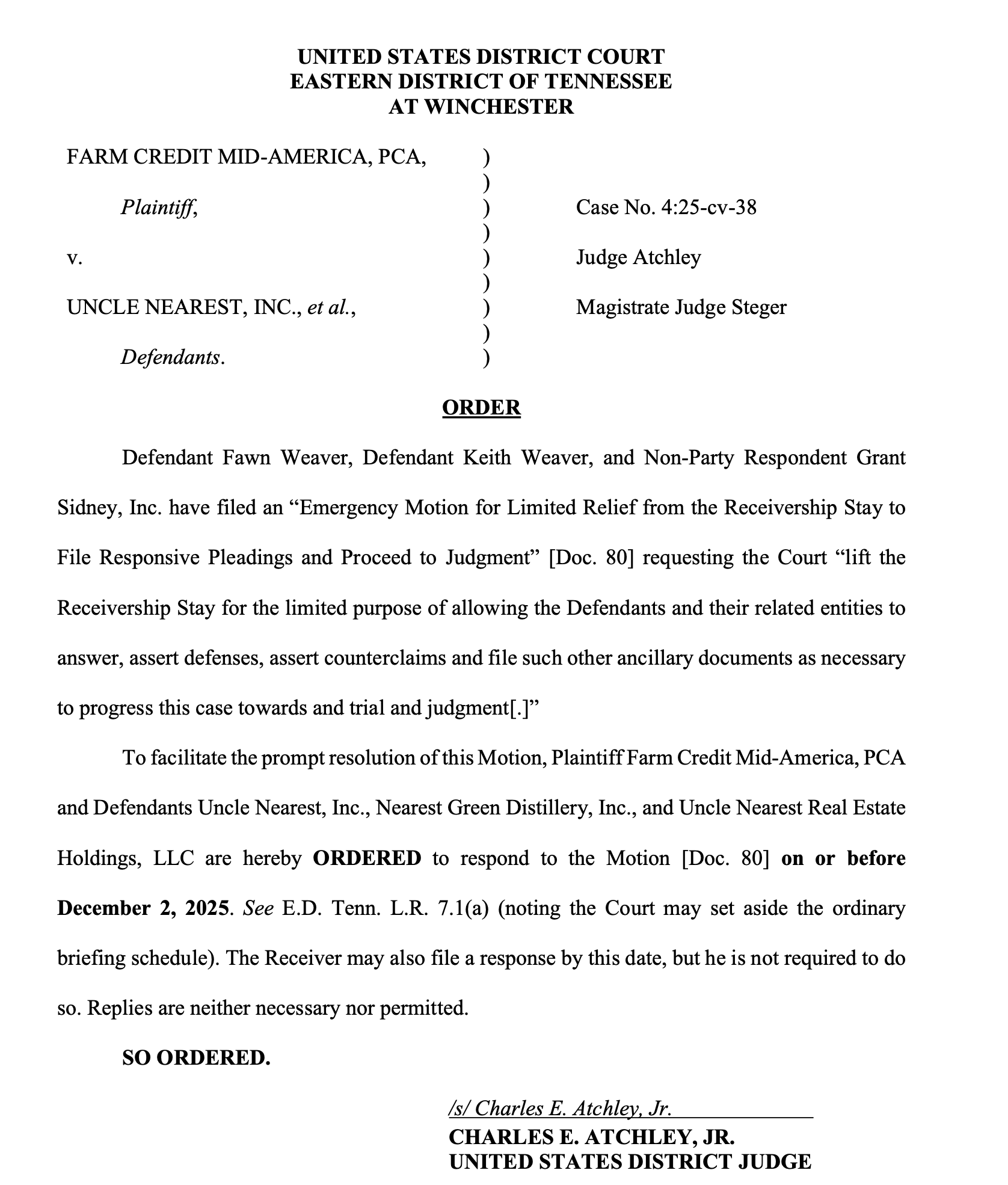

UPDATE #3- 2/10-

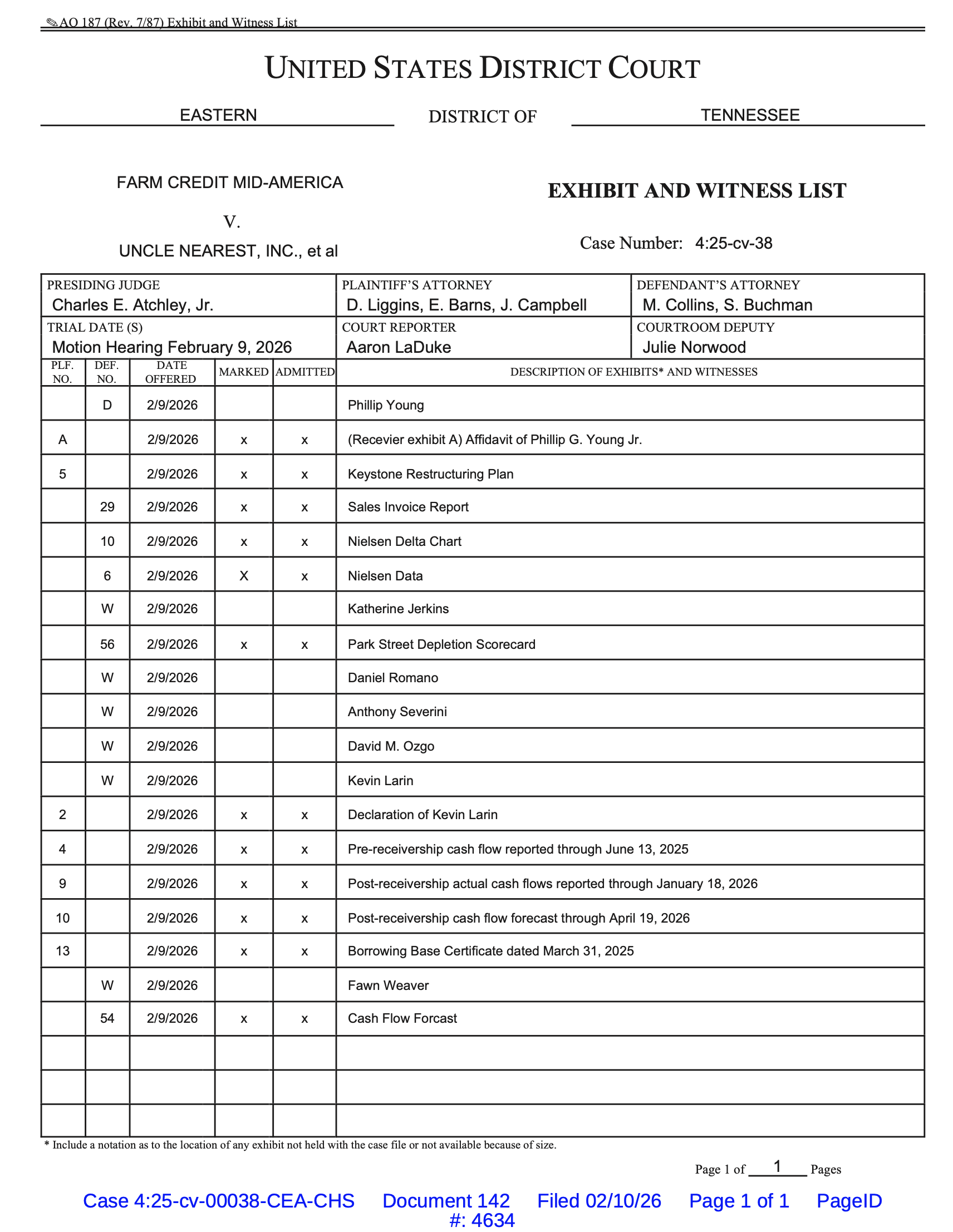

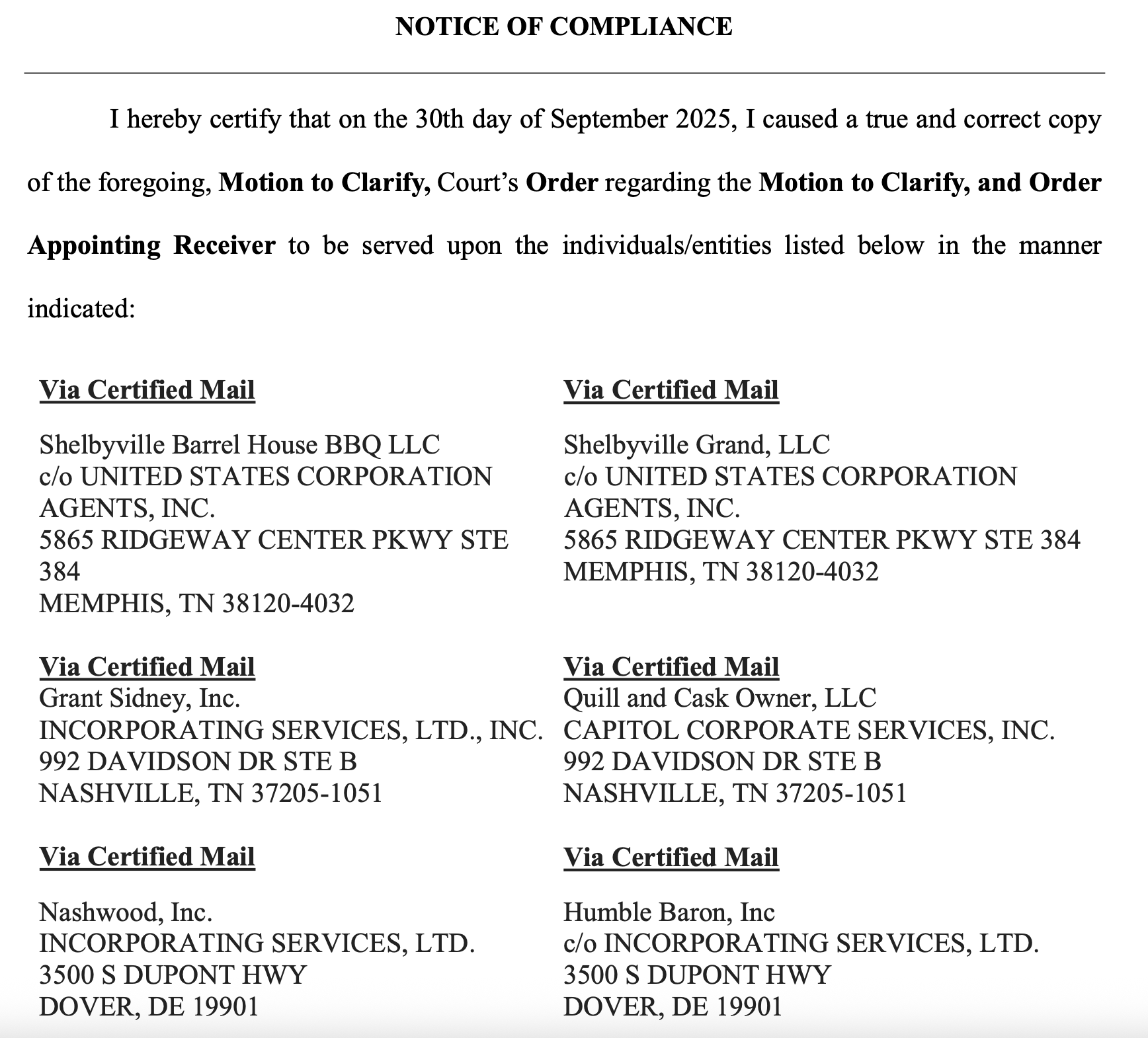

We didn’t get the court documents today that we wanted, but we did get some quicks. We got some minutes (boring), and an order (also boring). Let’s break down the order and get on with our day (the exhibit list will be in image form below).

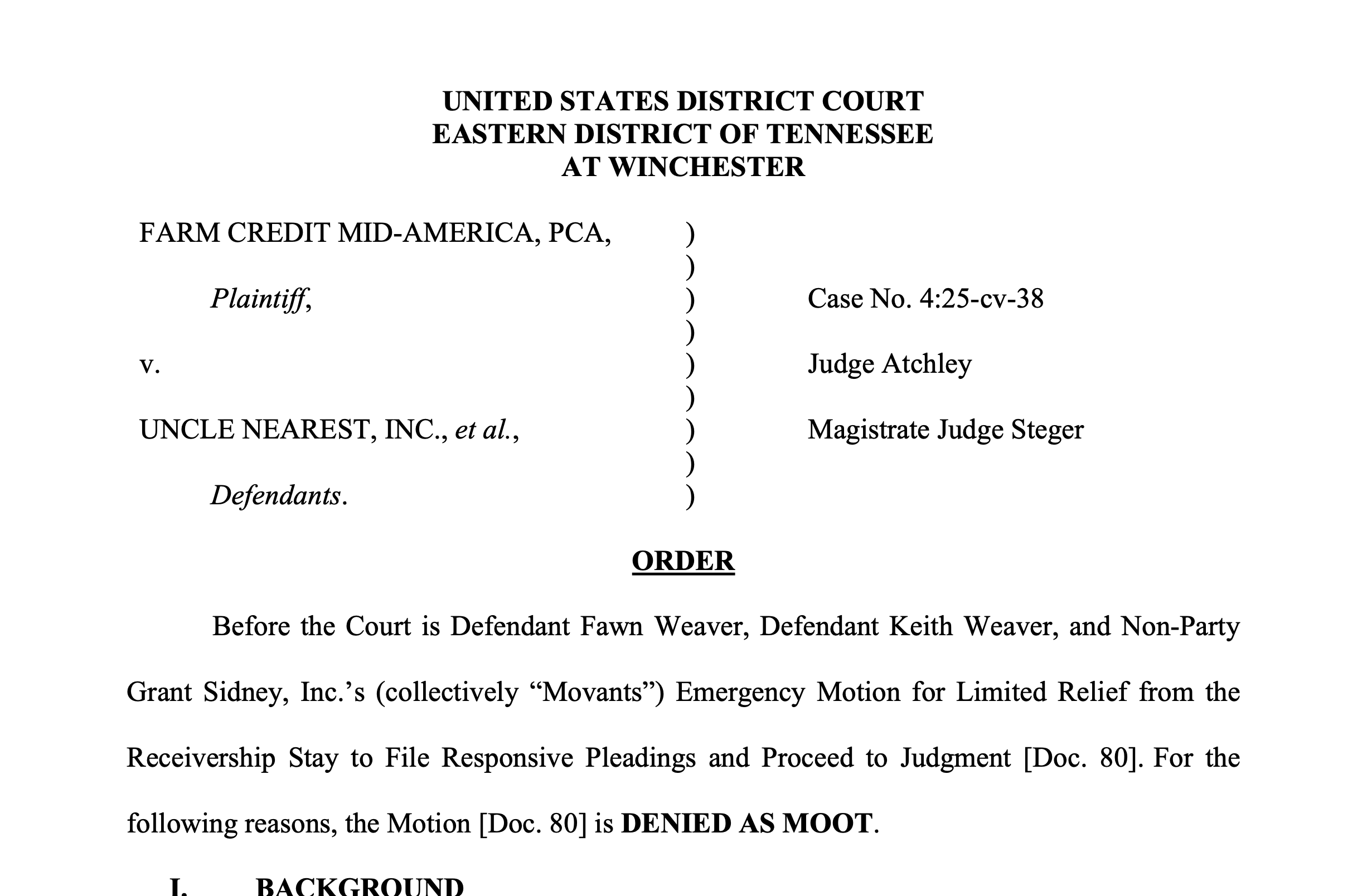

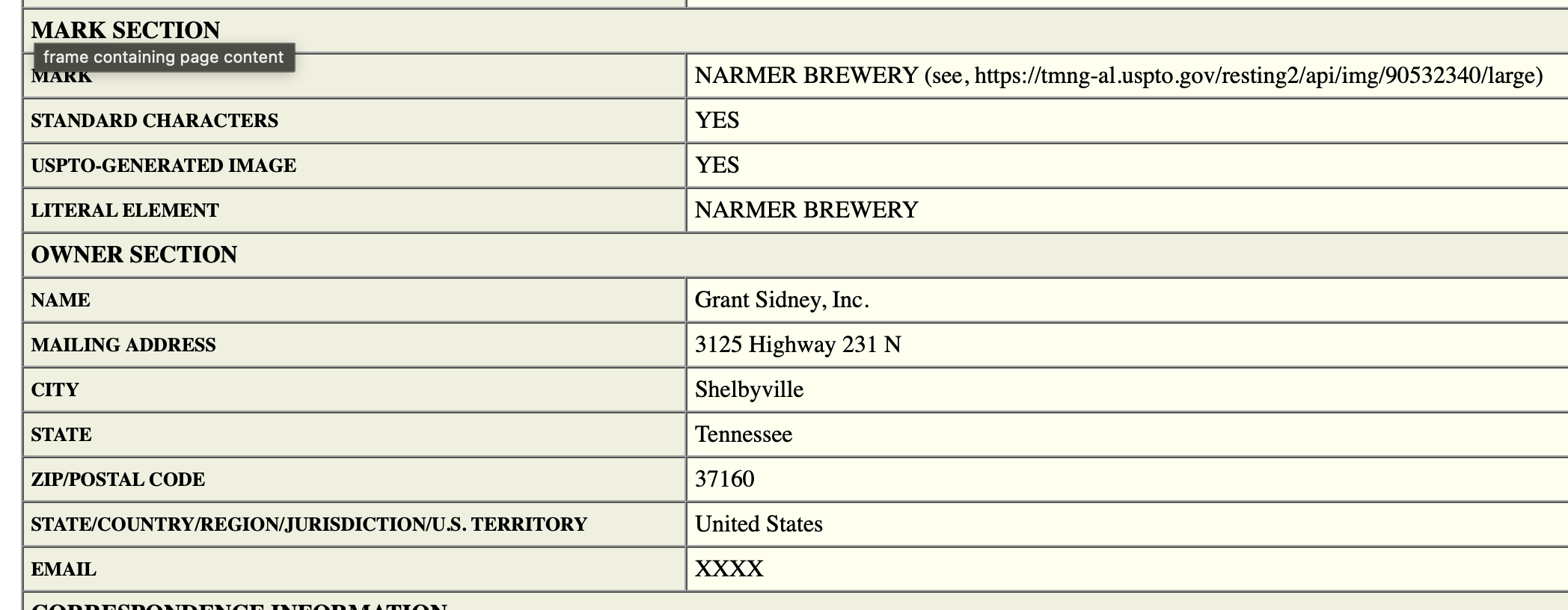

“On February 9, 2026, the Court held a hearing on Non-Party Grant Sidney, Inc., Defendant Fawn Weaver, and Defendant Keith Weaver’s Motion to Reconsider [Doc. 91] asking the Court to reconsider its appointment of a receiver over Defendants Uncle Nearest, Inc., Nearest Green Distillery, Inc., Uncle Nearest Real Estate Holdings, LLC, and a list of other assets defined in paragraphs 2 and 3 of the Order Appointing Receiver.”

Yeah, we know it was 2/9 and zero media attended. Pretty embarrassing showing on the local media by the way. How do you miss that hearing? I’m not pointing a finger at anyone specific, but jesus this is a big deal in the business/spirits world and has garnered attention globally. A real miss.

“At the end of the hearing, the Court informed the Parties that it would allow them to submit additional materials relating to both the Motion to Reconsider and the Receiver’s Motion for Clarification [Doc. 41] which the Court was unable to hear at the February 9th hearing due to time constraints. This Order governs the submission of these additional materials.”

I wonder who talked too much throughout the hearing. Any bets? Probably rhymes with Deceiver. Oh wait, lots of things rhyme with that. Let’s say it rhymes with Dawn. .

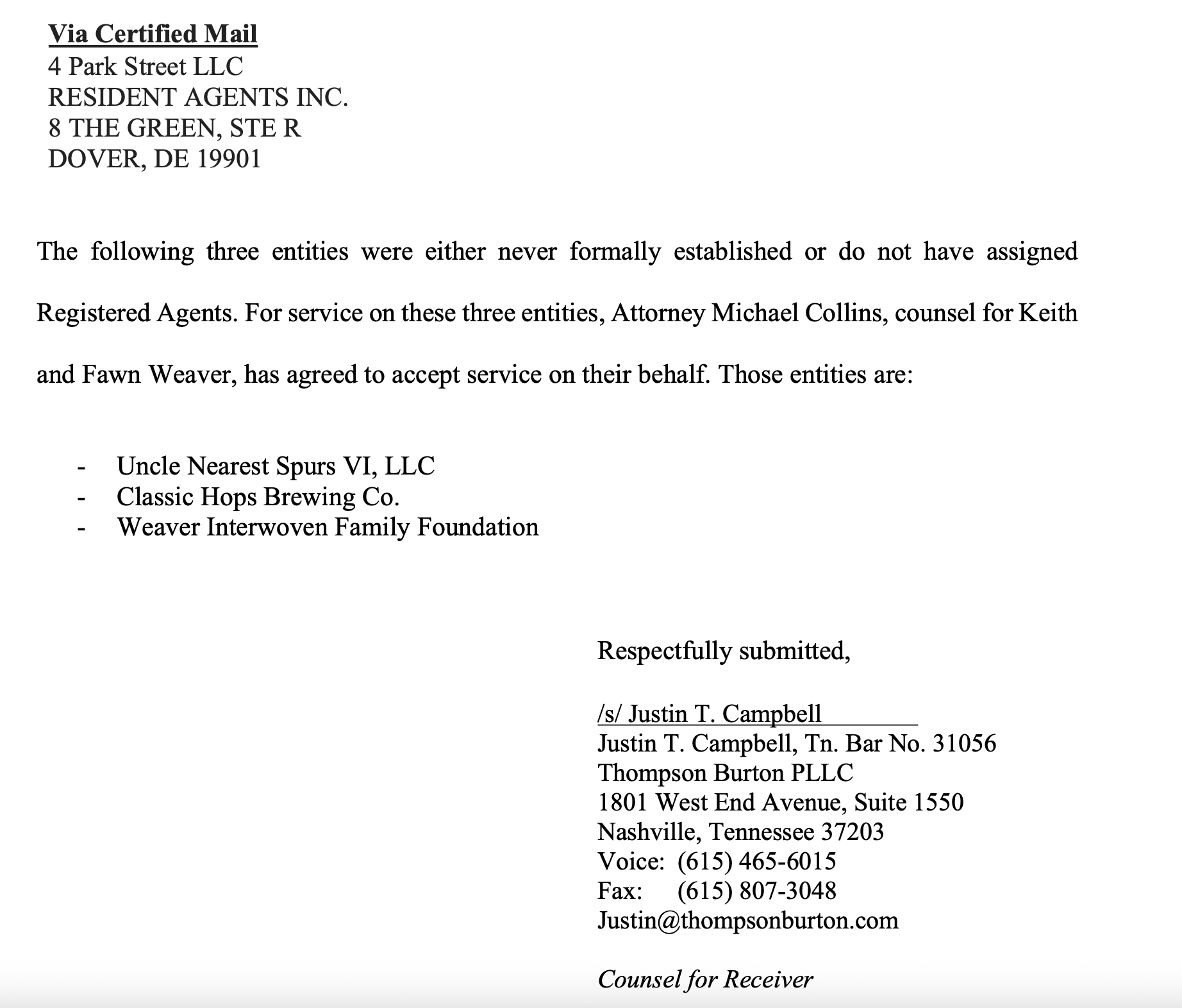

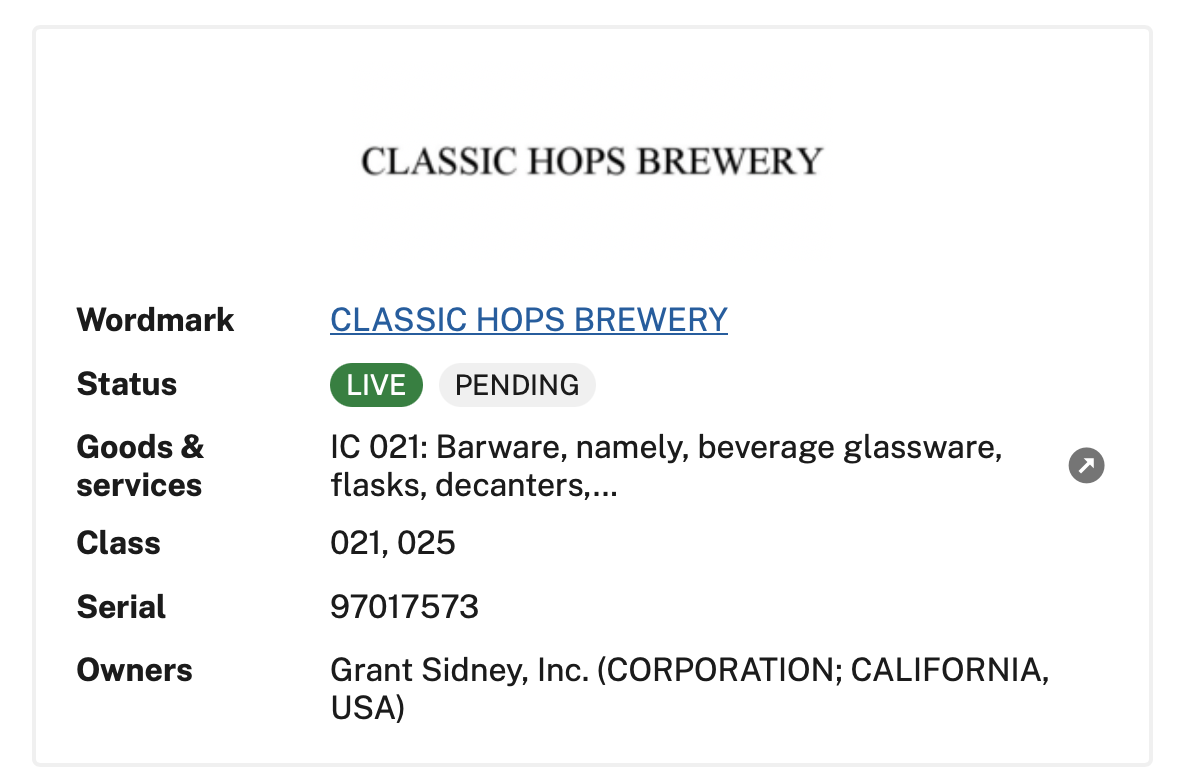

“The Receiver’s Motion for Clarification [Doc. 41]—which seeks clarification as to whether seven additional entities should be included in the receivership estate—was also set to be heard on February 9th. At the February 9th hearing, however, the Receiver agreed to submit his motion on the papers given the limited time available for a hearing.”

Cap’N Phillip is like sure boss, I can email that to ya.

“On or before February 26, 2026, the Parties SHALL submit supplemental briefs regarding the Motion to Reconsider [Doc. 91] and/or the Motion for Clarification [Doc. 41] as may be appropriate.”

The parties being EVERYONE involved.

“These supplemental briefs SHALL address—with record citations and supporting legal authority—the Parties’ post-hearing positions on the Motion to Reconsider and/or the Motion for Clarification. Special emphasis should be placed on what the evidence presented at the February 9th hearing shows, not on rehashing prior arguments.”

Direct. Specific. No fucking rehashes. Focus on what was discussed, not some new nonsense.

“The Parties that have taken a position on both the Motion to Reconsider and the Motion for Clarification SHALL submit separate supplemental briefs for each motion.”

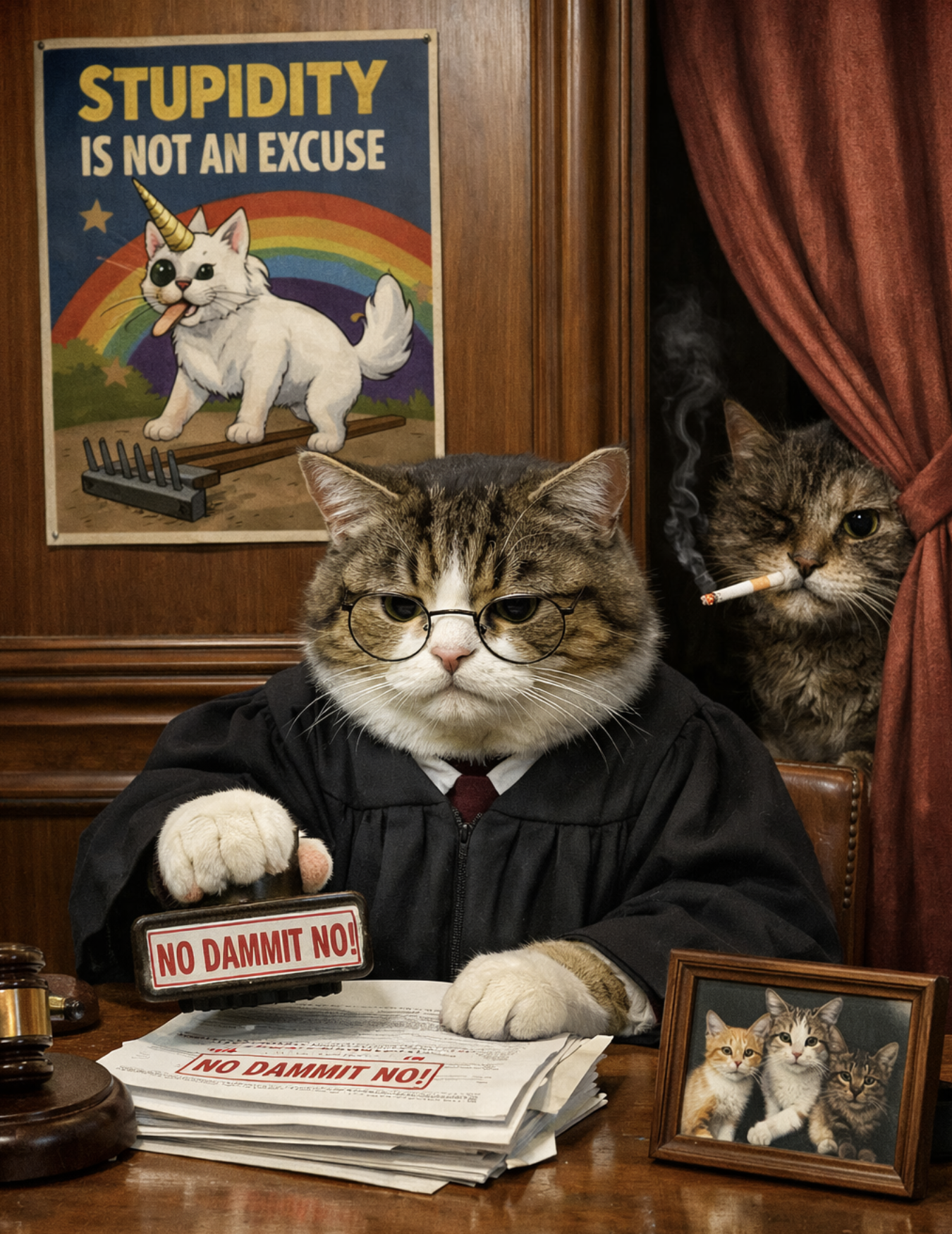

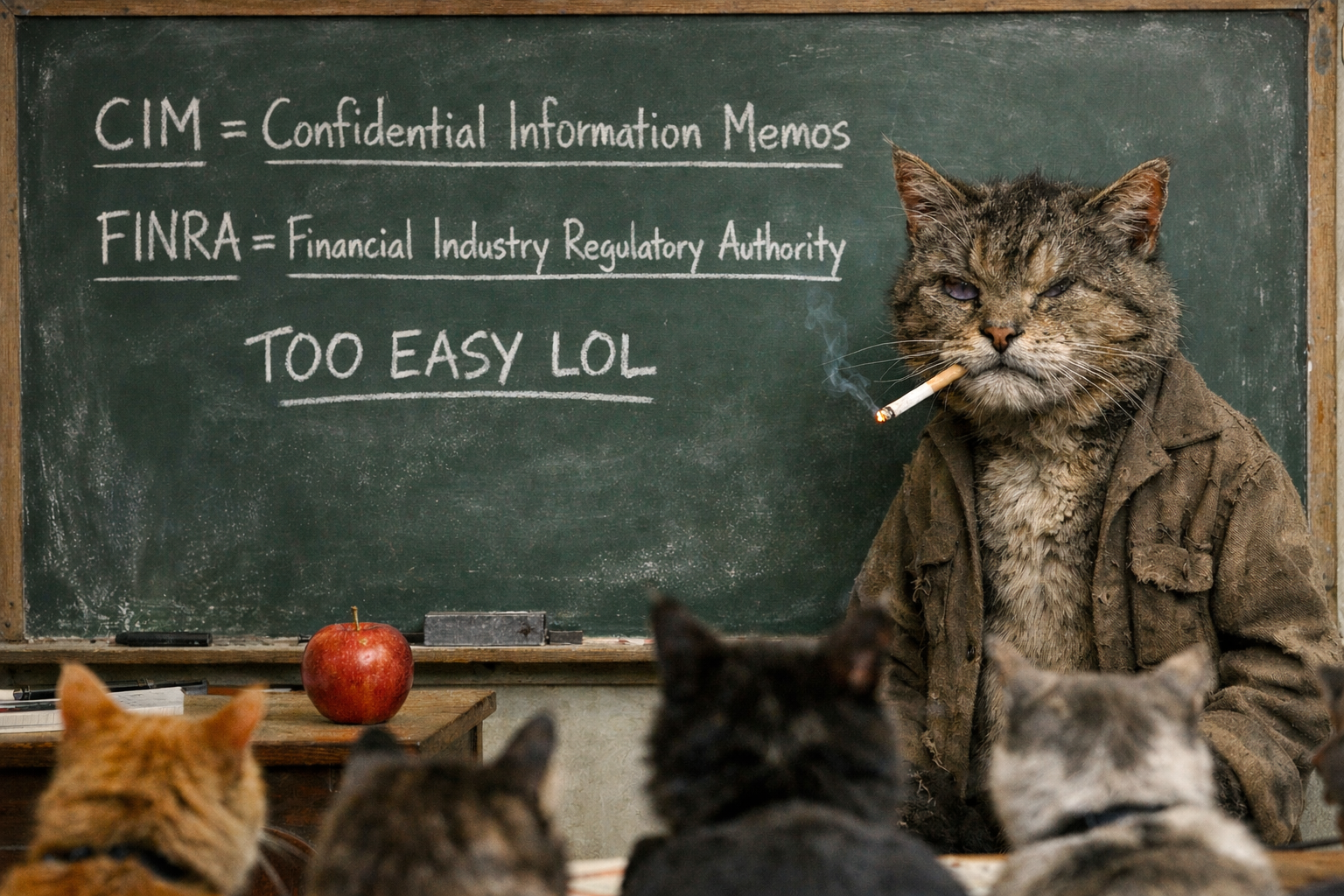

Separate briefs. Oh noes. Pacer taking all my monies. Well, not really, the cats do, but every 10 pages filed is one less can of delicious wet food for the ferals. I feel like The Weaver doesn’t like cats.

Please don’t ask me how to interpret this, I have no idea.

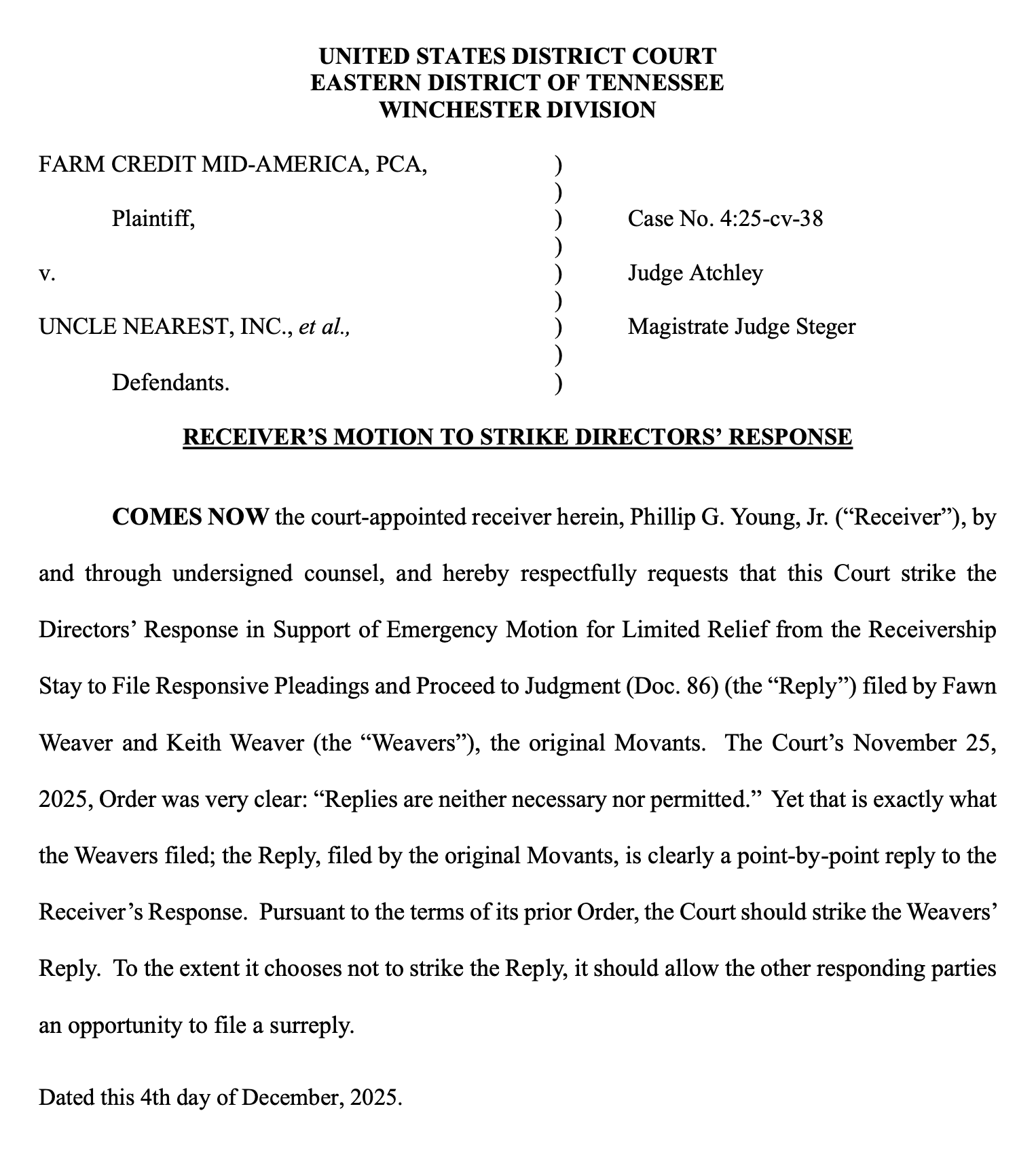

“The Parties may submit supplemental exhibits alongside their briefs. On or before March 5, 2026, the Parties may submit responses to any and all supplemental briefs filed pursuant to this Order. Replies are neither necessary nor permitted.”

Where have I heard that “neither necessary nor permitted” line before? OH right, this same court, different order.

“Finally, and as noted at the February 9th hearing, the status quo shall remain unchanged until such time as the Court rules on the Motion to Reconsider and the Motion for Clarification. In other words (and for the avoidance of any doubt), the Receiver continues to possess all the powers granted to him in the Order Appointing Receiver [Doc. 39], and the receivership retains its original scope.”

This is for the most thickheaded of the parties. We all know which ones.

“SO ORDERED.”

Look, I was obviously not there in court, and those that were aren’t talking. The transcript can only be done via the court clerk right now (90 day pacer delay) and it’s like $4 per page. It’s several hours of testimony, I’m not rich, these cats eat very well, so we won’t know what was said, who talked for how long, and how it ended.

I can however read between the lines, and give some thoughts. So here they are-

The Weaver (TM) probably filibustered.

The court probably wants to make sure they get this right, and have all the legalities lined up straight and clean.

The receivership goes on until further notice, and that includes sale preparation, running the business, and continuing the work they laid out in the quarterly report. That also means investigations continue.

John Eugster gonna have an emo cry cry one of these days. Those FINRA complaints won’t get better with age.

Filing date 2/26.

Response date 3/5.

Senzaki is not uttering a single peep and yet he is just getting dragged non-stop. This might be the biggest rope-a-dope since Ali.

On we go.

Folks, I present to you, the New York Times.

UPDATE #2 2/10-

The New York Times has entered the chat. If you’re a subscriber, click the link here.

UPDATE 2/10-

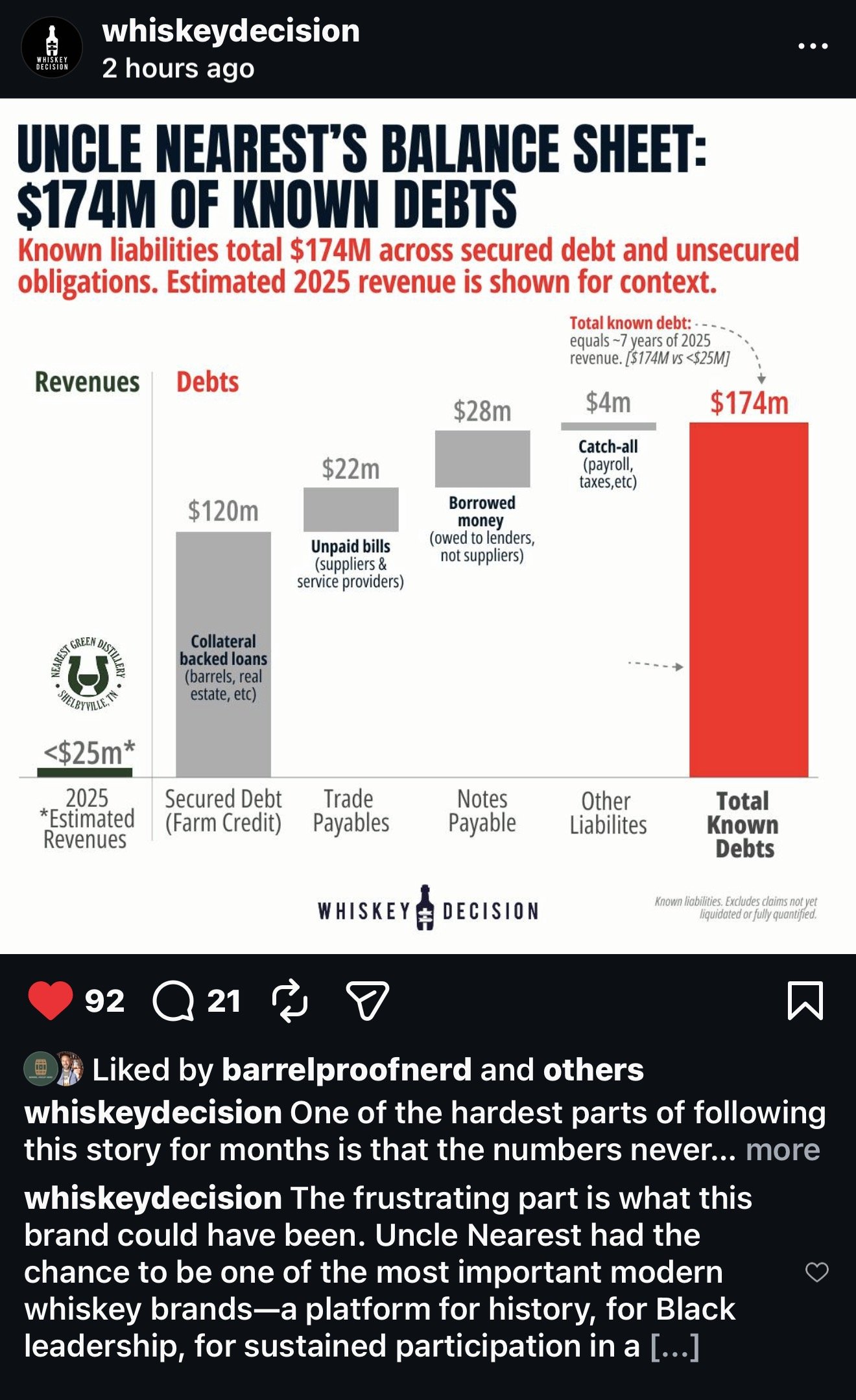

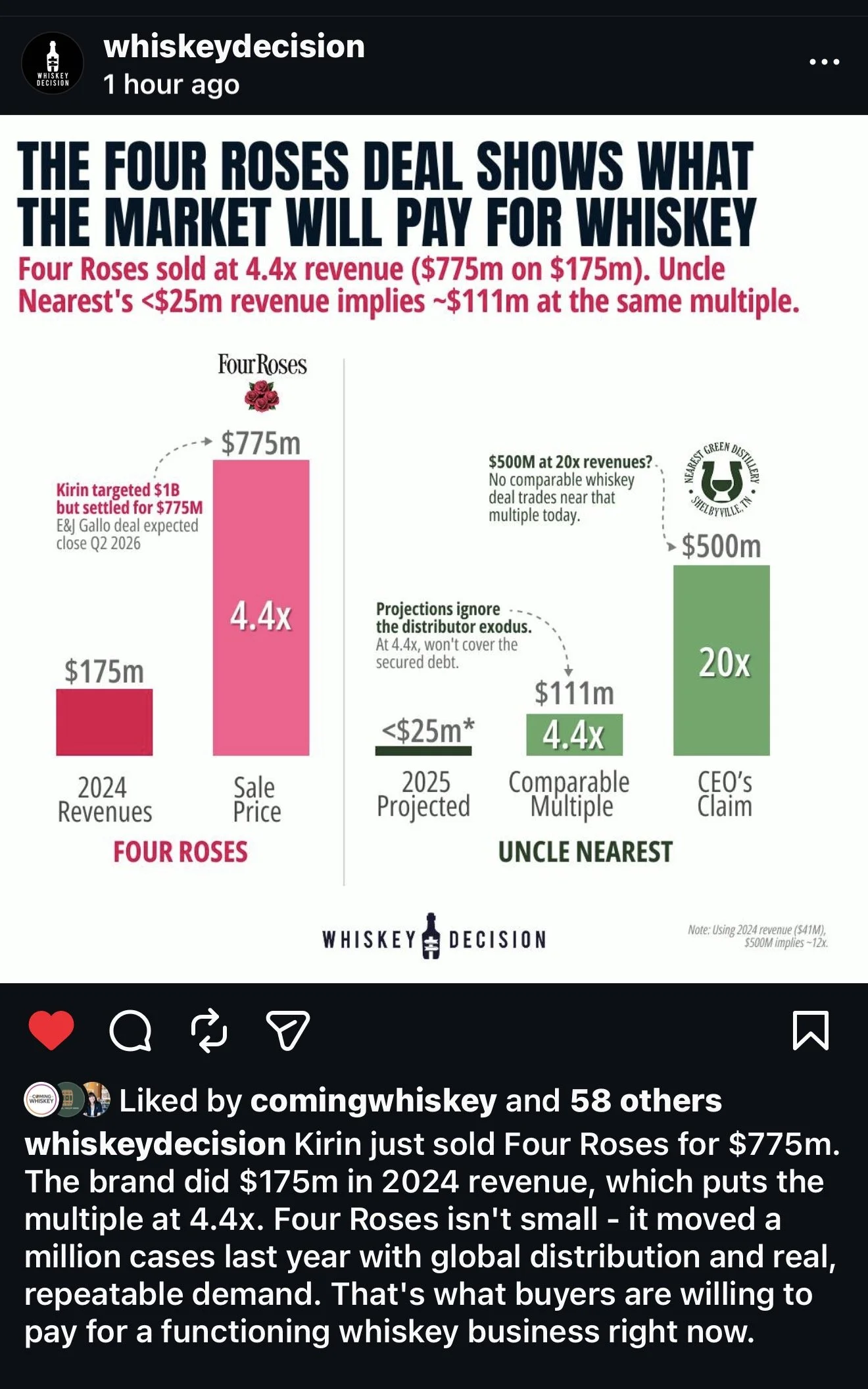

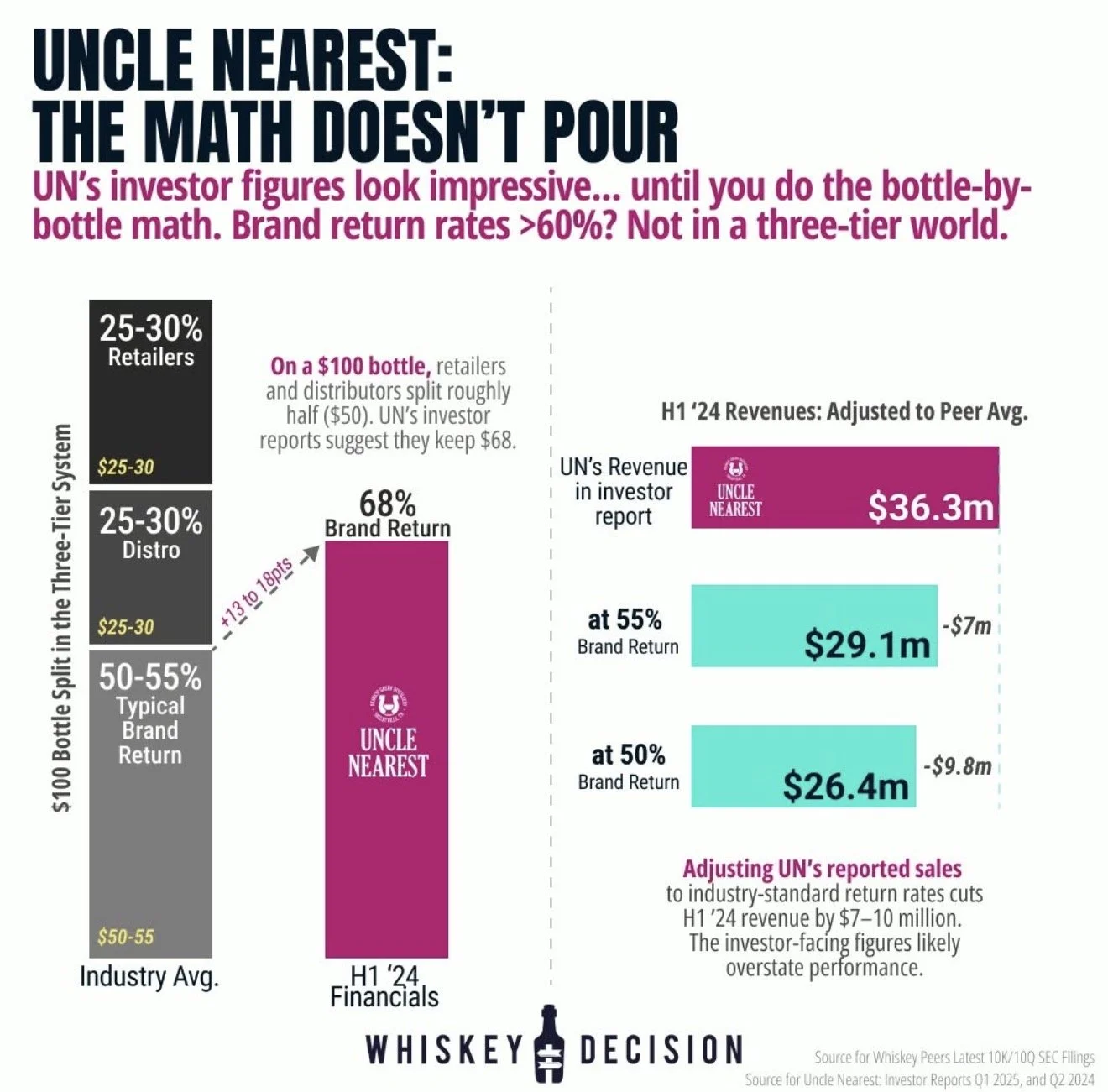

I knew we were going to have to rely on the local media to report back on what happened in court, I just didn’t know we were all going to have to wait so damn long. I got up super early this morning to check, and still nothing. When I know something other than The Weaver (TM) stories on IG, I’ll update. In the meantime another data driven breakdown by Whiskeydecision on IG.

UPDATE #2- 2/9-

The hearing is over, and we have literally nothing about it except that The Weaver is grateful grateful grateful she was in court today, she really likes lemon drops and hamburgers, Keith and Victoria are here favorite people (Sorry Kate), and that she will update us all soon (once she runs her story through ChatGPT obviously).

None of my sources were at the hearing, so we will have to wait for the court documents/orders to see how it went, because the Receiver doesn’t use IG to work the case.

Just remember, the judge could’ve taken Fawn’s wallet, and she would tell everyone how blessed she was.

UPDATE 2/9-

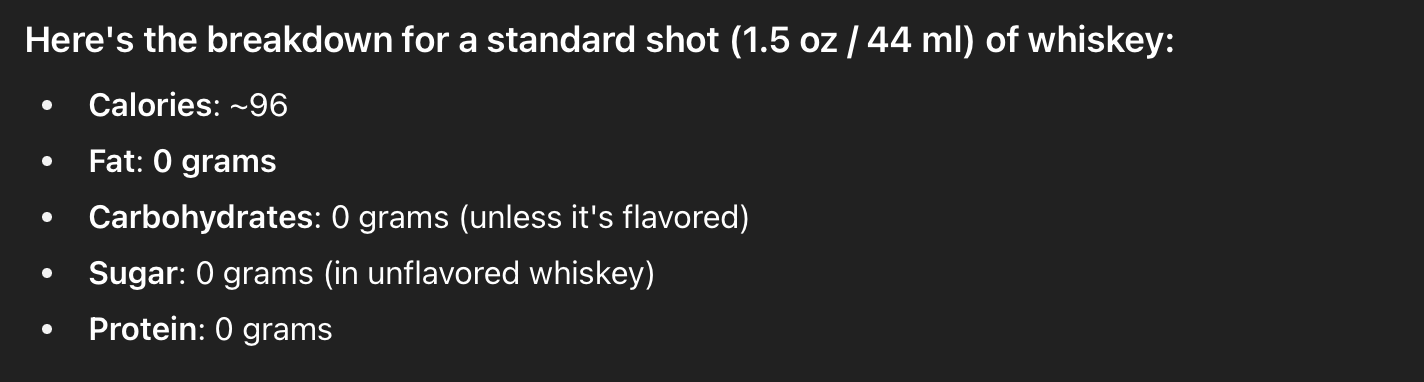

The hearing is underway, and while we wait for any nuggets to drop from local reporting in Knoxville, I needed an excuse to drink some cold brew and type, and Whiskeydecision on Instagram gave it to me. He took the sales reporting from the Receivers Quarterly report (which The Weaver (TM) strangely did not dispute, even though she had claimed $75m) and compared it to the 2024 complete numbers for Four Roses which was recently sold for $775 million.

FR had $175 million in revenue (sales) in 2024.

That makes a multiple of 4.4x.

Fawn claims $500 million in valuation on sales that never approached even half that.

Fawn multiples would be 20-40x at a valuation of $500 million to $1.1 billion.

Four Roses is a profitable distillery.

Uncle Nearest has never turned a profit, and is also not a distillery.

Fawn really leans into the intangibles of the brand and its place in the market and historical significance. AKA the good old Trust Me Bro Vibe valuation.

Prior to the receivership, when it was safer to claim numbers that no one in management would challenge, yeah even Eugster, the one non-Weaver board of directors member, this self declared valuation was nutty.

Anyone else refreshing news sites like it’s their full time job today? I am. WSJ, Shelbyville, NYT, Axios…

Did I catch this at a Mardi Gras parade? Yes, yes I did. The world can be a funny place sometimes.

UPDATE #2- 2/8-

Just a quick one, The Weaver (TM) filed a late night updated list of witnesses and exhibits. Couple quick things.

Added Witness- David M. Ozgo, Former Chief Economist, DISCUS

He was with DISCUS about 20 years and left in 2021.

Added- “ Fawn Wesaver E-mail to Investors”

No, that typo isn’t mine. It was in the filing. Fawn Wesaver. Tomorrow should be more of the same.

UPDATE 2/8-

We’ve got a few hours before kickoff (Go Bills!) so I figured I’d just drop a couple of quick hits, things I’m wondering, and a few links to some articles. Regrettably I will not be attending the hearing tomorrow, the logistics were too complicated and too expensive for me to go up there just to say “Hi Kate.” I’ll leave the reporting on the hearing to the professionals. I will do updates with links to their stories, and if anyone wants to share what they saw/heard at the hearing, I will report on that (and court docs/orders).

Duane Cross has a good article that pretty much is a what’s what recap of the entire story, so if you want a very well done cheat sheet to refresh (or test) your memory, this is it.

Sometimes whiskey writer who writes a lot about whiskey, Chuck Cowdery also wrote up his own article about the saga.

Will the judge order the continuation of the receivership or dissolution of it from the bench?

Will the judge order inclusion or deny inclusion from the bench?

Will there be several days of deliberations as the Weaver’s continue to liquidate assets?

If the house was sold to the Pineda’s (friends of), does Keith get to stay there for free? Or does he have an AirBnB?

Will Kate finally realize what’s going on?

Will anyone in the court refer to the Movants as the Meowvants (TM)?

How long will it take for the judge to break his gavel?

Will Michael Collins cry in the car?

Will the unbothered and unmoved persona make it through the week?

Will MomTok survive this?

How many employees current or former will be in the audience?

Will any of the investors attend?

I wonder if the BroFundMe’s will be there.

This is a great opportunity for The Weaver (TM) to tell the world how everyone on earth is a liar but her.

Kandi is tired, but she’s a damn national treasure. I wish she was gonna be there for the hearing, but her ride is longer than mine.

I am behind on responding to people. Like weeks behind. I apologize. I haven’t forgotten, nor am I ignoring you.

I think there will be a lot of interesting things taking place on Monday that aren’t just the hearing itself.

I wonder if we will get a hype video at 6am.

Selling your car to make payroll? If so, ouch.

UPDATE 2/7-

Happy day before the Super Bowl to anyone that cares. Today I’m just doing some quick hits and relaying some things I have heard through the grapevine. I’m not declaring that these are true, but I trust that they are based on my working knowledge with sources that haven’t gone wrong once.

Humble Baron will be open Saturdays and Sundays 12-5.

There will be drinks only.

No more brunch.

They have 3 people left over from the Bleak Friday Layoff Massacre.

If you want food, you have to go get it yourselves in the Barrelhouse. (no servers).

Hunble Baron will be making fresh popcorn in that very expensive kitchen.

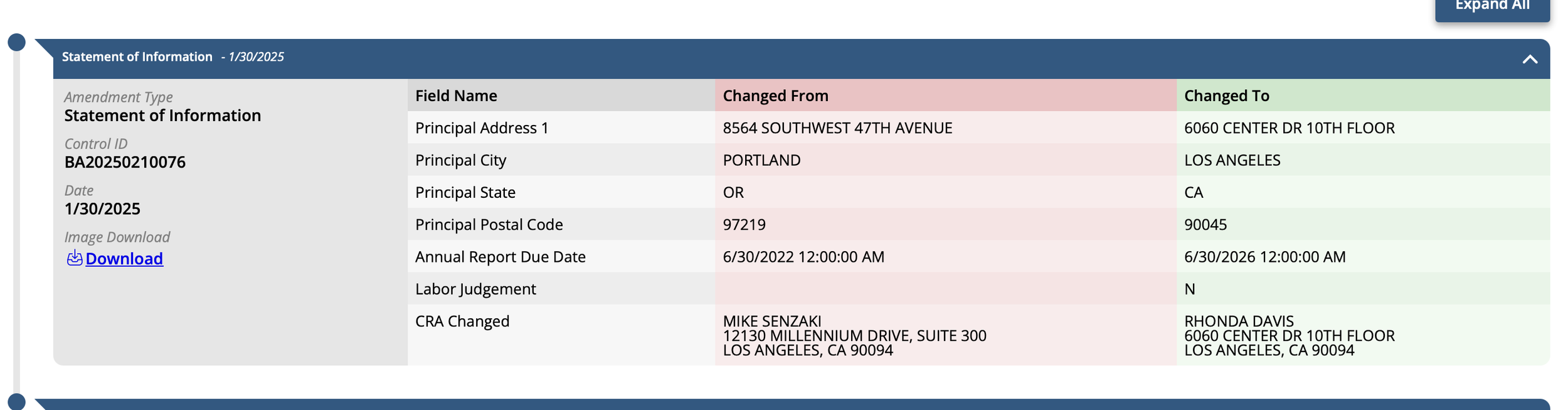

The Weaver (TM) may have sold their house in Shelbyville in a pocket sale (no word on closing price). I’m waiting for the deed documents to be made public.

It is alleged that Alex and Kia Pineda bought it (both are closely tied to the Weavers.).

Keith may have sold his beloved Mustang to meet payroll for Humble Baron (which could explain why the direct deposit didn’t happen).

Keith may have been told that he cannot touch any of the bank accounts for the entities likely to be brought in to the receivership. Or he may not have been. Or there isn’t any money in them anyway.

There are very few people taking tours at the distillery (which is not uncommon in winter to be fair.).

No word on why you cannot reserve a spot at HB from the website for February or any other month (oddly the mobile version does allow for non-February reservations).

Cap’N Phillip may or may not be on site next week for several days with interested buyers. Just not Monday.

The Court has issued a location change for the hearing, as they are expecting a lot more of the public to show up because Fawn is in essence, begging folks to do so.

That trip for me would be north of $1,000 and since I can’t just use UN funds to fly, hotel, and get my hair done…. I’m faced with 8.5 hours of driving each way. Gonna be a game day decision for me, probably not gonna.

If anyone gets a voice memo recording of the hearing, please send it to me.

If you’re wondering what yesterday’s pacer entry was all about.

The quality of the filings this week vary greatly.

UPDATE 2/6-

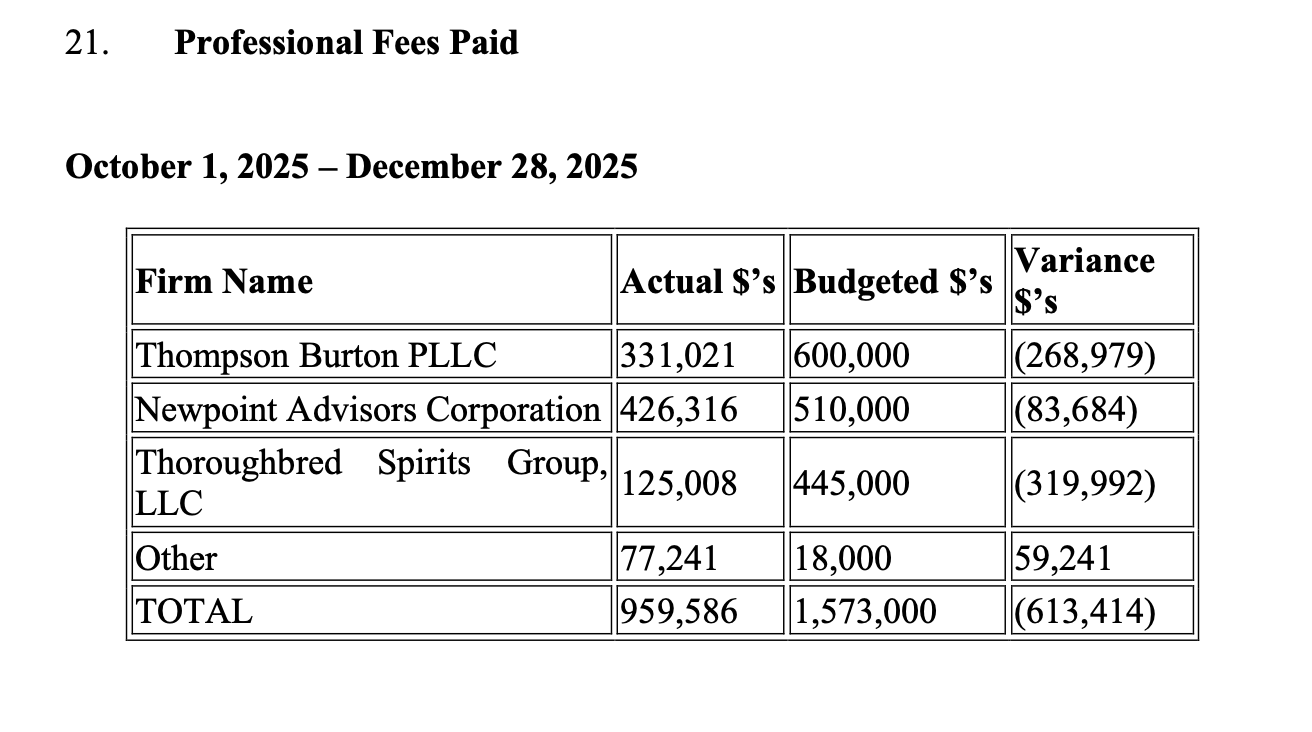

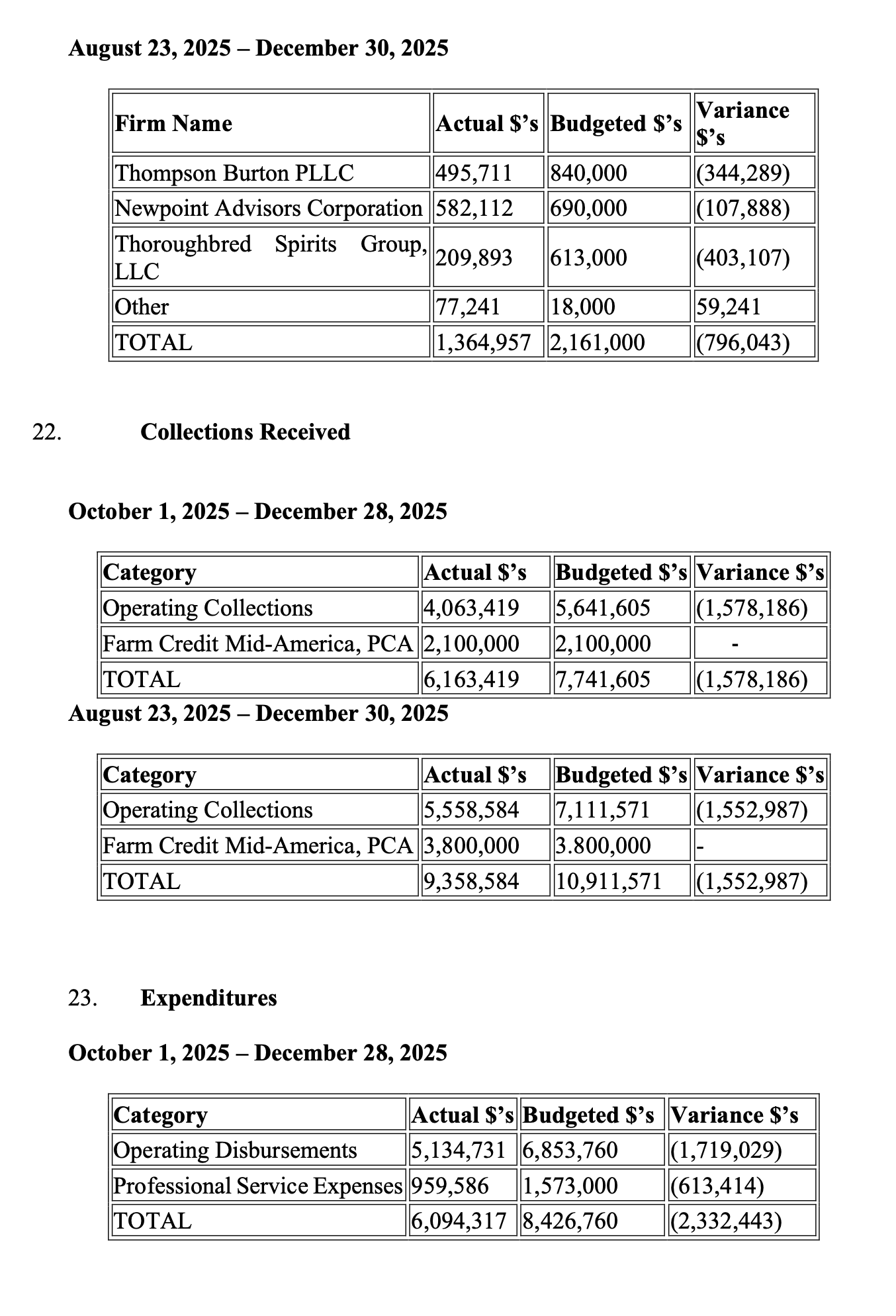

Now that the dust has settled from all of the filings, hopefully it’s rather quiet until Monday. While I don’t expect a lot of court documents to drop that day, I do expect there will be news coming out of the hearing rather quickly. While I won’t be in attendance, I expect local news to be covering it, so it’s not like we will all be in the dark. This morning I wanted to do some quick hits, and I’ll lead with them, but below there will be a short breakdown of an affidavit of The Weaver (TM) witness Anthony Severini that was buried in her bloated filing.

Gallo is purchasing Four Roses for $775 million. Now ask yourself, is UN worth the $500 million that The Weaver (TM) claims? Also, if she claims it’s a half billion valuation now, what happened to the other half she used to claim? Four Roses did about $170m in sales in 2024. Fawn thinks UN is 12x earnings. I can’t. I just cannot.

Humble Baron mobile site is showing bookings available for March, but not the desktop version, which has all reservation links removed. Is it going to reopen? Is it not?

I predict that The Weaver (TM) lies the moment her hand hits the bible at that hearing and doesn’t stop until the end.

I predict she will attempt to filibuster her way through the hearing, trying to delay and monopolize the time of the court.

I predict that her bluster will be as out of touch with reality in court as it is on socials.

I predict that the judge will have to use the Irk Stick often.

I predict that Keith will crack.

I predict Kate will speak fast, and use a lot of dressing on a word salad. Hi Kate.

I predict that this hearing will not go the way The Weaver (TM) thinks it will.

I predict that facts will defeat vibes.

I predict that not only will the receivership continue, but that inclusion of the Seventies (TM) will happen, and quickly.

Ok, now for the affidavit declaration document of Anthony Severini, who is the CFO of Genesis Global Workforce Solutions Inc. and is being called as a witness for the Meowvants (TM).

“Genesis Global is the Employer of Record ("EOR") for Uncle Nearest, Inc., responsible for payroll processing, employee benefits administration, and related human resources functions.

4. Genesis Global has served as the EOR for Uncle Nearest, Inc. since 2019.

5. This Declaration addresses (a) the historic business relationship between Genesis Global and Uncle Nearest, Inc. and (b) the relationship between Genesis Global and the court- appointed Receiver for Uncle Nearest, Inc., including relevant communications concerning payroll.”

Anthony Severini sounds familiar somehow. This is a Foreshadowing Alert.

“This affidavit further addresses the continued support of Fawn Weaver and Keith Weaver, founders of Uncle Nearest, Inc., by Genesis Global, as well as my own support, and the future of the business relationship between Genesis Global and Uncle Nearest, Inc.”

Is this about to be weird? It’s starting kinda weird.

“Genesis Global has provided extended financing terms to Uncle Nearest for payroll and benefits for their employees based on our long-standing business and personal relationship with the Weavers and our belief that Uncle Nearest has a strong future with positive potential to keep paying its financial obligations. These beliefs are based on our basic knowledge of their industry, our direct experience with the brand, its market penetration that we have seen first-hand, and our direct positive experience with both Fawn and Keith Weaver. During the time I have known Fawn and Keith, they have honored all their agreements with me and Genesis Global without exception.”

It’s weird, UN owes or owed, $200k to Genesis. If that’s honoring all their agreements, I’d hate to see a disagreement, oh wait, that’s part of the Foreshadowing Alert. .

“Prior to the Receivership being installed in August 2025, payments were being made and applied to the oldest outstanding invoices first. Subsequent to the Receivership, we are required to apply payments to current payroll invoices. Invoices that were outstanding as of the Receivership starting date are continuing to age to comply with the court requirements.”

Were they catching up? Doesn’t look like it. Seems like they were paying old debts while accumulating new ones, not quite getting back above water. Kinda like treading water, six feet under the surface.

“As late as the day before the commencement of the Receivership, Genesis had agreed to continue to process and pay all the employees of Uncle Nearest and Nearest Green.”

On credit. Without the generosity of Genesis, the employees would not have been paid.

“Only as a result of the notification of the Receivership that informed me that the Weavers were no longer allowed to make financial decisions on behalf of the Company, I was required to freeze any new credit to Uncle Nearest. Since the Weavers were now precluded from making financial commitments on behalf of the Company, Genesis Global did not have any assurances from the Weavers on Genesis being paid for their services going forward.”

I would like to see the assurances from them prior to the receivership that led a CFO to continue allowing debt to accrue while fronting them money. I’d love to see that contract (not entered as an exhibit).

“Upon our receipt of the Court’s notification of the Receiver, I reached out to the Receiver to inform them that we are now requiring payroll to be paid in advance. This is our standard practice when a company is in this type of situation. This was not a reflection of our belief in the Company or the Weavers, but a reflection that the Weavers were no longer controlling the finances of the Company and could not commit to making sure Genesis Global was repaid on its services.”

Is it me? It’s weird right? They don’t trust the receiver, but they trust the people running a company into receivership? I get that the stay froze all debt, but the receiver was going to pay for new payroll, so in essence, it’s a semantical difference. The Weavers were paying old debt while accruing new ones, the receiver was paying new debt and not old ones. Is this a good witness for The Weaver (TM)?

She didn’t always like the judge.

“To be clear, payroll for Uncle Nearest was not in jeopardy of not being processed prior to the Receiver’s commencement.”

I really wonder what terms were behind this fronting the money. Surely there are terms.

“During September 2025, I had a conversation with Philip Young to get an understanding of the overall process of the Receiver, status of our outstanding payables and the state of the business. During this conversation, Mr. Young stated he was very bullish on the Company, he believed the Company’s value was much larger than its liabilities. He stated he was hopeful that by the end of the year but most likely by end of Q1 2026, the company would have new financing in place or the company would be sold and believed every vendor would be paid back in full, including Genesis Global.”

This was a mere week or two into the receivership. Cap’N Phillip was looking at “books” that were untrustworthy, but he was not aware of that at the time. Genesis is unlikely to ever see a dime of that debt they allowed to grow.

“Based on those representations, Genesis Global agreed to continue processing payroll even though the creditor stay prevented payment on invoices that Uncle Nearest had been systematically paying down prior to the receivership.”

How much was being paid down vs. accrued? The debt to Genesis is $200k ish. Was it $400k prior? $201k?

“Early in January 2026, I had a follow up conversation with Mr. Young. He stated during this call that no bank offers had come in to refinance debt nor had any acceptable investor offers come in. At this time, he was unsure when the Receivorship would end but that he was informing the bank and the courts that it is unsustainable to keep a receiver in place too long, as it does damage to the brand and general operations will begin to suffer. Additionally, I asked Mr.Young if the Company was cash flow positive now. He stated the company has been running cash flow positive. I then asked if this accounted for the receiver costs, which he said it did not.”

Somebody is lying…….

“On Monday, January 19, 2026, I received a call from Ms. Weaver asking whether I had ever told the Receiver that payroll for Uncle Nearest was in jeopardy of being paid. I told her payroll for the Company, prior to the receivership, was always processed and funded based on commitments from her and our belief in their ability to operate the company and their personal assurances to continue to make payments to Genesis. Since the Receiver has been installed, payroll being paid and processed is now dependent on Genesis receiving funds from the Receiver timely. While the Receiver is in place and the Weavers are not providing representations for the Company, we cannot extend any credit to the receiver.”

Pretty sure the receiver isn’t expecting any credit, which is why he’s paying Genesis for payroll. Unlike a certain CEO. I’m still scratching my head about this witness. This doesn’t seem like any kind of smoking gun. It’s a drop in the bucket of things that The Weaver (TM) is facing in this hearing on 2/9.

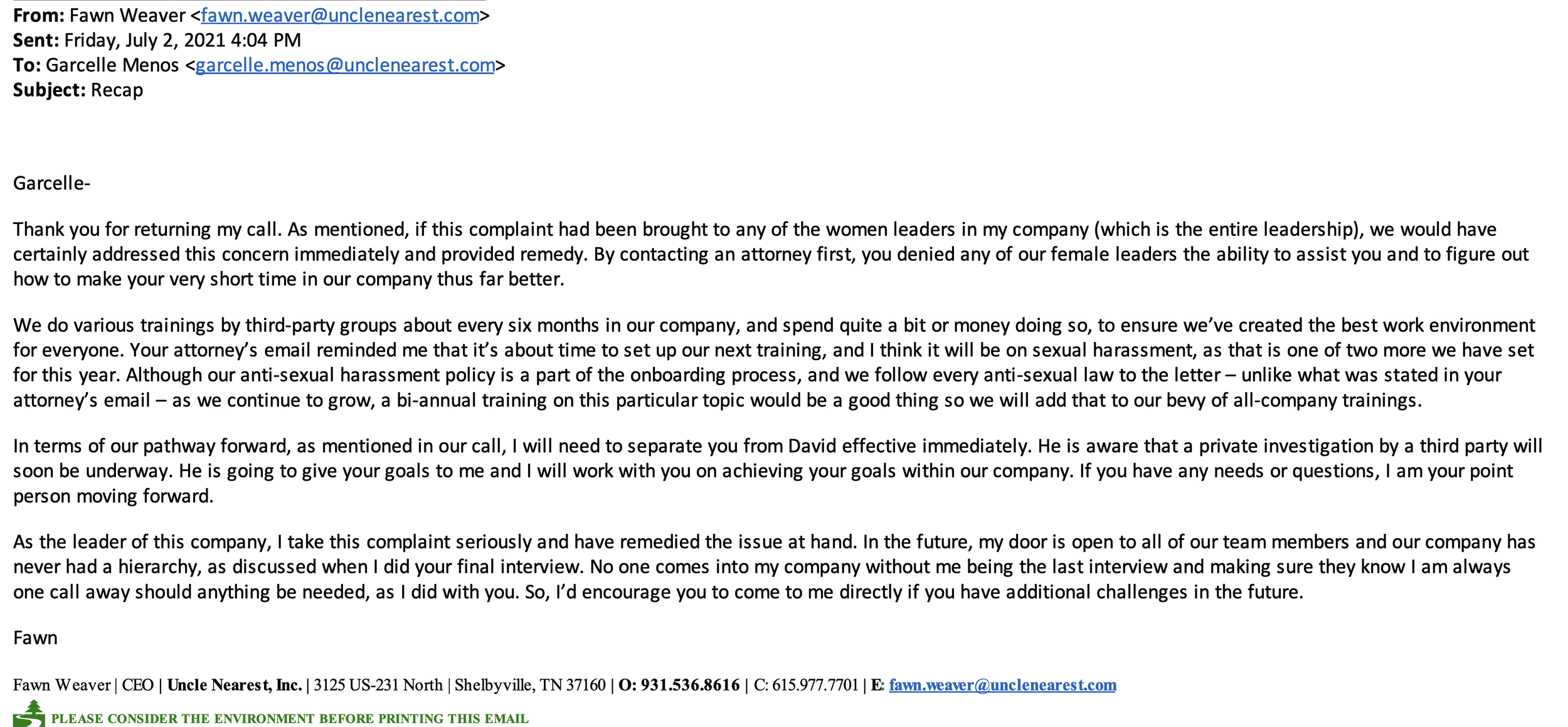

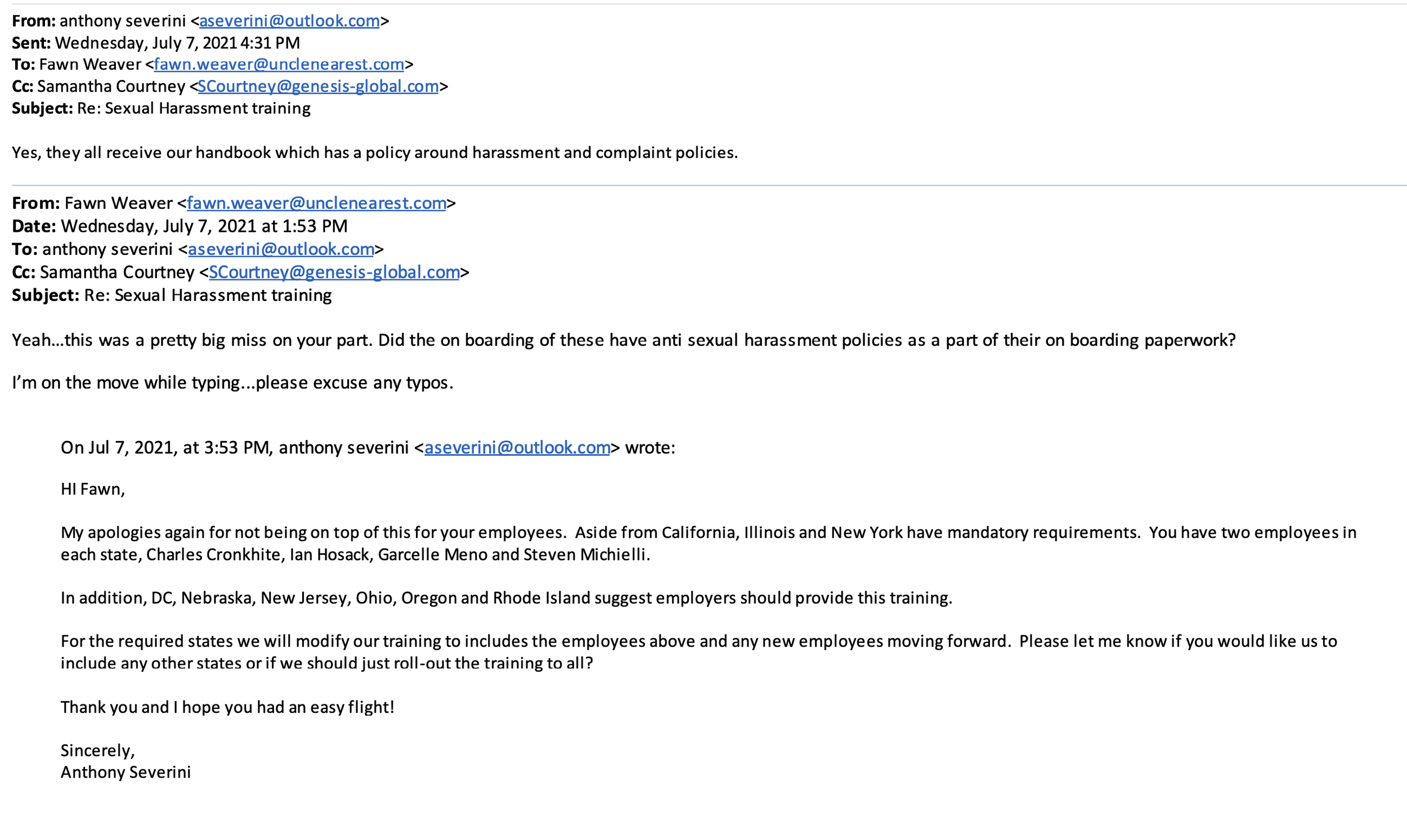

Ok, so about that foreshadowing alert- I thought I recognized the name, and my Angel on my Shoulder (TM) reminded me of where I recognized it. The Menos lawsuit.

“At all relevant times, Uncle Nearest outsourced the logistics for onboarding and HR- related training to Genesis Global, which Plaintiff disputes to the extent that Weaver represented via email that she “oversee[s] all aspects of [Uncle Nearest]’s work environment.”

“In an email exchange between Weaver and Anthony Severini (“Severini”) of Genesis Global Recruiting, Inc. on July 7, 2021, Weaver discovered that Uncle Nearest was not in full compliance with all state sexual harassment training requirements— specifically for its Illinois and New York employees, including Plaintiff—which Weaver told Genesis Global was a “pretty big miss on your part.”

“Severini replied that “they all receive our handbook which has a policy around harassment and complaint policies.”

“Plaintiff testified that she never received an employee handbook until October 12, 2021, after lodging her complaint.”

Is any of this surprising really?

Lots of sharks passing on this pizza with no cheese.

UPDATE #4- 2/5-

Couple of quick things. The court ordered the documents exposing the SSN’s to be sealed and then refiled with redactions. Which they’ve now done. Gosh bank, you coulda thanked me at least. It’s ok though, it was the right thing to do.

UPDATE #3- 2/5-

107 pages. That’s The Weaver (TM) filing. A lot of it is a giant rehash also known as the airing of her grievances. A lot of exhibits (yes, I’m aware I haven’t broken down the Receiver or Bank exhibits yet). So probably about 10 pages of actual interest, so expect a lot of excerpts.

Before we dive into it, I just have to say I still cannot believe that video, or that email she sent to shareholders. Mindblowing dumbshittery full of lies, lies, and Fawn lies.

Anyone still believing her, that isn’t a bot, deserves what they’re getting or will get at this point. I get sticking around for the paycheck, I truly do, and I respect that, but I’m talking about the true believers, the ones willing to put on sneakers and wait for the UFO’s to show up and take them away…. those folks, have enabled this to go on far longer than it should have, and their time to face the music is coming.

On with the show.

Ok, 3 pages in and I need a drink. She pretty much just rehashes what she’s been filing forever.

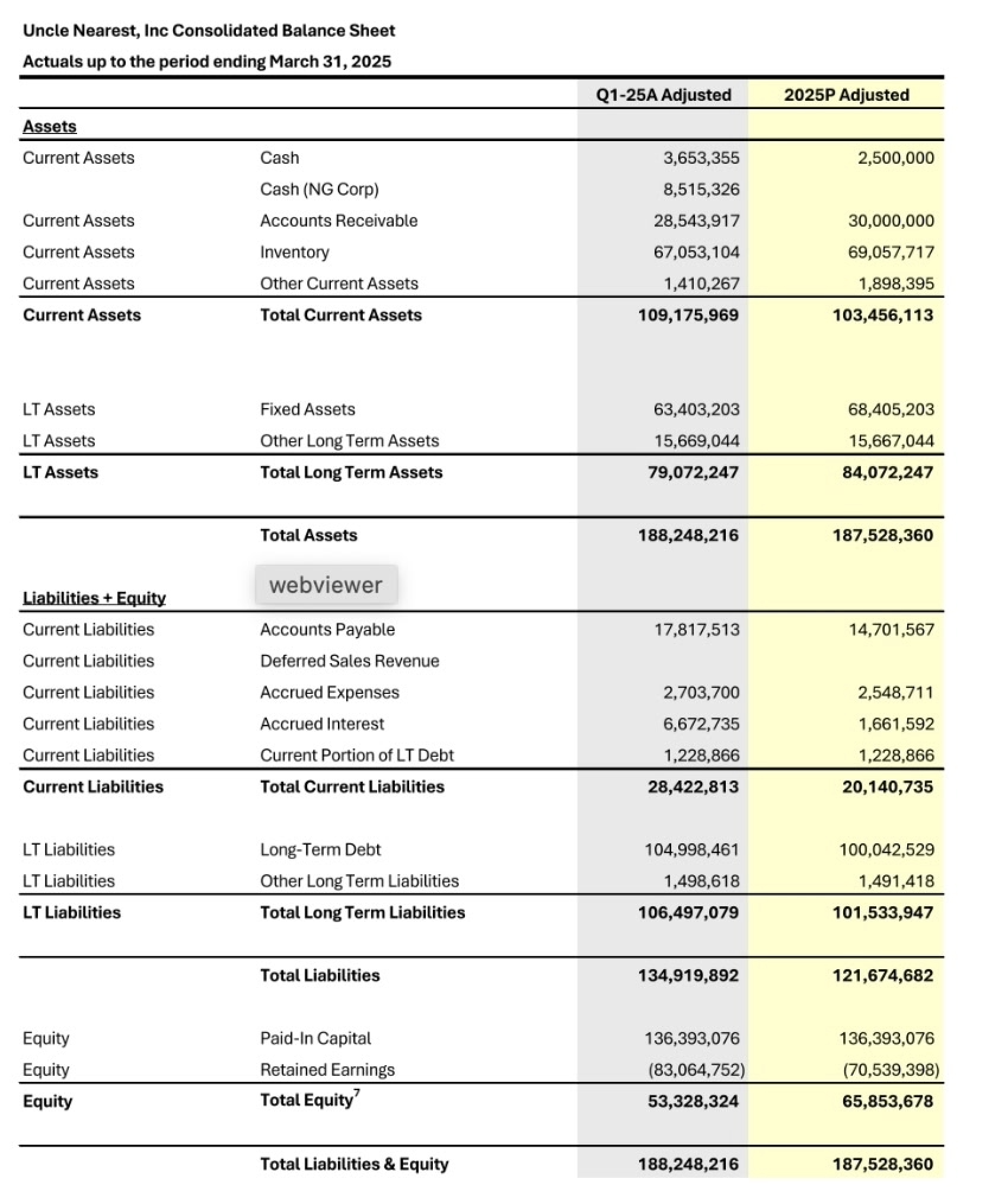

“With respect to the Uncle Nearest brand value, using the Receiver’s own acknowledgement of $41 million in 2024 revenue, which figure excludes GAAP-compliant wholesale barrel sales that have historically been a core component of the Company’s business and are similarly utilized by other major bourbon producers, and applying the conservative 12.9x sales multiple used in prior capital raises, the brand itself is worth greatly in excess of the $160 million, which is the total indebtedness asserted by the Receiver but has not been supported by any filed schedules or financial statements. In sum, Uncle Nearest’s asset base, including hard assets and brand equity, is worth significantly more than the total alleged indebtedness of the Company.”

This is some mental gymnastics here at best. 12.9x multiple? PIE IN THE SKY COPIUM.

“The Movants have developed a defined and actionable plan to reverse the sales degradation that has occurred during the Receivership and to restore the Company to the sales growth trajectory it maintained before the Receivership began.”

That plan is to take editable XL spreadsheets and just input whatever numbers make them look good.

The Meowvants (TM) then rehash that they can hire Felicia as CFO, and they have been in discussions with sources of financing (TRUST ME BRO INC.) to fund renewed marketing (note, not fund the operations of an insolvent business). Then some moves to improve sales growth numbers that are divorced from reality. They then say that the bank has provided no financial information or evidence to support the insolvency claim (they did, lots of it in the exhibits that are incoveniently hard to spin to support the narrative she is trying to drive.).

“The Movants are providing the limited financial information that they have been provided to date and would request that, as part of the hearing on the Motion to Reconsider, the Receiver be required to file under seal comprehensive financial statements and operational documents for the Company.”

Not us, just the receiver, so the narrative can be spun. This will not stand.

She then drops some PR on the assets, talking about the distillery, the land, the most visited highest ranked fat free gluten free mumbo jumbo she’s been throwing around forever.

“During the Summer of 2025, prior to the Receivership, the Company’s management was entertaining two sale-leaseback transactions – both placing a value on the Uncle Nearest Distillery property of $65 million or greater.”

Now this sounds like why the bank filed the lawsuit to protect assets from dilution. The Weaver (TM) was about to squeeze the value out of that property, and had the bank not moved, it would have.

“Some of the Company’s rye inventory valued above $3,000.”

For Canadian rye? Are you insane? No shade at Canadian Rye, I’m a big fan of WhistlePig’s sourced stuff, Barrell and their excellent Canadian Rye that ends up in Seagrass releases, and Alberta Premium. But no way is the UN stuff valued at above $3000 a barrel. Right now brokers are trying to move 8 year-old Old Grand Dad aged at 8 years for $1400-1800 a barrel. Don’t @ me, I know OGD isn’t rye.

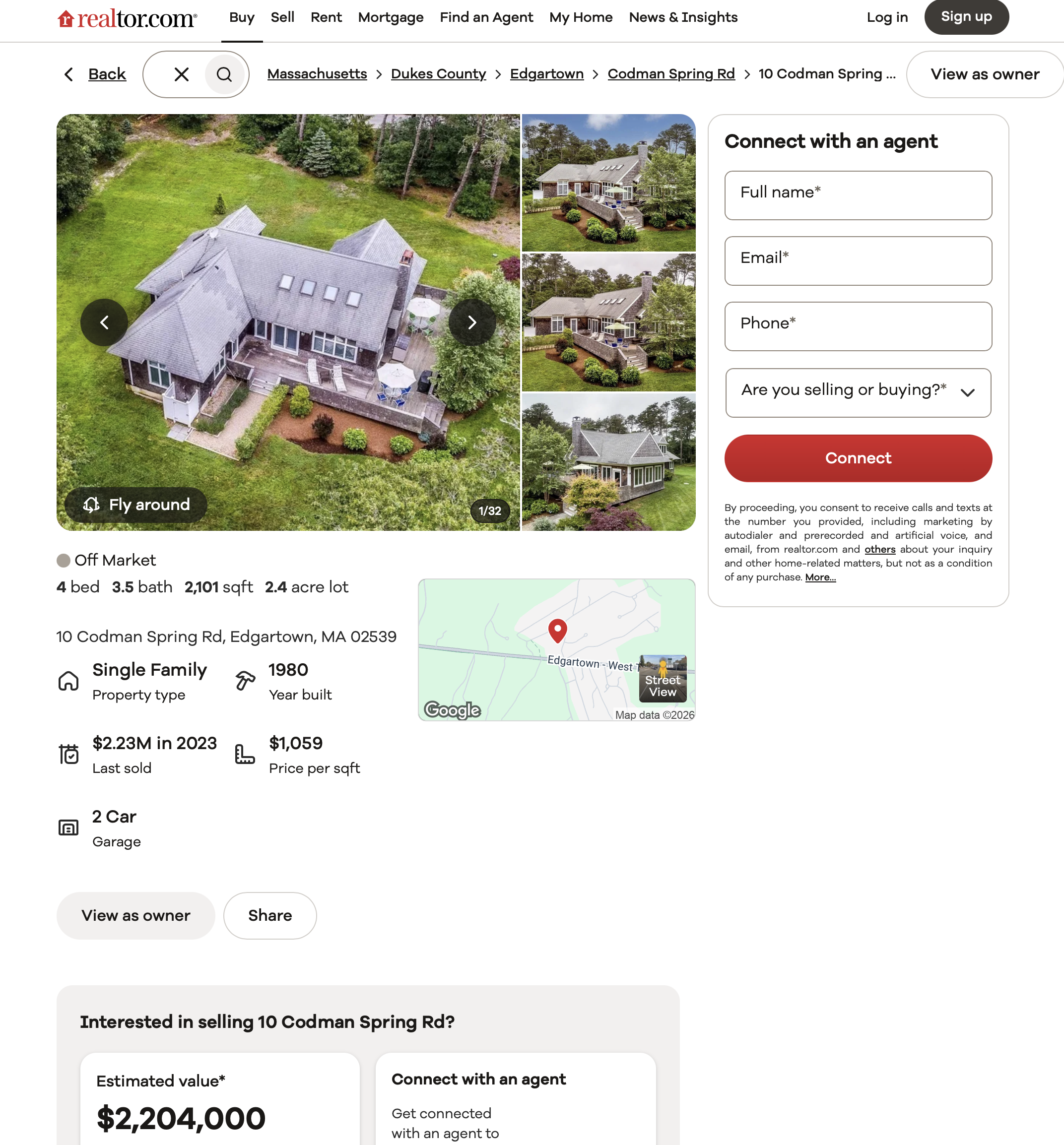

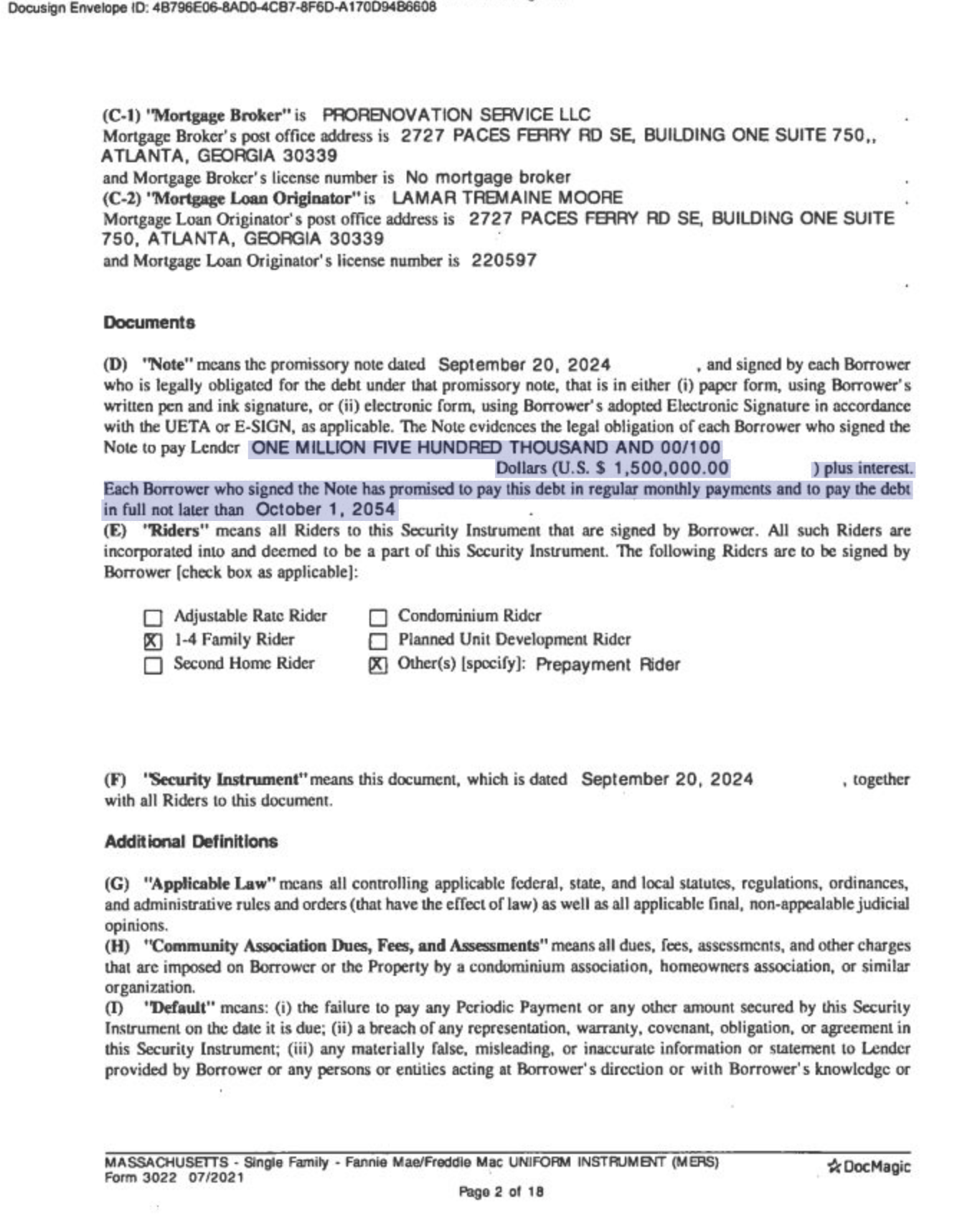

“The Martha’s Vineyard property has an estimated value of $4,000,000.”

You mean this one?

“The property in Cognac, France has a value of at least $2,000,000.”

“Using the 12.9x sales multiple historically applied to Uncle Nearest capital raises — a multiple that is conservative when compared to those applied in recent transactions involving similarly situated brands — the brand’s value as of the first month of the Receivership would have been $528,900,000. “

William Shakespeare, in all of his eloquence would reply simply, “Bullshit.”

“The Receiver has asserted that the Company’s total debt is $160 million but has provided no financial information to support that calculation.”

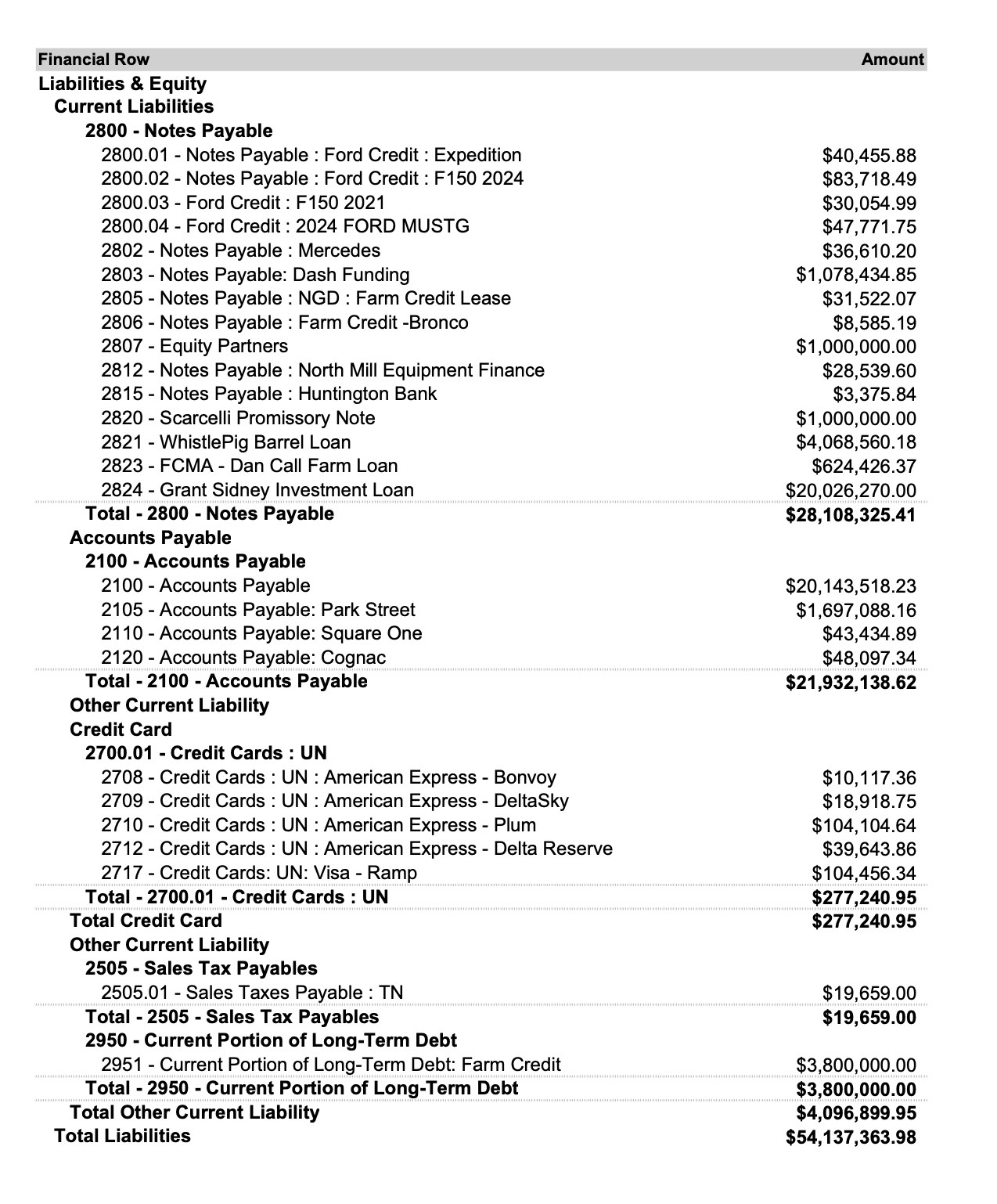

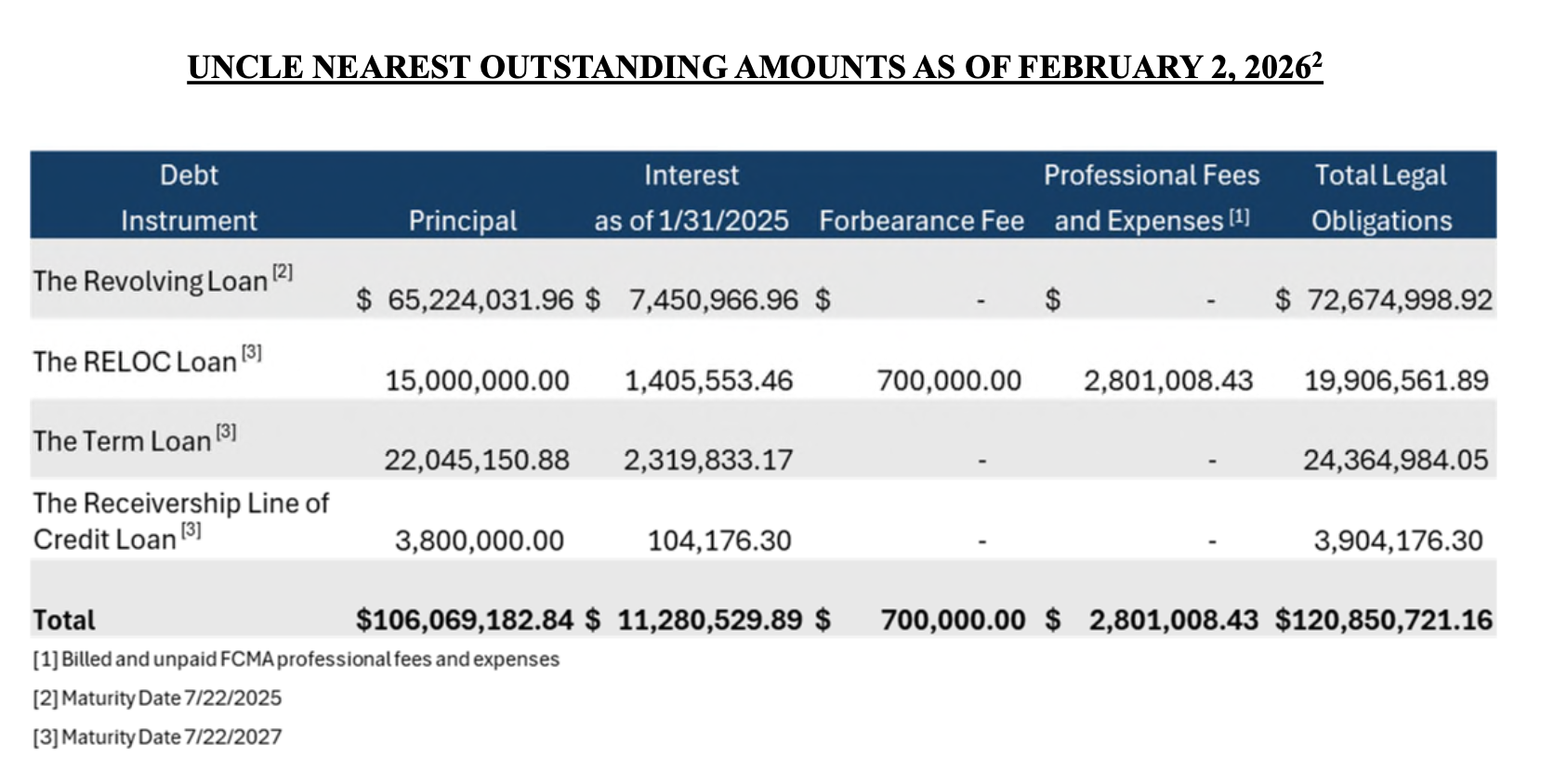

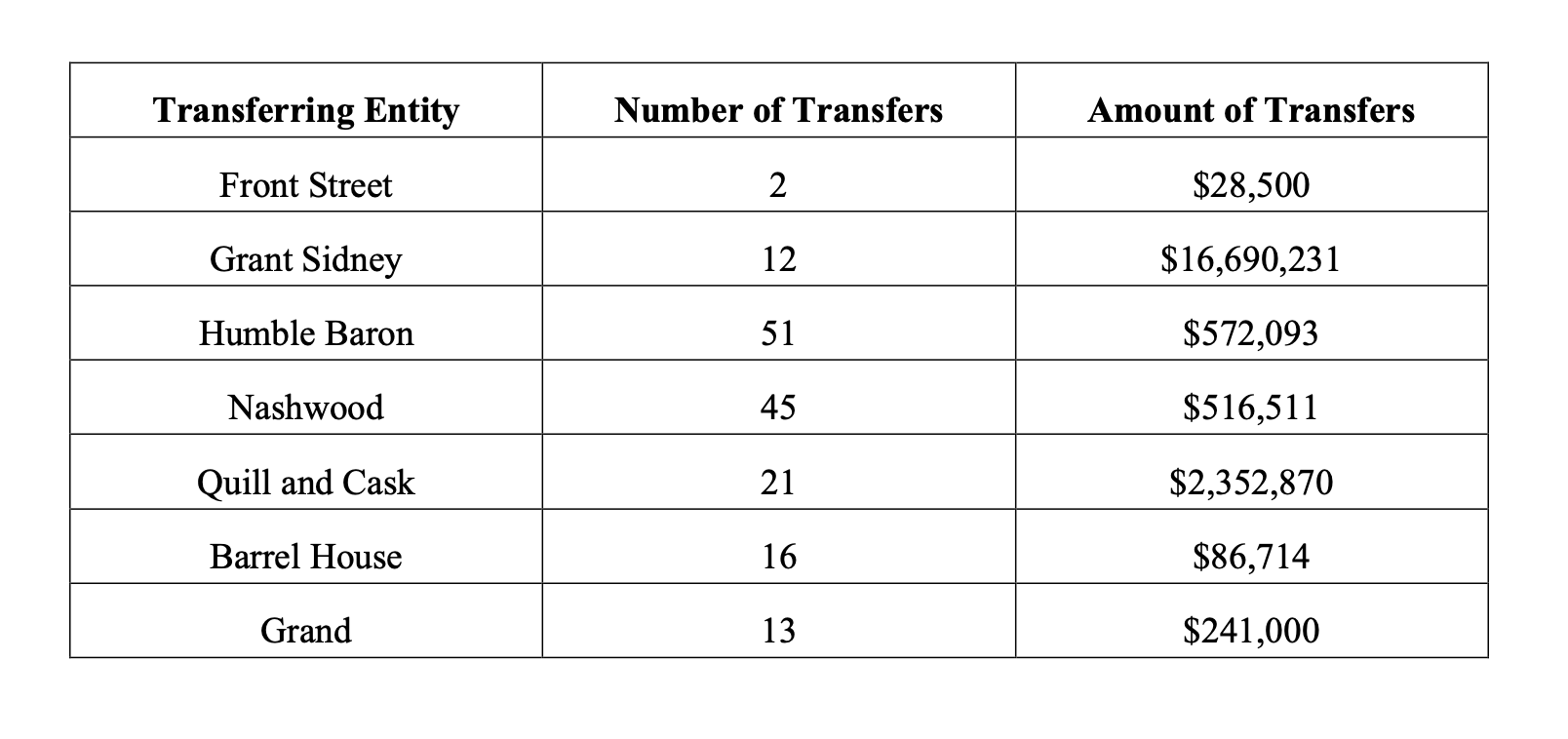

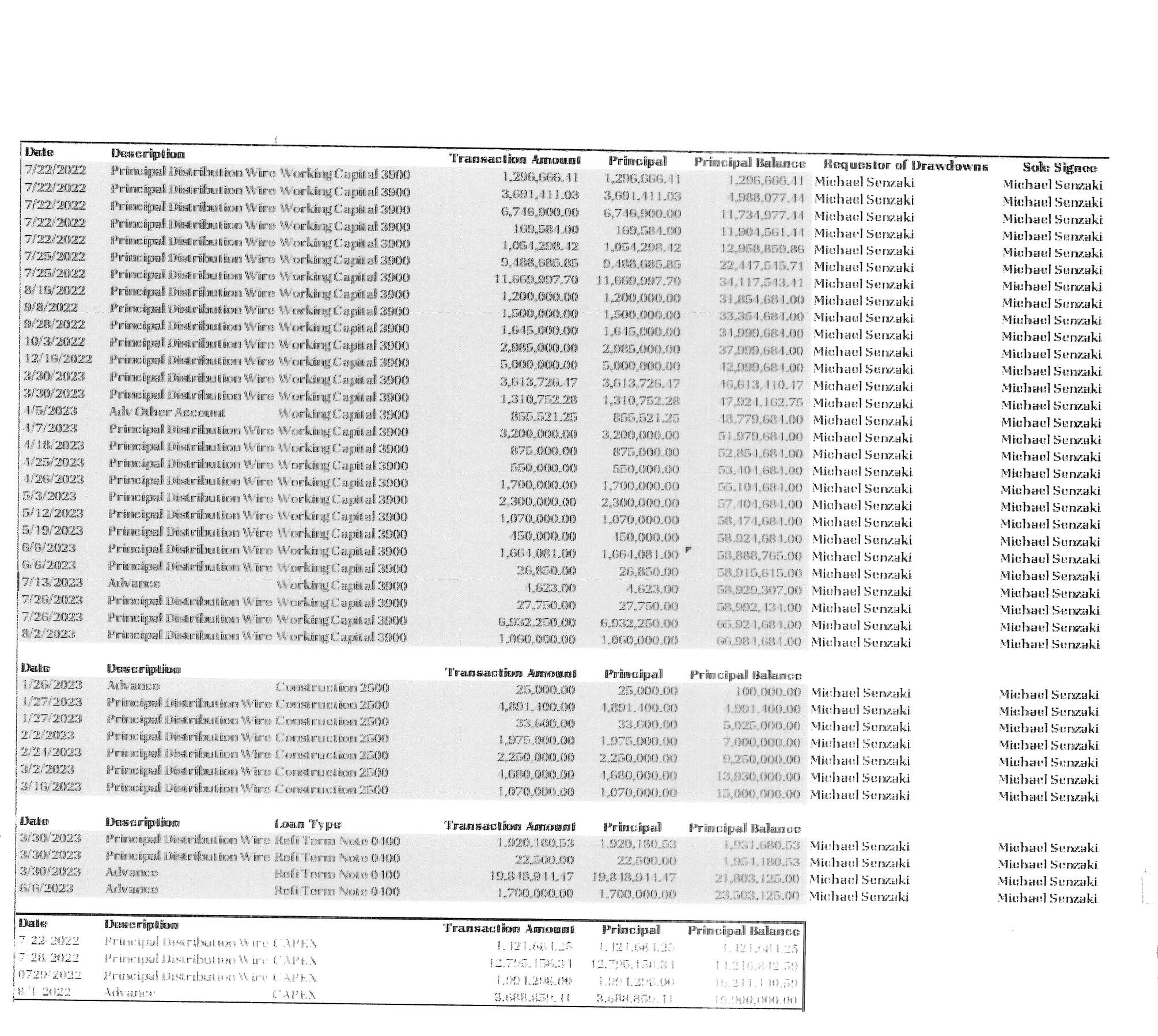

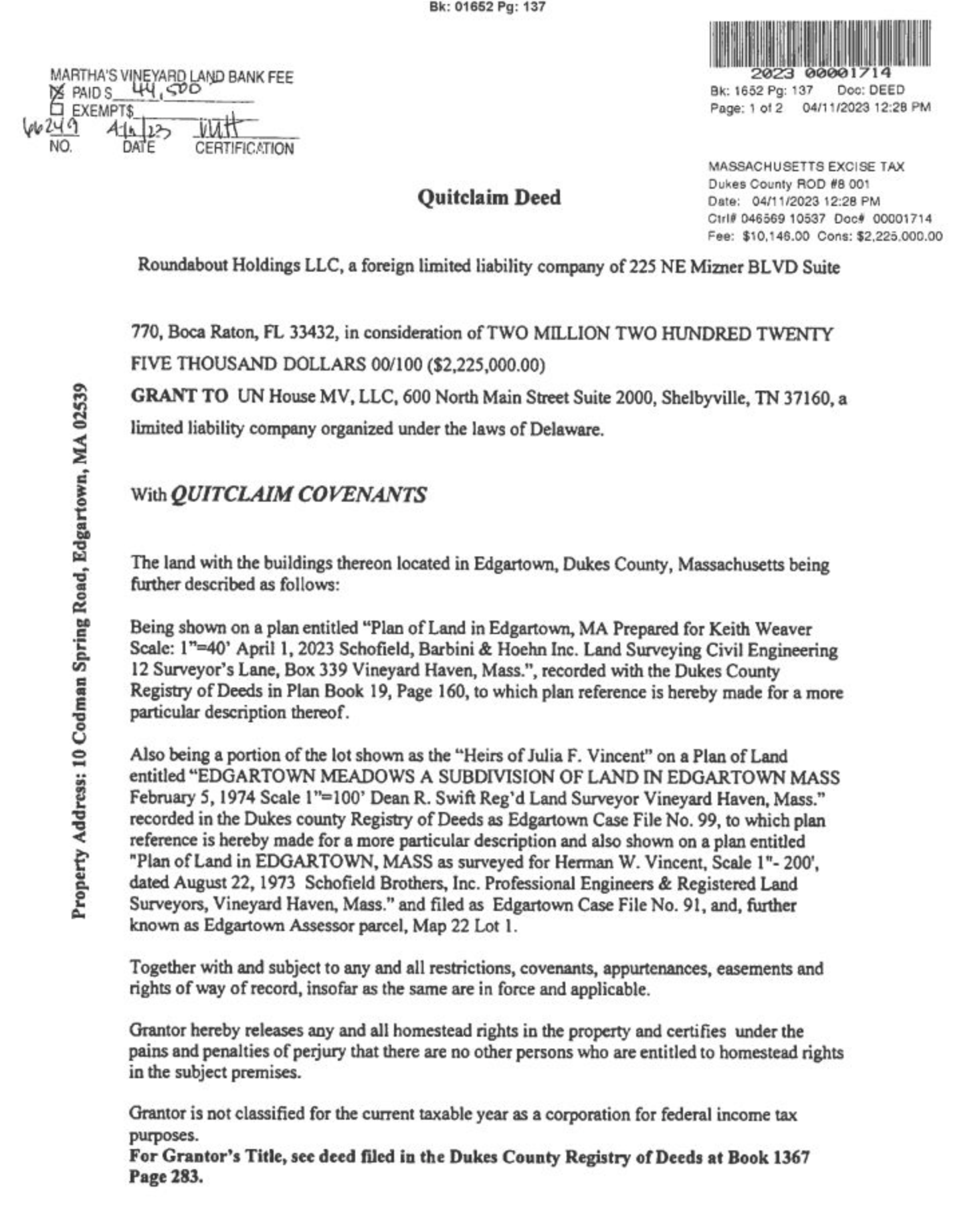

I mean he did. Well, ok, the bank did. See below image.

Tack on the $108 million and counting on the loan alone.

“Receiver has not provided the Court with financial records to clarify this calculation and has informed the Movants that Company financials will not be shared unless the Movants agree not to submit them in Court filings — a condition they cannot accept.”

Well, he says it a little differently. He doesn’t trust The Weaver (TM) with the information, because he thinks Fawn then feeds it to Kate to bloat her sales numbers to make it look like the company is solvent. Hi Kate.

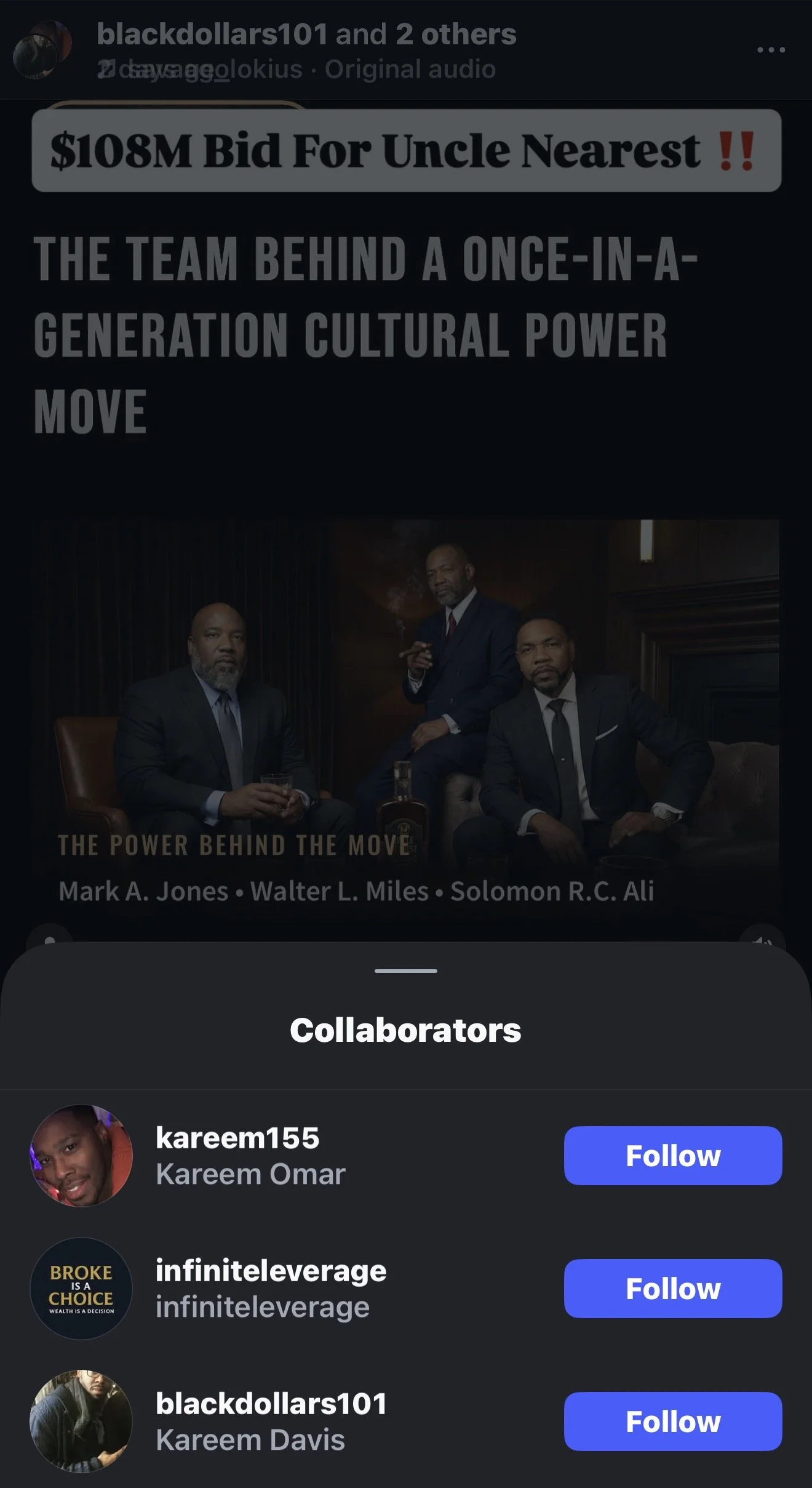

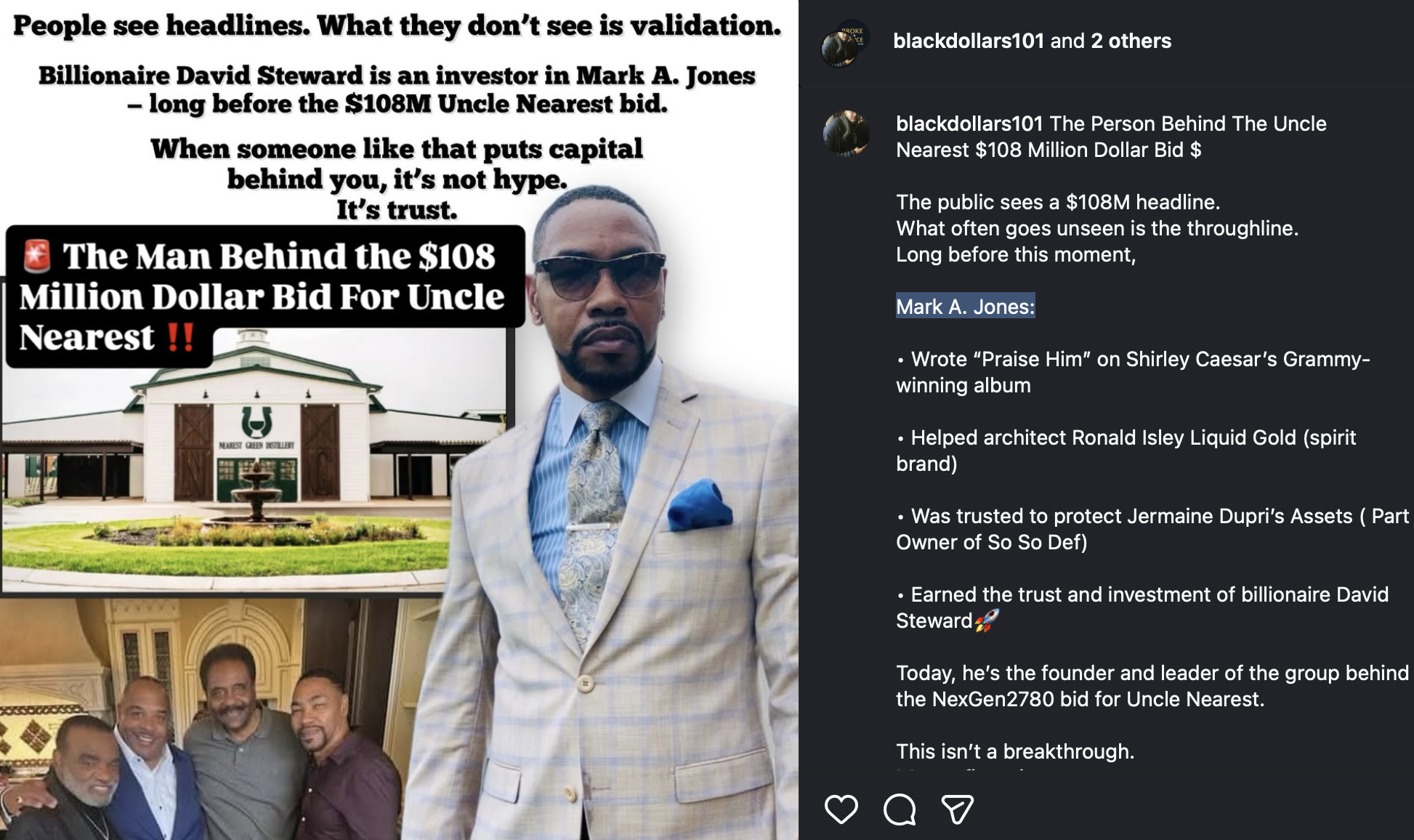

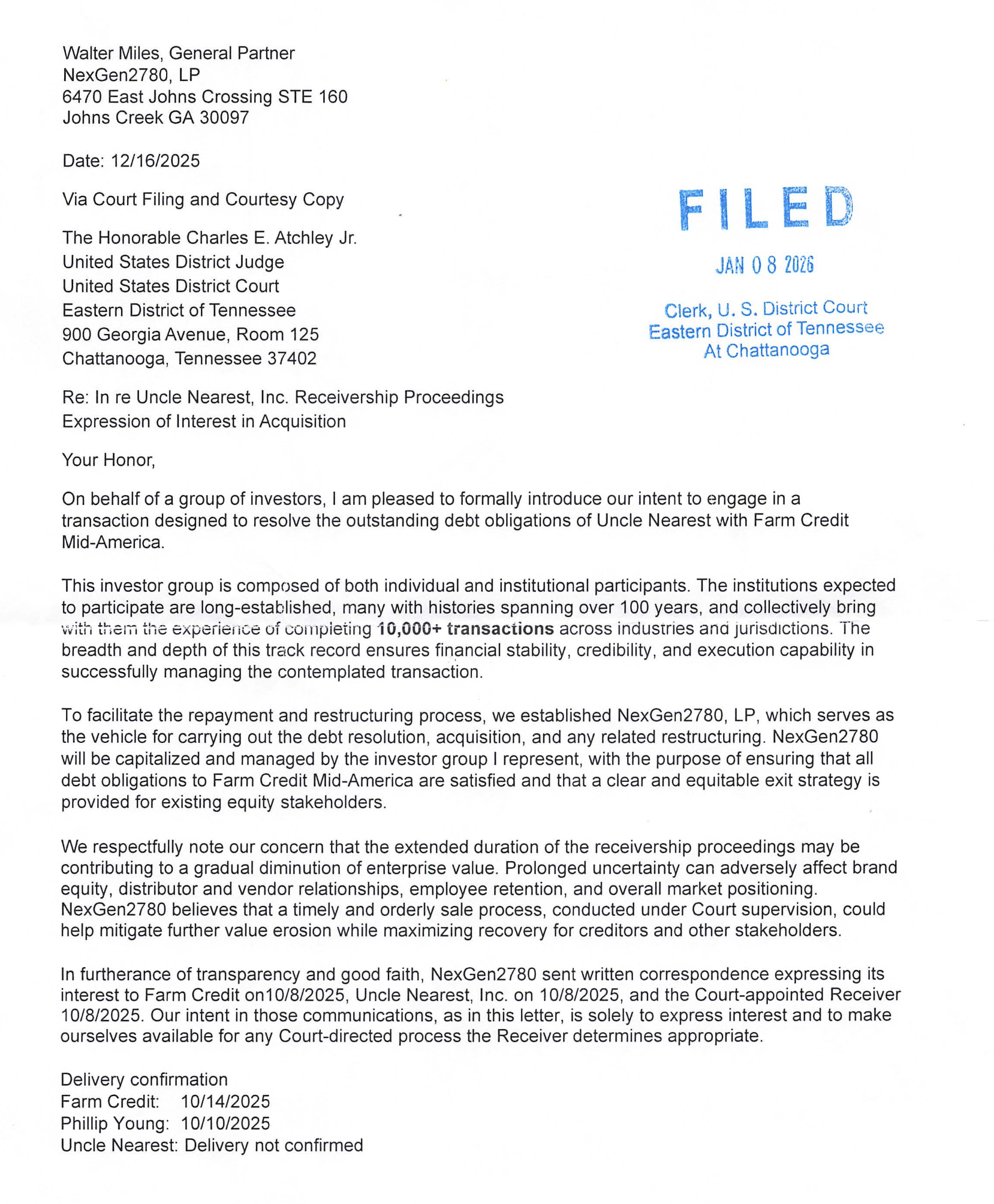

She then goes on in propping up the farcical NexGen power move for the culture BroFundMe offer. We will not be wasting any more time on that group, unless they stupidly write a check.

She then goes on to spin some form of new math that unsurprisingly doesn’t add up, in an effort to prove solvency.

“While the management team that had been in control of the Company from its founding until the appointment of the Receiver was not perfect, it did shepherd the Company from a start-up with no sales to one of the 30 lar”

Yeah I stopped typing mid-sentence because a lot of propaganda followed. “Not perfect” is one way of saying running up massive debts, uncontrollable spending on vanity, ego, non-money generating assets, stealing from employees, and running the company into receivership.”

“Penelope Bourbon, which is another RNDC brand similar to Uncle Nearest, was out-performing the market and achieving positive year-over-year growth through August 2025, as was Uncle Nearest. Penelope Bourbon’s growth during this period was driven in material part by the successful execution of Limited Time Offers (“LTOs”), a strategy that the Receiver and Farm Credit declined to approve for Uncle Nearest during a critical selling window.”

Sorry Matt. Also, sorry, but Penelope and UN aren’t even in the same league, let alone sport.

“The Receiver also made the decision to forego bottling which caused out of stocks among a number of markets. Instead of bottling product and selling it to RNDC at a profit, the Receiver allowed RNDC to move existing product between its various associated distributorships. Since a distributor is not allowed to move product between states, the only way that this could be accomplished was for Uncle Nearest to accept a return of product from one distributor in one state, issue a credit, and then resell the product to another distributor in another state using that credit. This circular transaction generated no revenue for Uncle Nearest, resulted in lost sales, and allowed the receiving distributor to sell the product without paying for it, while Uncle Nearest bore the opportunity cost.”

The lack of concern for RNDC by Fawn is likely just how she views all vendors big and small. Your problem not mine doesn’t inspire confidence in other businesses to want to do business with you. There were massive stocks in Texas, California, and Florida, 18-24 months worth of UN sitting in distribution warehouses. Which was why Clear the Shelves would never work. That would have to have been sustained for at least a year before the distributor might feel compelled to order new product.

The Weaver then continues on claiming that the Receiver is a liar. It’s the usual stuff. No evidence provided (I swear to god they filed this document without looking at the receivers / banks exhibits. Likely because ChatGPT struggles with reading images (nice play Cap’N Phillip, for filing your entire affidavit as images), she probably didn’t even see that there is in fact EVIDENCE.

Lamborghinis are funnier than a truck.

“With respect to the Quickbooks records that were deleted by a former employee, the Receiver acknowledges that he was made aware of that situation in the first few days of the Receivership and yet, after more than five months, provides no update on the status of those records other than that he “is working to recover that data.”

The QB data exists. It’s not lost. Nothing is ever truly deleted anymore.

“The Receiver has indicated that he “has begun a forensic investigation into the finances and transactions of the company” and that the investigation “is expected to take considerable time to complete.”22 The problem is that we are not before the Court on a fraud allegation. “

Not yet. Not yet. Tick Tock.

“The Receiver has turned this case into a fishing expedition to investigate matters that are simply not before the Court. To be clear, the Movant’s don’t fear an investigation other than the fact that, at a professional fee burn rate approaching approximately $400,000 per month, the proposed investigation taking considerable time will cost the Company more than it should have to afford, considering that, after approximately five months of investigation and approximately $2 million in fees, the Receiver has been unable to identify any allegation of fraud with the specificity that would be required for a properly plead fraud allegation. Indeed, as noted above, the alleged missing barrels are actually now known to not be missing at all and the allegations relating to the Martha’s Vineyard property has been completely debunked.”

Let’s be clear, they absolutely fear an investigation. They couldn’t give two shits about a burn rate for a company they aren’t even paying bills for. The bank is paying for that. Nothing has been debunked, no matter how many times The Weaver (TM) says they have.

They wrap up with a request the termination of the receivership. You know, part of me is hoping the Judge just says ok Fawn, you convinced me, here’s your company, go do your thing. We all know how that would turn out, and that’s me being petty, and entertaining my childhood love of setting things on fire (no animals, no property, no crimes). Stepping aside from my cynical attitude, I cannot in any way grasp any possibility that the judge removes the receivership.

I can foresee some sanctions on her however, for that email, and that video. I’ll look over the exhibits over the weekend, along with the Farm Credit ones, and the Receivers and report on anything interesting.

It’s such a bizarre thing to watch such a massive fall from grace in the glow of a ring light and a giant framed selfie in the background - Angel on my Shoulder.

UPDATE #2- 2/5-

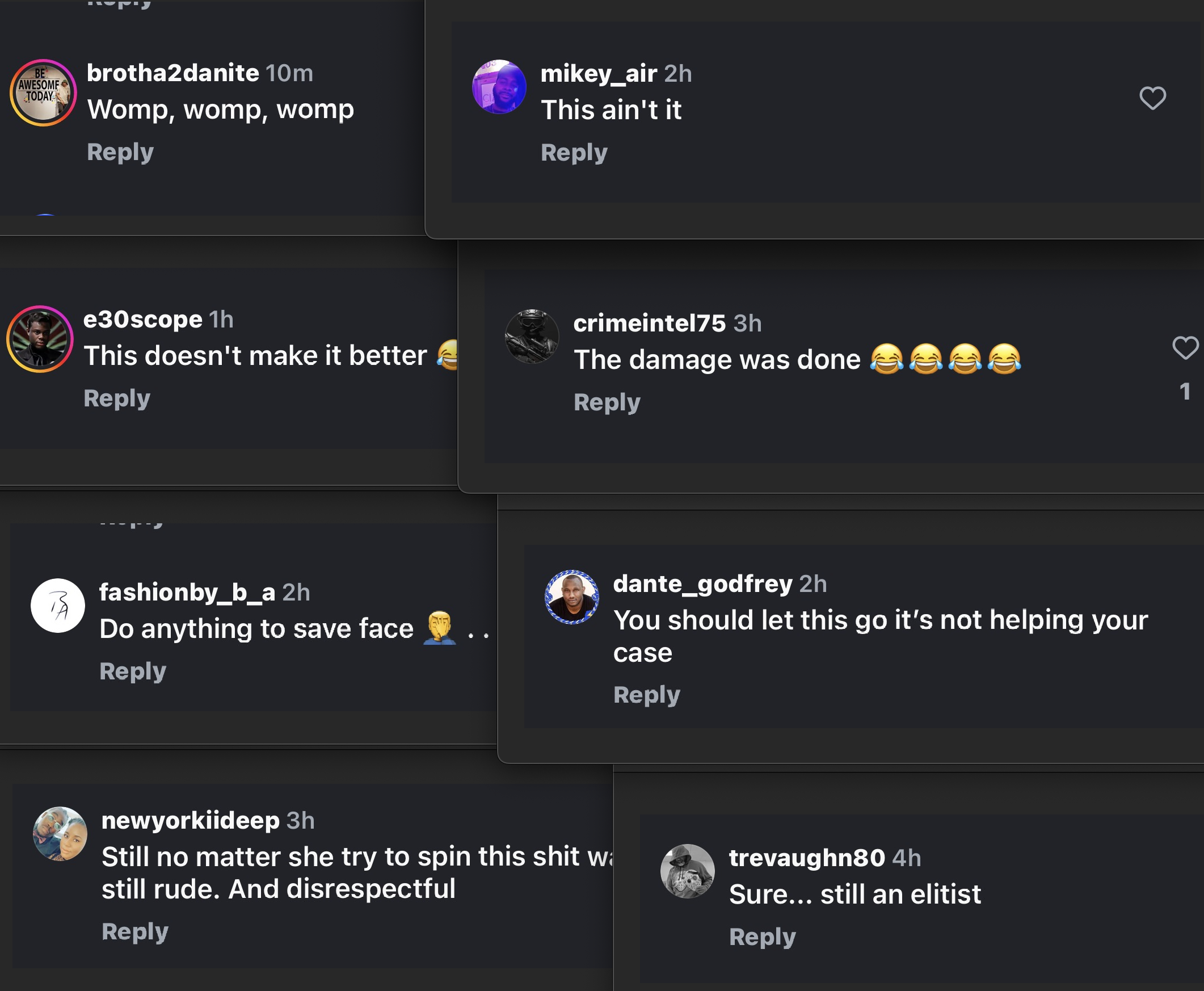

What the FUCK did I just watch? I slept in late today, I’ve been pretty exhausted by this past week and I wake up to one of the wildest, most bizarre, unhinged, and decoupled from reality things from The Weaver (TM) that I’ve seen in a long time. The video is on her IG, you know where it is, you don’t need me to link it. I’ll break it down, and there will be screenshots, oh yes, there WILL be screenshots. Let’s break it all the way down.

“Fam, God is so good. First of all, y'all are blowing up. My DMs and my emails, and just letting me know how much you have my back, my text messages, saying, Y'all are praying, all the rest of that stuff, I love you.”

Prayer is about all that’s left to do, and crying, lots and lots of crying. Culties gonna Cult.

“You should know something about me, though. I have no idea what y'all are talking about a little bit. “

If you don’t know what they’re talking about, why this video that will be precisely about what they’re talking about? Also, that “a little bit” was the truth escaping The Weaver (TM) mouth for the first time in a long time.

“But I've never been one to believe my own press. So I've never read it when it was good. I don't read it when it's bad. “

Have you ever looked at the UN website and looked at the massive collection of press releases? Folks, I’m not sure there’s anyone more obsessed with their own press as this person is.

“So the only way I know when it's been, like, a wild week of press is that y'all will blow me up to telling me you got my back, so I love you for that. “

I guess she doesn’t talk to her lawyer much.

But just know, I started this process unbothered, unmoved. I remain unbothered, unmoved.”

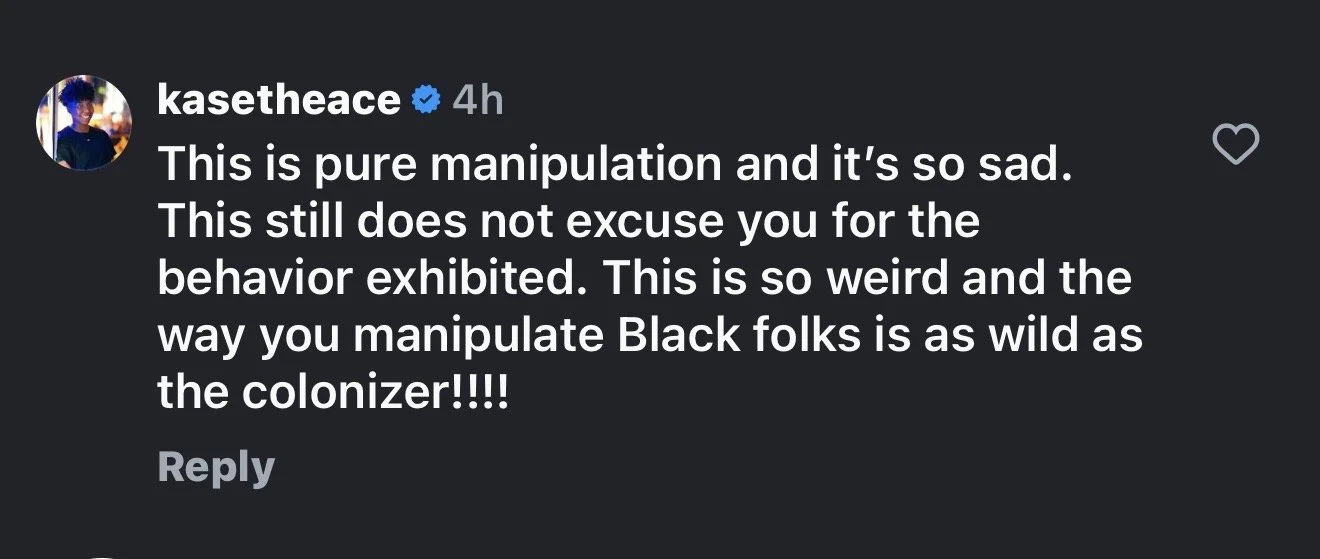

I’ll let the commenter below respond to this one.

NO NOTES.

“I set out to do something, and I was very clear that I was setting out to build the next great American brand. Hard Stop, not Spirit Brand, next great American brand, period.”

And that brand was Fawn Weaver.

“And I also said, I would be the first person to build, lead, and own a spirit conglomerate that had not been founded by led by, owned by a white male.”

Sure, and this was an important thing to do. Why you fuck that up?

“The moment I did that, it put a target on my back. I already knew that, and that's okay.”

Why is that assholes always talk about targets on their backs, and never about how that target was so firmly affixed? It’s because you’re an asshole.

“When you're coming into an industry, that has been gate kept since literally before the founding of our country. You come in, and you can walk through the gate, or you can let the whole world know, I'm just gonna tear down the gate. And everybody else is gonna come in through without a gate. And I was real clear in saying that. “

A powerful picture she paints here, and yes, the gatekeeping is in fact real, for women, and POC.

“So I knew what was gonna happen at some point, but make no mistake about it, and most of you have already seen this. What we're witnessing is literally an attempt to robbery in broad daylight.”